If you’re currently enrolled in a Medicare Advantage Plan but considering a change, you may be wondering if it’s possible to switch back to Original Medicare. The good news is that you can indeed make this transition, and this article will guide you through the process, outlining when and how you can return to Original Medicare from a Medicare Advantage Plan.

Understanding Your Options

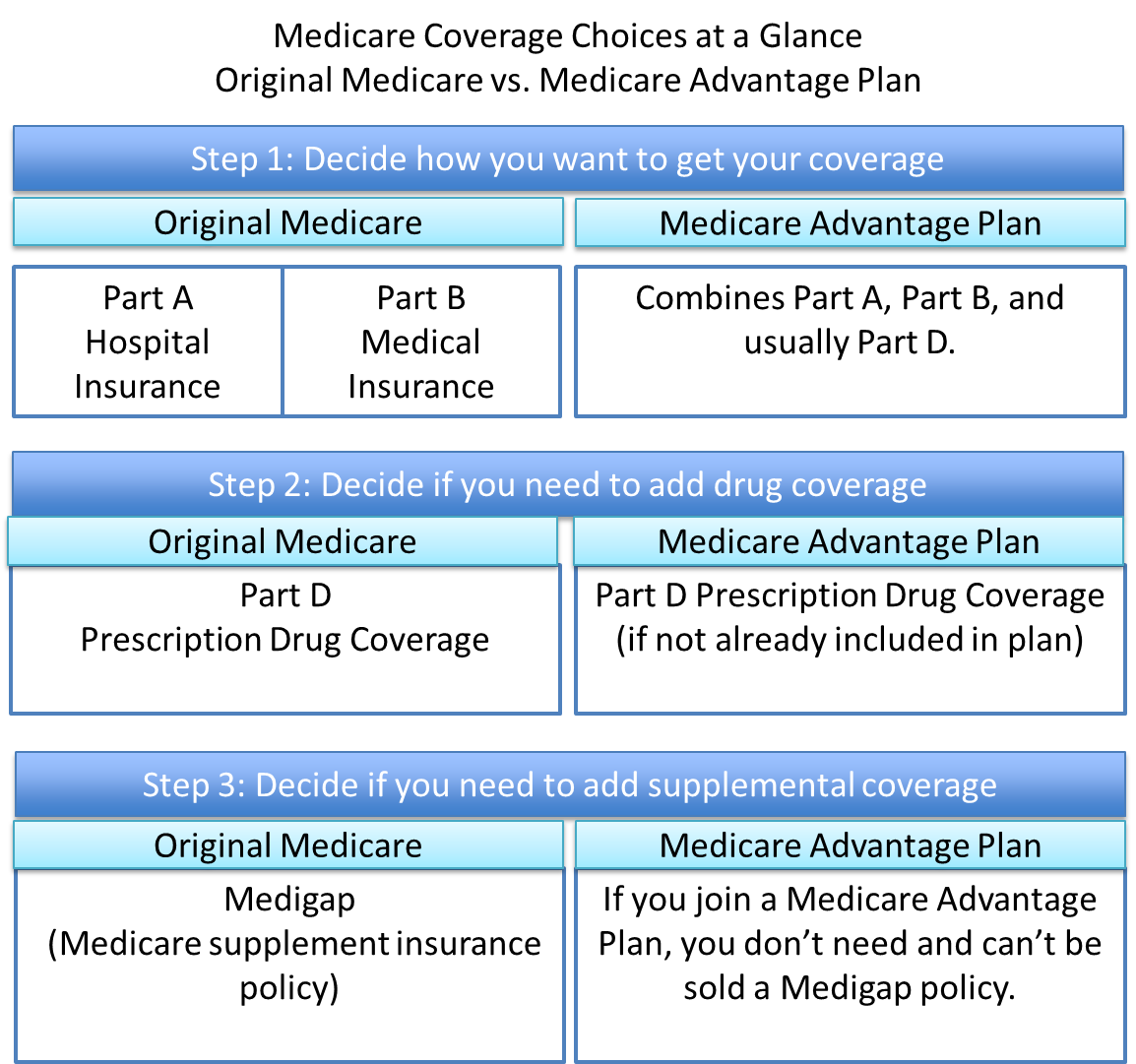

Medicare offers two main pathways for receiving your healthcare coverage: Original Medicare and Medicare Advantage Plans. Original Medicare, also known as Traditional Medicare, is the government-run program that includes Part A (Hospital Insurance) and Part B (Medical Insurance). Medicare Advantage Plans, on the other hand, are private health plans offered by Medicare-approved companies that bundle Parts A and B, often including additional benefits like prescription drug coverage (Part D) and extras like dental, vision, and hearing services.

While Medicare Advantage Plans can be an attractive option for some beneficiaries, circumstances may arise where you find it more suitable to switch back to Original Medicare. Perhaps you’re moving to a new area where your current plan’s network is limited, or you’re dissatisfied with the plan’s coverage or costs. Whatever the reason, the good news is that you have the flexibility to make the change.

When Can You Switch?

There are specific enrollment periods during which you can transition from a Medicare Advantage Plan back to Original Medicare. These include:

-

Annual Open Enrollment Period (October 15 – December 7): During this annual window, you can drop your Medicare Advantage Plan and return to Original Medicare. Any changes made during this period will take effect on January 1 of the following year.

-

Medicare Advantage Open Enrollment Period (January 1 – March 31): If you’re already enrolled in a Medicare Advantage Plan, you can use this period to switch back to Original Medicare. Any changes made during this window will take effect on the first day of the following month.

-

Special Enrollment Periods (SEPs): In certain qualifying situations, such as moving to a new address outside your plan’s service area or losing your current coverage, you may be eligible for a Special Enrollment Period to make changes to your Medicare coverage, including switching back to Original Medicare.

