Medicare is a vital healthcare program for millions of Americans, and understanding the enrollment process is crucial. The question “Do I have to enroll in Medicare every year?” is a common one, and the answer is not as straightforward as it may seem. In this comprehensive guide, we’ll explore the ins and outs of Medicare enrollment, renewal processes, and the various enrollment periods.

Automatic Renewal: The General Rule

The good news is that, in most cases, you don’t need to renew your Medicare coverage every year. If you’re enrolled in Original Medicare (Parts A and B) or a Medicare Advantage (MA) plan, your plan will typically renew automatically.

Original Medicare (Parts A and B)

If you’re enrolled in Original Medicare, you don’t need to take any action to renew your coverage annually. However, you need to continue paying your monthly Medicare Part B premium (and Part A premium, if applicable). The Part B premium for 2024 is $174.70, and the Part A premium is free for most beneficiaries who have worked and paid Medicare taxes for at least 10 years.

Medicare Advantage Plans (Part C)

Medicare Advantage plans, also known as Part C, will automatically renew each year unless the plan is terminated by Medicare or the insurance company stops offering it. If your plan is not renewed, you may qualify for a Special Election Period, which allows you to switch to another Medicare Advantage plan or return to Original Medicare.

Medicare Prescription Drug Plans (Part D)

Similar to Medicare Advantage plans, Medicare Part D prescription drug plans will renew automatically unless the plan is terminated by Medicare or the insurance company. If your plan is not renewed, you’ll need to enroll in a new Part D plan during the appropriate enrollment period.

The Annual Notice of Change (ANOC)

Although your Medicare plan may renew automatically, it’s crucial to review the Annual Notice of Change (ANOC) that your plan provider sends you each fall. The ANOC outlines any changes to your plan’s coverage, costs, and benefits that will take effect on January 1 of the following year.

Carefully review the ANOC to ensure that your plan still meets your healthcare needs and budget. If you don’t receive an ANOC by October or if you want to cancel your plan, contact your plan provider.

Medicare Enrollment Periods

While your Medicare plan may renew automatically, there are specific enrollment periods when you can make changes to your coverage. These include:

Initial Enrollment Period (IEP)

The Initial Enrollment Period is the first opportunity you have to sign up for Medicare. It begins three months before the month you turn 65, includes the month you turn 65, and ends three months after the month you turn 65. During this seven-month period, you can enroll in Medicare Parts A and B, as well as a Medicare Advantage or Part D plan.

Annual Enrollment Period (AEP)

