Accidents happen, and sometimes the unthinkable occurs – your beloved vehicle is deemed a total loss, and it wasn’t even your fault. This situation can be overwhelming, leaving you with a mix of emotions and a slew of questions. Fear not, as this comprehensive guide will walk you through the steps to take when your car is totaled due to someone else’s negligence.

Understanding What It Means When Your Car is Totaled

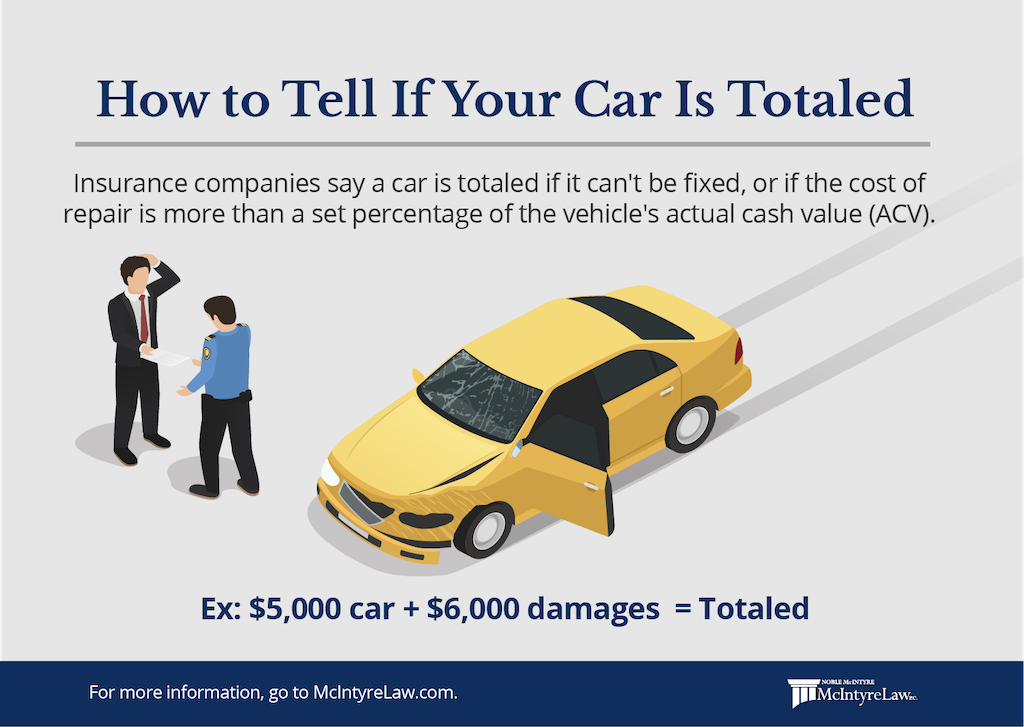

When your car is declared a total loss, or “totaled,” it means that the cost of repairing the vehicle exceeds its actual cash value (ACV) prior to the accident. The ACV is the fair market value of your car, taking into account its age, mileage, and condition.

Insurance companies typically follow a formula to determine if a car is totaled. Many states have a “total loss formula” (TLF) that requires insurers to declare a vehicle a total loss when the repair costs exceed a certain percentage of the ACV, often around 70%. However, this percentage can vary depending on the state and the insurance company’s policies.

The Importance of Being Not at Fault

If the accident was not your fault, the responsibility for covering the costs associated with your totaled car falls squarely on the at-fault driver’s insurance company. This means that you should not have to pay your deductible or any out-of-pocket expenses related to the accident.

However, it’s crucial to gather evidence and documentation to prove that you were not at fault. This includes obtaining a police report, gathering witness statements, and taking photos or videos of the accident scene.

Filing a Claim and Navigating the Process

Step 1: Notify Your Insurance Company

Even though you were not at fault, it’s still important to notify your insurance company about the accident as soon as possible. Provide them with all the details, including the other driver’s insurance information and any evidence you have gathered.

Step 2: File a Claim with the At-Fault Driver’s Insurance Company

Next, you’ll need to file a claim with the at-fault driver’s insurance company. This is known as a third-party claim, as you are not their policyholder. Be prepared to provide all the necessary documentation, including the police report, witness statements, and any medical records or repair estimates, if applicable.

Step 3: Get Your Car Inspected

The insurance company will likely send an adjuster to inspect your vehicle and determine its ACV and the cost of repairs. It’s recommended to take your car to a repair shop approved by the insurance company, as this can streamline the process.

Step 4: Review the Settlement Offer

Once the insurance company has evaluated the damage and determined the ACV of your vehicle, they will present you with a settlement offer. Carefully review the offer to ensure it accurately reflects the value of your car and any additional expenses, such as rental car fees or towing costs.

Handling Additional Expenses and Loan Balances

If you still owe money on a loan or lease for your totaled vehicle, the insurance company should pay the remaining balance directly to your lender or leasing company. It’s important to provide the necessary loan or lease information to the insurance company to ensure a smooth process.

In some cases, the insurance payout may not cover the entire loan balance, especially if you owe more than the car’s ACV. This is where gap insurance comes into play. Gap insurance covers the “gap” between the ACV and the remaining loan balance, ensuring you don’t have to pay out of pocket.

Additionally, if you had rental car coverage or other additional expenses related to the accident, such as medical bills, the at-fault driver’s insurance should cover these costs as well. Be sure to keep detailed records and receipts to support your claims.

Dealing with Insurance Company Disputes

While most insurance companies aim to resolve claims fairly, disputes can arise. If you disagree with the insurance company’s assessment of your vehicle’s value or the settlement offer, don’t hesitate to negotiate. Provide evidence to support your claims, such as comparable sales prices for similar vehicles in your area.

If negotiations fail, you may need to consider legal action or filing a complaint with your state’s insurance regulatory agency.

Replacement Options and Next Steps

Once the claim is settled, you’ll need to decide how to proceed. If the insurance payout is sufficient, you can use it to purchase a replacement vehicle. Alternatively, you may choose to keep the settlement and continue driving your totaled car with a salvage title, although this option is generally not recommended due to safety concerns.

Remember, the insurance company will typically take possession of your totaled vehicle once the claim is settled, unless you choose to keep it as a salvage vehicle.

Conclusion

Having your car totaled through no fault of your own can be a stressful and challenging experience. However, by following the steps outlined in this guide, you can navigate the process with confidence and ensure that you receive fair compensation from the at-fault driver’s insurance company. Remember to gather all necessary documentation, communicate clearly with the insurance companies involved, and don’t hesitate to seek legal assistance if disputes arise.

What happens when your car is totaled and you still owe money?

FAQ

Should I pay deductible if not at fault?

Can I keep my totaled car in Illinois?

Can you keep a totaled car in New York?

Can I keep my totaled car in California?