It’s essential to pay close attention to these enrollment periods and their respective deadlines to ensure a seamless transition back to Original Medicare.

How to Make the Switch

Once you’ve determined the appropriate enrollment period for your situation, the process of switching from a Medicare Advantage Plan to Original Medicare is relatively straightforward. Here are the steps you’ll need to follow:

-

Decide on your drug coverage: If you wish to have prescription drug coverage under Original Medicare, you’ll need to enroll in a separate Medicare Part D (Prescription Drug Plan). You can join a Part D plan during the same enrollment period when you switch back to Original Medicare.

-

Contact your current Medicare Advantage Plan: Inform your Medicare Advantage Plan that you wish to disenroll and return to Original Medicare. They may provide you with specific instructions or forms to complete.

-

Enroll in Original Medicare: If you’re not already enrolled in Parts A and B of Original Medicare, you’ll need to complete the enrollment process. You can do this by contacting the Social Security Administration or visiting their website at www.ssa.gov.

-

Consider supplemental coverage: With Original Medicare, you may want to explore supplemental coverage options, such as a Medicare Supplement Insurance (Medigap) policy, to help cover out-of-pocket costs like deductibles, coinsurance, and copayments. Medigap plans are offered by private insurance companies and can provide additional financial protection.

It’s important to note that if you’ve been without creditable drug coverage for 63 consecutive days or more after dropping your Medicare Advantage Plan, you may face a late enrollment penalty when you join a Medicare Part D plan. This penalty is calculated based on the number of months you went without creditable coverage and is added to your monthly Part D premium.

Conclusion

Switching from a Medicare Advantage Plan back to Original Medicare is a viable option for beneficiaries who find that Traditional Medicare better suits their healthcare needs or preferences. By understanding the enrollment periods and following the necessary steps, you can seamlessly transition between these two coverage pathways, ensuring continuity of care and access to the benefits you require. Whether you’re motivated by cost considerations, provider network changes, or personal preferences, the ability to return to Original Medicare provides you with the flexibility to make informed decisions about your healthcare coverage.