Life insurance is an essential financial safety net that secures the future well-being of your loved ones. However, understanding the average monthly cost of life insurance can be a daunting task, with numerous factors influencing the premiums. In this comprehensive guide, we’ll demystify the pricing dynamics and provide you with valuable insights to help you make informed decisions.

The Elusive Average: Unveiling the Numbers

According to authoritative sources, the average cost of life insurance in the United States is approximately $23 per month. However, this figure is merely a broad estimate, as the actual premiums can vary significantly based on several critical factors, such as age, health status, coverage amount, policy type, and location.

Decoding the Cost Factors

To gain a deeper understanding of life insurance costs, let’s explore the key factors that influence premiums:

1. Age: The Inescapable Factor

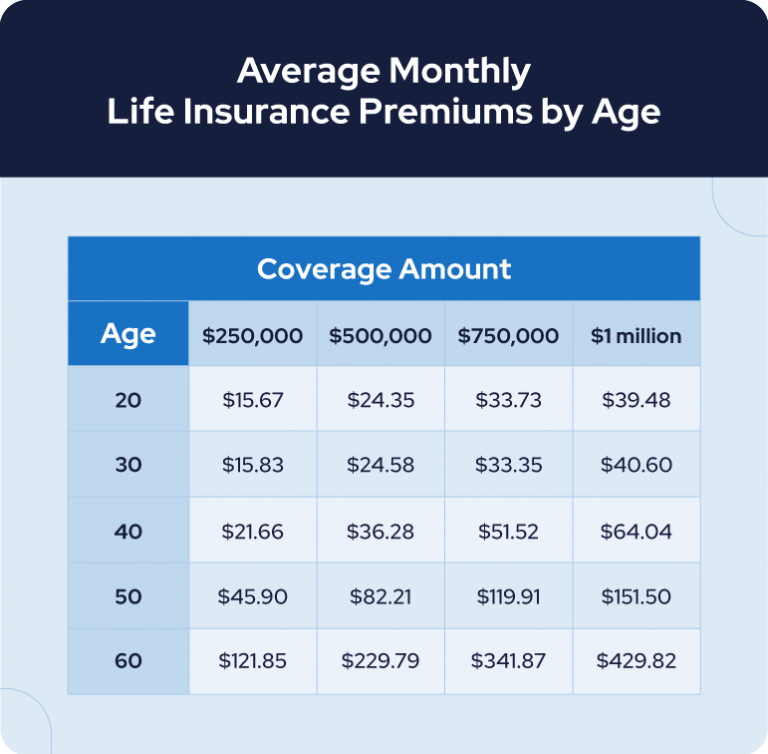

Age plays a pivotal role in determining life insurance premiums. Generally, the younger you are when you purchase a policy, the lower your monthly premiums will be. As you age, the risk of developing health complications increases, leading to higher premiums. For example, a 30-year-old healthy individual may pay around $20 per month for a 20-year term life insurance policy with $500,000 in coverage, while the same policy for a 50-year-old could cost upwards of $80 per month.

2. Health Status: A Vital Consideration

Your current health condition and medical history significantly impact life insurance costs. Insurers evaluate various factors, such as smoking habits, pre-existing medical conditions, family medical history, and overall wellness. Individuals with chronic illnesses or high-risk lifestyles can expect to pay higher premiums compared to their healthier counterparts.

3. Coverage Amount: Protecting Your Loved Ones

The coverage amount, or the death benefit, is another critical factor influencing life insurance costs. Generally, the higher the coverage amount, the higher the monthly premium. However, it’s essential to strike a balance between adequate protection for your loved ones and affordable premiums that align with your financial capabilities.

4. Policy Type: Term vs. Permanent

Life insurance policies can be broadly categorized into two types: term life insurance and permanent life insurance (such as whole life or universal life). Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years, and is generally more affordable than permanent life insurance. Permanent life insurance, on the other hand, offers lifelong coverage and often includes an investment component, resulting in higher premiums.

5. Location: Regional Variations

Believe it or not, your geographic location can also influence life insurance costs. Insurance companies consider factors such as the cost of living, healthcare expenses, and mortality rates in different states or regions when calculating premiums. For example, according to MoneyGeek’s data, the average cost of a 10-year term life insurance policy in Texas is $30 per month, while in Utah, it’s $17 per month.

Strategies to Reduce Life Insurance Costs

While some factors, like age and health, are beyond your control, there are several strategies you can employ to minimize life insurance costs:

-

Purchase Early: Securing life insurance at a younger age can lock in lower premiums for the duration of your policy. This proactive approach can save you thousands of dollars over the long run.

-

Maintain a Healthy Lifestyle: Adopting a healthy lifestyle by exercising regularly, avoiding tobacco products, and managing pre-existing conditions can positively impact your premium rates.

-

Evaluate Your Coverage Needs: Periodically reassessing your life insurance coverage needs can help ensure you’re not overpaying for more coverage than necessary.

-

Compare Quotes: Shopping around and comparing quotes from multiple insurers can reveal significant variations in premiums, enabling you to find the most competitive rates.

-

Consider Term Life Insurance: If your primary goal is to provide financial protection for a specific period, such as until your children become independent or your mortgage is paid off, term life insurance can be a cost-effective option.

The Bottom Line

While the average monthly cost of life insurance is $23, this figure is merely a starting point. Your actual premiums will depend on a range of individual factors, including age, health, coverage amount, policy type, and location. By understanding these dynamics and employing effective strategies, you can secure the right life insurance coverage without breaking the bank, ensuring a financially secure future for your loved ones.

How Much Does Whole Life Insurance Cost?

FAQ

How much should life insurance cost a month?

|

State

|

Average Annual Life Insurance Premium

|

Average Monthly Premium

|

|

California

|

$668

|

$56

|

|

Colorado

|

$645

|

$54

|

|

Connecticut

|

$724

|

$60

|

|

Delaware

|

$657

|

$55

|

How much do most people pay monthly for life insurance?

How much life insurance can I get for $100 a month?

How much a month is a $500 000 whole life insurance policy?