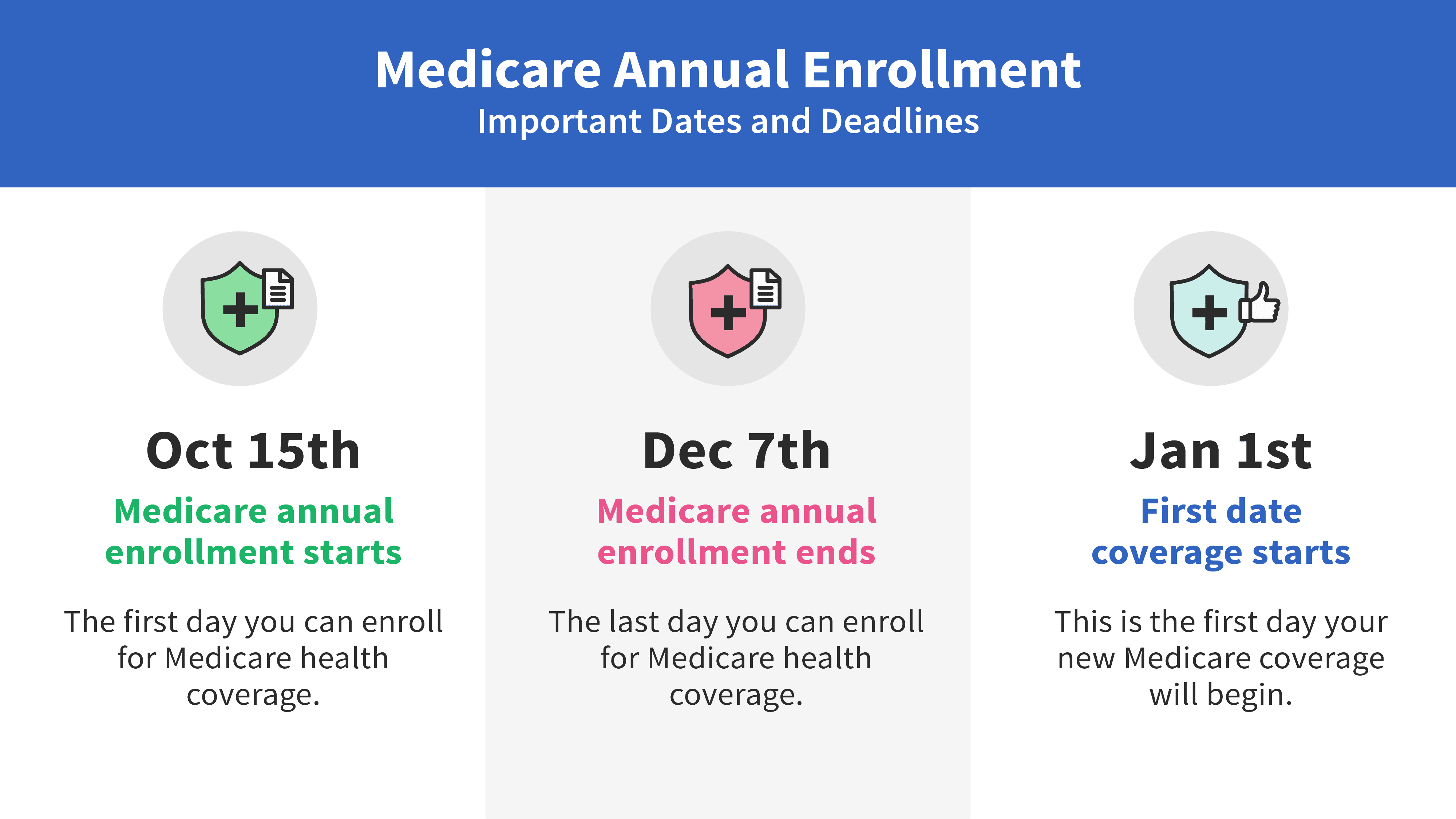

The Annual Enrollment Period, also known as the Open Enrollment Period, runs from October 15 to December 7 each year. During this time, you can join, switch, or change your Medicare Advantage or Part D prescription drug plan coverage for the following year.

Medicare Advantage Open Enrollment Period (MA OEP)

If you’re already enrolled in a Medicare Advantage plan, the Medicare Advantage Open Enrollment Period runs from January 1 to March 31 annually. During this period, you can switch to a different Medicare Advantage plan or return to Original Medicare (and join a Part D plan if needed). However, you can only make one change during this period.

Special Enrollment Periods (SEPs)

Special Enrollment Periods allow you to enroll in or change your Medicare coverage outside of the regular enrollment periods if you meet certain qualifying circumstances, such as moving to a new area or losing your current coverage.

Why You Should Review Your Medicare Plan Annually

Even though your Medicare plan may renew automatically, it’s essential to review your coverage each year during the Annual Enrollment Period. Your healthcare needs and financial situation can change, and reviewing your plan can ensure that it still meets your requirements. Additionally, plan costs, benefits, and provider networks may change annually, so it’s crucial to stay informed and make any necessary adjustments.

Conclusion

In most cases, you don’t need to enroll in Medicare every year, as your coverage will renew automatically. However, it’s essential to review your Annual Notice of Change and take advantage of the various enrollment periods to make any necessary changes to your Medicare plan. By staying informed and proactive, you can ensure that your Medicare coverage continues to meet your healthcare needs and budget.

Do I Have to Renew My Medicare Plan Each Year? [Ask Andy]

FAQ

Is it necessary to re enroll in Medicare every year?

What happens if you never enroll in Medicare?

Is Medicare mandatory at 65?

Does Medicare have an annual enrollment period?