When it comes to assessing one’s financial standing, calculating net worth is a crucial exercise. Net worth provides a comprehensive snapshot of your overall wealth, taking into account your assets and liabilities. However, one question that often arises is whether annuities, a popular retirement income tool, should be included in this calculation. The answer, as with many financial matters, is not straightforward but understanding it can have a significant impact on your retirement planning.

Demystifying Net Worth

Before delving into the role of annuities in net worth calculations, let’s first understand what net worth entails. Net worth is the difference between your total assets and total liabilities. Assets include everything you own, such as cash, investments, real estate, and personal property. Liabilities, on the other hand, encompass all your outstanding debts, such as mortgages, loans, and credit card balances.

The formula for calculating net worth is simple:

Net Worth = Total Assets - Total LiabilitiesA positive net worth indicates that your assets exceed your liabilities, while a negative net worth suggests that your liabilities surpass your assets.

Annuities: A Valuable Asset

Now, let’s address the central question: Are annuities part of your net worth? The resounding answer is yes. Annuities, particularly those owned by high-net-worth individuals, are considered assets and should be included in the net worth calculation.

High-net-worth individuals often use annuities as part of their comprehensive financial strategy for several reasons:

-

Guaranteed Income: Annuities provide a steady and predictable income stream, which is attractive for wealth preservation and retirement planning.

-

Tax Benefits: Annuities offer tax-deferred growth, allowing high-net-worth individuals to manage their taxable income more effectively.

-

Estate Planning: Annuities can be structured to benefit heirs, making them a valuable tool for estate planning and wealth transfer.

-

Diversification: Incorporating annuities into an investment portfolio adds diversification, reducing overall risk exposure.

-

Inflation Protection: Some annuities offer inflation-adjusted payouts, preserving purchasing power over time and safeguarding against the erosive effects of inflation.

-

Longevity Risk Management: Annuities mitigate the risk of outliving one’s assets, a significant concern for those with substantial wealth and longer life expectancies.

By including annuities in their net worth calculations, high-net-worth individuals gain a more accurate representation of their overall financial standing and retirement readiness.

Calculating Net Worth with Annuities

When calculating net worth with annuities, it’s important to consider the type of annuity and its current value. Here are a few guidelines:

-

Deferred Annuities: For deferred annuities, which have not yet begun making payments, the current account value should be included as an asset in the net worth calculation.

-

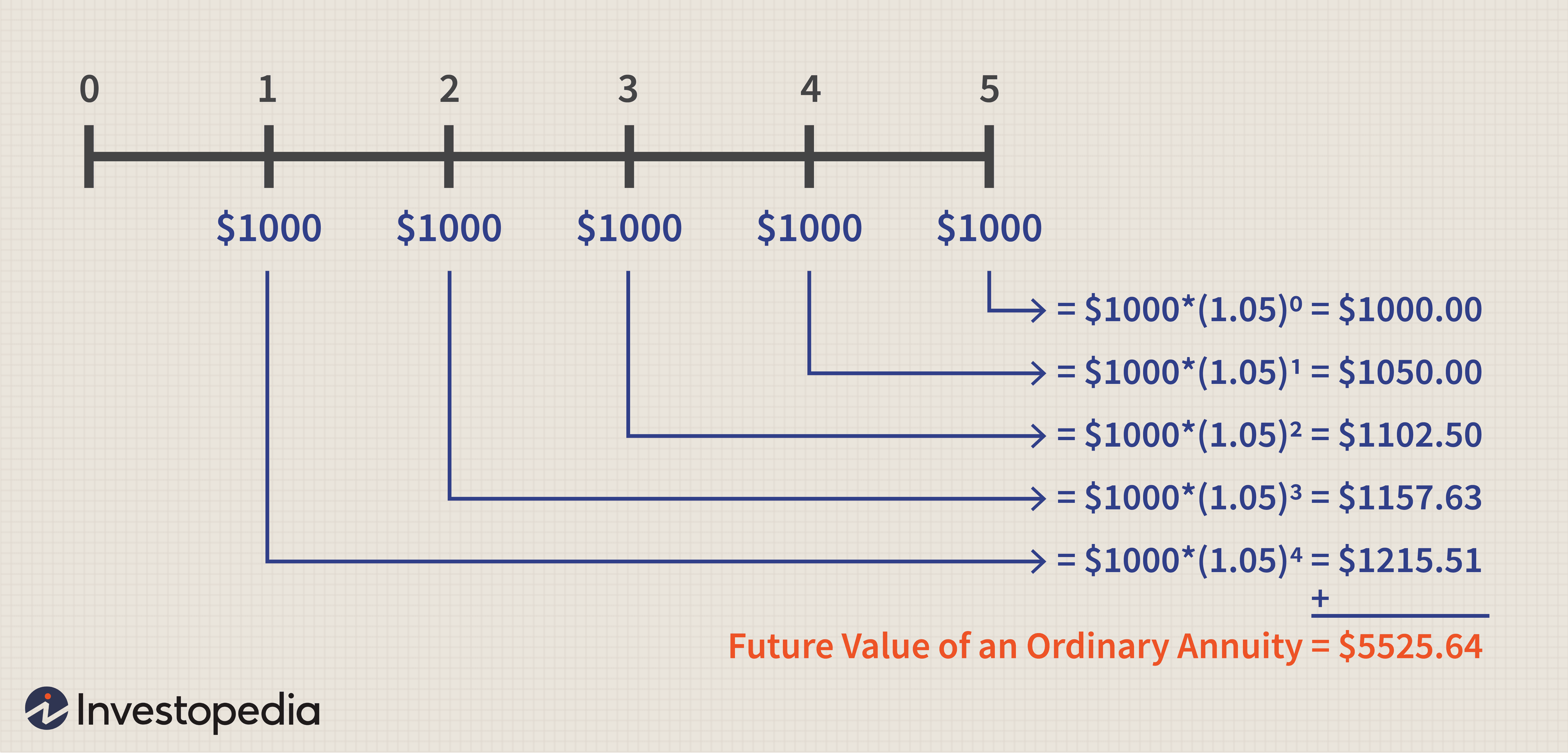

Immediate Annuities: For immediate annuities, which provide regular income payments, the present value of the remaining payments should be included as an asset.

-

Variable Annuities: For variable annuities, whose value fluctuates based on the performance of underlying investments, the current account value should be used in the net worth calculation.

It’s worth noting that while annuities contribute to net worth, they are generally considered illiquid assets due to the potential for surrender charges and penalties if funds are withdrawn prematurely. As a result, it’s essential to carefully consider the liquidity needs and overall financial goals when incorporating annuities into a portfolio.

The Bottom Line

In the realm of financial planning and retirement readiness, understanding the role of annuities in net worth calculations is crucial. By recognizing annuities as valuable assets, high-net-worth individuals can gain a more comprehensive view of their overall wealth and make informed decisions about their retirement income strategies.

However, it’s important to remember that annuities are complex financial products, and their inclusion in net worth calculations may vary depending on the specific type and terms of the contract. Consulting with a qualified financial advisor can help ensure that annuities are properly accounted for and aligned with your overall financial goals and risk tolerance.

Embracing annuities as part of your net worth can provide peace of mind and a more accurate representation of your financial standing, empowering you to navigate the complexities of retirement planning with confidence.

How Should You Factor In a Pension Into Your Net Worth Statement?

FAQ

Is an annuity included in net worth?

Do rich people invest in annuities?

Is my annuity considered an asset?

What is included in net worth?