Life insurance is an essential tool for protecting your loved ones financially, but navigating the different types of policies can be overwhelming. Two of the most common options are term life and whole life insurance, and understanding their differences is crucial when deciding which one suits your needs best. In this article, we’ll break down the key features, pros, and cons of each type, so you can make an informed decision.

What is Term Life Insurance?

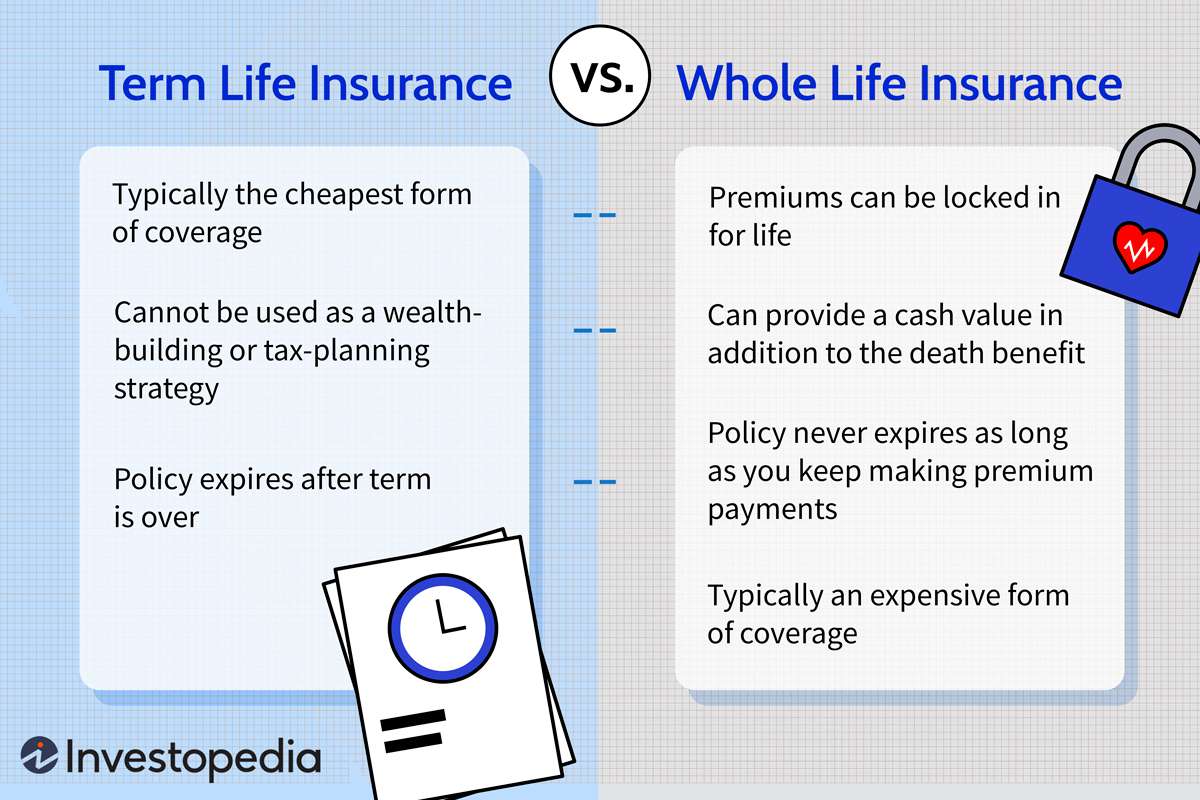

Term life insurance is the simplest and most affordable form of life insurance. It provides coverage for a specific period, typically ranging from 10 to 30 years. If the policyholder passes away during the term, their beneficiaries receive a death benefit payout. However, if the policyholder outlives the term, the policy expires, and no benefits are paid out.

Pros of Term Life Insurance:

- Affordability: Term life insurance premiums are significantly lower than whole life insurance premiums, making it an accessible option for those on a tight budget.

- Flexibility: You can choose the term length that aligns with your needs, such as covering your children until they become financially independent or paying off your mortgage.

- Simplicity: Term life insurance is straightforward, with no cash value component or investment features.

Cons of Term Life Insurance:

- Temporary Coverage: Once the term ends, you’ll need to renew the policy (typically at a higher premium) or purchase a new one if you still require coverage.

- No Cash Value: Term life insurance does not accumulate cash value, so you cannot borrow against or withdraw from the policy.

What is Whole Life Insurance?

Whole life insurance is a type of permanent life insurance that provides coverage for your entire lifetime, as long as you continue paying the premiums. Additionally, it includes a cash value component that grows tax-deferred over time.

Pros of Whole Life Insurance:

- Lifelong Coverage: Whole life insurance remains in force for your entire life, providing peace of mind that your beneficiaries will receive a death benefit payout.

- Cash Value Growth: A portion of your premium payments goes into a tax-deferred cash value account, which grows over time and can be borrowed against or withdrawn if needed.

- Guaranteed Level Premiums: Your premium payments remain the same for the duration of the policy, making budgeting easier.

Cons of Whole Life Insurance:

- Higher Premiums: Whole life insurance premiums are significantly higher than term life premiums, often five to fifteen times more expensive for the same death benefit amount.

- Limited Flexibility: Once you’ve purchased a whole life policy, it’s challenging to adjust the coverage amount or the premium payments.

- Complex Structure: Whole life insurance policies can be more complex than term life policies, with various riders and options that may require professional assistance to understand fully.

Which One is Right for You?

Choosing between term life and whole life insurance depends on your specific needs, budget, and long-term financial goals. Here are some general guidelines:

-

Term Life Insurance: If you’re seeking affordable coverage for a specific period, such as until your children become financially independent or until your mortgage is paid off, term life insurance may be the more suitable option.

-

Whole Life Insurance: If you desire lifelong coverage and the ability to build cash value that you can borrow against or withdraw from, whole life insurance could be a better fit. It’s also an option to consider if you have estate planning needs or want to leave a legacy for your beneficiaries.

It’s important to note that term life insurance can be converted to whole life insurance later on, but the conversion process may be subject to additional underwriting and higher premiums based on your age and health at the time of conversion.

Final Thoughts

Both term life and whole life insurance serve different purposes and have their own advantages and disadvantages. Before making a decision, it’s crucial to assess your financial situation, objectives, and risk tolerance. Consulting with a licensed insurance professional can help you navigate the complexities and determine the most appropriate coverage for your unique circumstances.

Remember, the purpose of life insurance is to provide financial protection for your loved ones in the event of your untimely passing. While term life insurance offers temporary coverage at a lower cost, whole life insurance provides lifelong protection and the potential for cash value accumulation. Ultimately, the choice between the two depends on your personal needs and priorities.

Why Is Term Insurance Better Than Whole Life Insurance?

FAQ

What is better term life or whole life?

What happens to term life insurance at the end of the term?

What are the disadvantages of term life insurance?

What is the disadvantage of whole life insurance?