Medicare Part B is an essential component of Original Medicare, providing coverage for various medical services and supplies that are not covered under Part A. However, unlike Part A, which is premium-free for most beneficiaries, Part B requires a monthly premium payment. This premium can be a significant expense for some Medicare beneficiaries, especially those with limited income and resources.

One way to reduce the financial burden of the Part B premium is through a Medicare Advantage plan that offers a Part B premium reduction or “giveback.” United Healthcare, one of the largest providers of Medicare Advantage plans in the United States, offers several plans with this feature.

What is a Part B Premium Reduction?

A Part B premium reduction, also known as a “giveback,” is a benefit offered by some Medicare Advantage plans that helps offset the cost of the Part B premium. With this benefit, the Medicare Advantage plan pays a portion of the beneficiary’s Part B premium each month, effectively reducing the out-of-pocket cost.

The amount of the Part B premium reduction can vary depending on the specific plan and the beneficiary’s location. Some plans may offer a fixed dollar amount reduction, while others may provide a percentage reduction based on the standard Part B premium for that year.

How United Healthcare’s Part B Premium Reduction Works

United Healthcare offers several Medicare Advantage plans that include a Part B premium reduction benefit. The amount of the reduction can vary depending on the plan and the beneficiary’s location, but it typically ranges from a few dollars to up to the full standard Part B premium amount.

For example, in 2024, the standard Part B premium is $174.70 per month. United Healthcare’s AARP Medicare Advantage from UHC ID-0004 (PPO) plan offers a Part B premium reduction of up to $65 per month. This means that if you enroll in this plan, United Healthcare will pay up to $65 towards your Part B premium each month, effectively reducing your out-of-pocket cost.

It’s important to note that the Part B premium reduction is not a separate payment or reimbursement. Instead, it is applied directly to the Part B premium, reducing the amount you owe each month.

Eligibility and Enrollment

To be eligible for a United Healthcare Medicare Advantage plan with a Part B premium reduction, you must meet the following requirements:

- Be enrolled in both Medicare Part A and Part B.

- Live in the plan’s service area.

- Not have end-stage renal disease (ESRD), unless certain exceptions apply.

If you meet these eligibility requirements, you can enroll in a United Healthcare Medicare Advantage plan with a Part B premium reduction during the annual Medicare Open Enrollment Period, which runs from October 15 to December 7 each year. You may also be able to enroll or switch plans during certain Special Enrollment Periods if you experience qualifying life events.

Additional Benefits and Considerations

In addition to the Part B premium reduction, United Healthcare’s Medicare Advantage plans often include additional benefits and coverage not offered by Original Medicare. These may include:

- Prescription drug coverage (Part D)

- Vision and dental benefits

- Fitness programs

- Over-the-counter medication allowances

- Transportation assistance

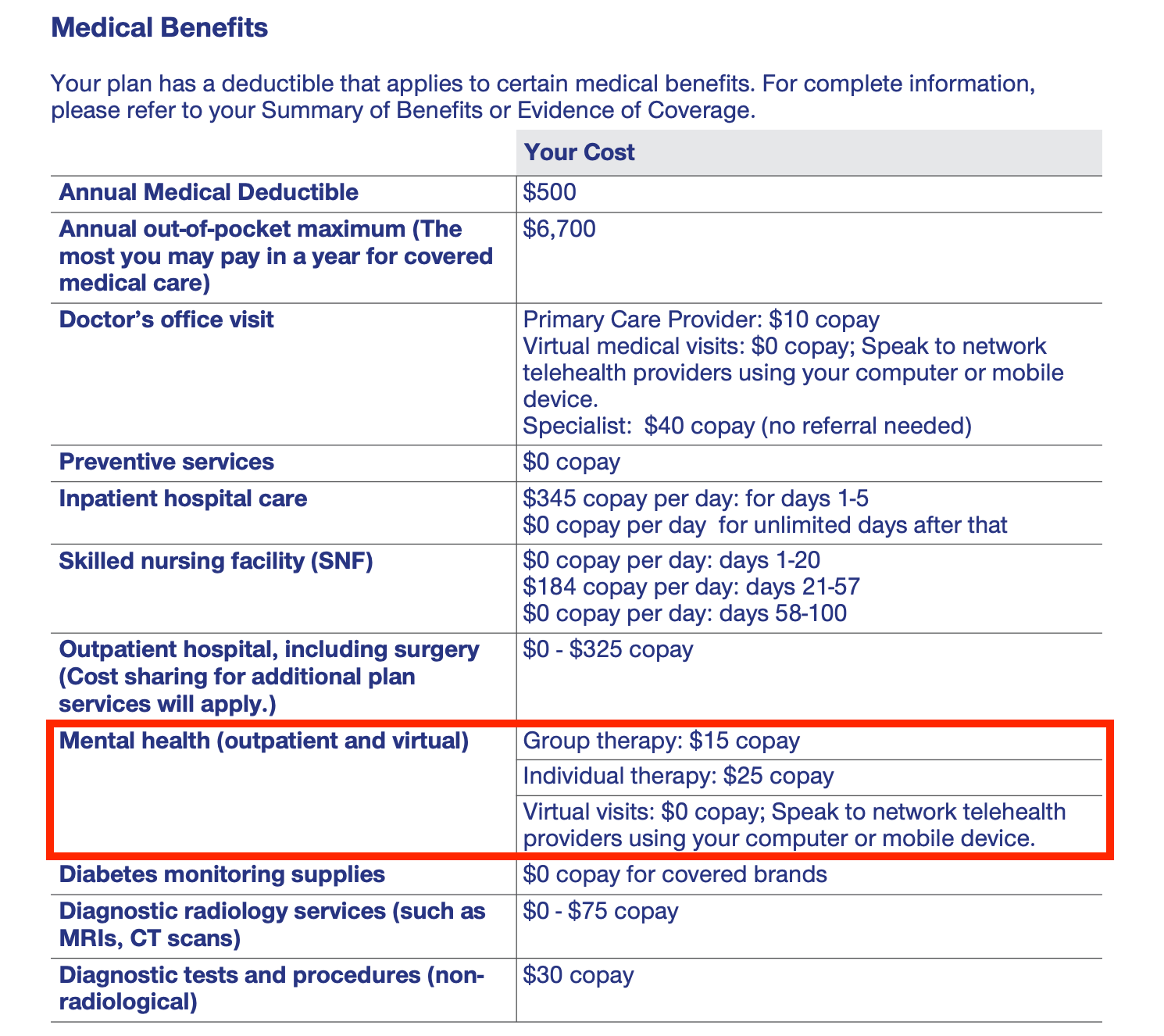

However, it’s important to carefully review the plan’s coverage details, copayments, deductibles, and network restrictions before enrolling, as these can vary significantly between plans and locations.

Conclusion

United Healthcare offers several Medicare Advantage plans that include a Part B premium reduction benefit, helping to offset the cost of the monthly Part B premium. This can be a valuable financial benefit for Medicare beneficiaries, especially those on a fixed or limited income.

If you’re considering a United Healthcare Medicare Advantage plan, be sure to factor in the Part B premium reduction when evaluating the overall cost and value of the plan. Additionally, carefully review the plan’s coverage details, network restrictions, and any additional benefits to ensure it meets your specific healthcare needs and budget.

How to Get Medicare Part B Reimbursed.

FAQ

Can you drop Medicare Part B coverage?

What is UnitedHealthcare Part B?