When it comes to securing your financial future and protecting your loved ones, the choice between an annuity and life insurance can be a puzzling one. Both are powerful financial instruments, but they serve different purposes and cater to distinct needs. In this comprehensive guide, we’ll explore the nuances of annuities and life insurance, helping you determine which option aligns better with your goals and circumstances.

The Fundamental Difference

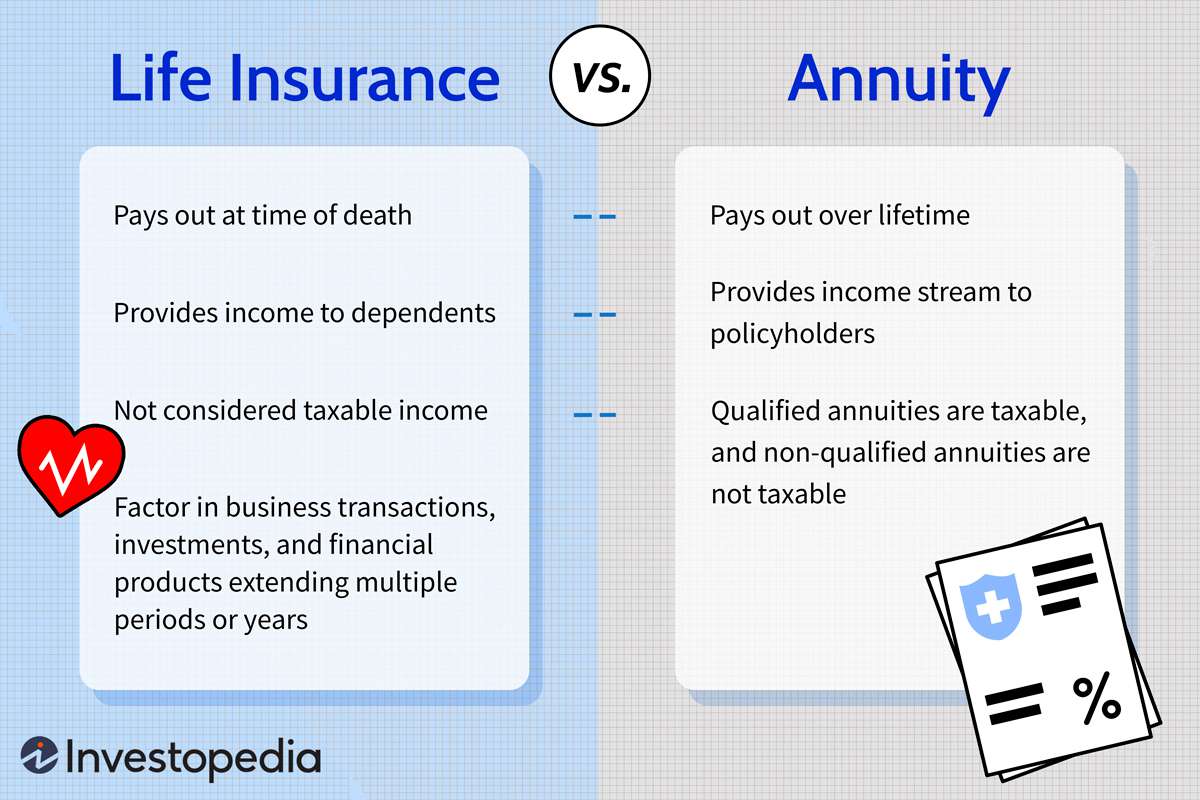

At their core, annuities and life insurance are distinct financial products with contrasting objectives. Life insurance is designed to provide financial protection for your beneficiaries in the event of your untimely demise. It offers a lump-sum payment, known as the death benefit, to your designated beneficiaries, ensuring they have the means to maintain their standard of living or cover outstanding debts.

On the other hand, annuities are primarily focused on securing your retirement income. They offer a guaranteed stream of payments, either for a predetermined period or for the remainder of your life, depending on the type of annuity you choose. Annuities are structured to help you maintain a consistent income during your golden years, mitigating the risk of outliving your savings.

The Question of Investment and Income Benefits

When it comes to investment and income benefits during your lifetime, annuities generally offer a more advantageous proposition. According to Investopedia, “Annuities offer better investment and income benefits while you’re alive.” This is because the entirety of your annuity contribution is devoted to generating investment returns and future income, without the need to allocate a portion for life insurance coverage.

Annuities often provide higher returns on your investment compared to life insurance policies. This is because life insurance premiums are divided between covering the cost of insurance and building cash value,

Annuity Vs. Life Insurance

FAQ

Who should not buy an annuity?

What is the biggest advantage of an annuity?

Should I convert whole life to annuity?