For many, the idea of retiring by the age of 60 is a dream – a chance to bid farewell to the daily grind and embrace a life of leisure and freedom. However, the reality is that this dream is becoming increasingly elusive for the majority of Americans. As we delve into the statistics, a startling picture emerges, revealing that early retirement is no longer the norm, but rather a privilege reserved for the fortunate few.

The Decline of Early Retirement

According to data from Gallup, the percentage of adults aged 55 to 74 who are retired has been declining steadily over the past two decades. Let’s take a closer look at the numbers:

-

Ages 55-59: In the early 2000s, 19% of individuals in this age group were already retired. However, this percentage has dropped significantly, with only 11% being retired in the 2016-2022 period.

-

Ages 60-64: Similarly, the retirement rate for this age group has fallen from 41% in the 2002-2007 period to a mere 32% in recent years.

-

Ages 65-69: Even among those traditionally considered of retirement age, the trend persists. Only 70% of individuals in this age range were retired between 2016 and 2022, a decrease from 76% in the earlier period.

-

Ages 70-74: The decline is less pronounced but still notable, with 83% being retired compared to 88% in the past.

These statistics paint a clear picture: fewer Americans are retiring early, and many are delaying their retirement well into their late 60s or even early 70s.

Factors Driving Later Retirements

Several factors contribute to this shift towards later retirement ages:

-

Longevity and Financial Preparedness: With increasing life expectancies, Americans are recognizing the need to save more for a longer retirement period. Many feel financially unprepared to retire at a younger age, prompting them to work longer to bolster their retirement savings.

-

Changes in Social Security: Reforms to Social Security have gradually raised the full retirement age from 65 to 67 for those born after 1960. This incentivizes workers to remain employed longer to maximize their benefits.

-

Shift from Manufacturing to Service Industries: The decline of manufacturing jobs, which often involved physically demanding labor, has given way to service-oriented and knowledge-based industries. These jobs are generally less physically taxing, allowing workers to remain employed for longer periods.

-

Changing Attitudes Towards Retirement: For many, retirement is no longer seen as a sudden transition but rather a gradual process. Some choose to continue working part-time or pursue encore careers, blurring the lines between traditional retirement and employment.

The Path Forward

While the dream of retiring by 60 may be fading, it doesn’t mean that all hope is lost. By understanding the challenges and making informed decisions, individuals can increase their chances of achieving an earlier retirement:

-

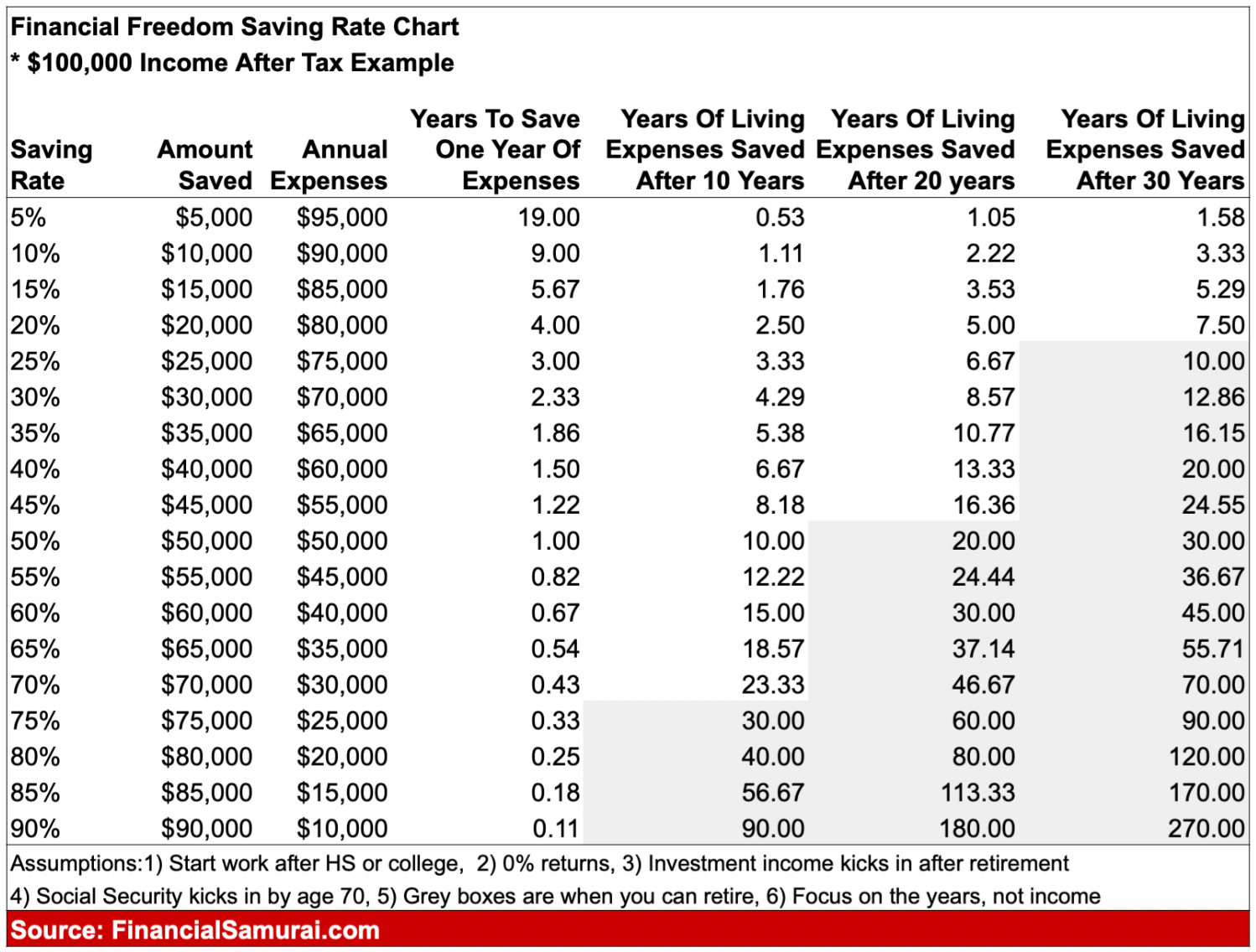

Start Saving Early: The earlier you start saving for retirement, the more time your money has to grow through compound interest. Maximize contributions to tax-advantaged accounts like 401(k)s and IRAs.

-

Diversify Income Streams: Explore alternative sources of income, such as rental properties, side businesses, or investments, to supplement traditional retirement savings.

-

Manage Expenses: Develop a realistic budget and prioritize debt repayment to minimize financial burdens in retirement.

-

Consider Working Longer: While not ideal for everyone, working a few extra years can significantly boost retirement savings and increase Social Security benefits.

Retiring by 60 may no longer be the norm, but that doesn’t mean it’s impossible. With careful planning, discipline, and a willingness to adjust expectations, individuals can pave their own paths to financial freedom and retire on their own terms.

Average Retirement Savings by Age 60. Are You Ready to Retire?

FAQ

What percentage of 60 year olds are retired?

Is it normal to retire at 60?

What is the most common age for retirement?

Why do most people retire at 62?