As a Medicare beneficiary, it’s essential to understand the various costs associated with your healthcare coverage, including premiums and deductibles. One question that often arises is whether these expenses are tax-deductible, potentially providing you with valuable savings come tax season. In this comprehensive guide, we’ll explore the deductibility of Medicare premiums for the year 2020 and provide you with the information you need to make informed decisions about your healthcare expenses.

Understanding Medical Expense Deductions

Before diving into the specifics of Medicare premium deductibility, let’s first establish the general rules for deducting medical expenses on your federal income tax return. The Internal Revenue Service (IRS) allows taxpayers to deduct qualifying medical expenses that exceed 7.5% of their adjusted gross income (AGI).

For example, if your AGI for the tax year 2020 is $50,000, you can only deduct medical expenses that exceed $3,750 (7.5% of $50,000). If your total eligible medical expenses amounted to $5,000, you could deduct $1,250 ($5,000 – $3,750) on your tax return.

Medicare Part B Premiums

One of the most common Medicare expenses that may be tax-deductible is the monthly premium for Medicare Part B, which covers outpatient medical services, preventive care, and durable medical equipment.

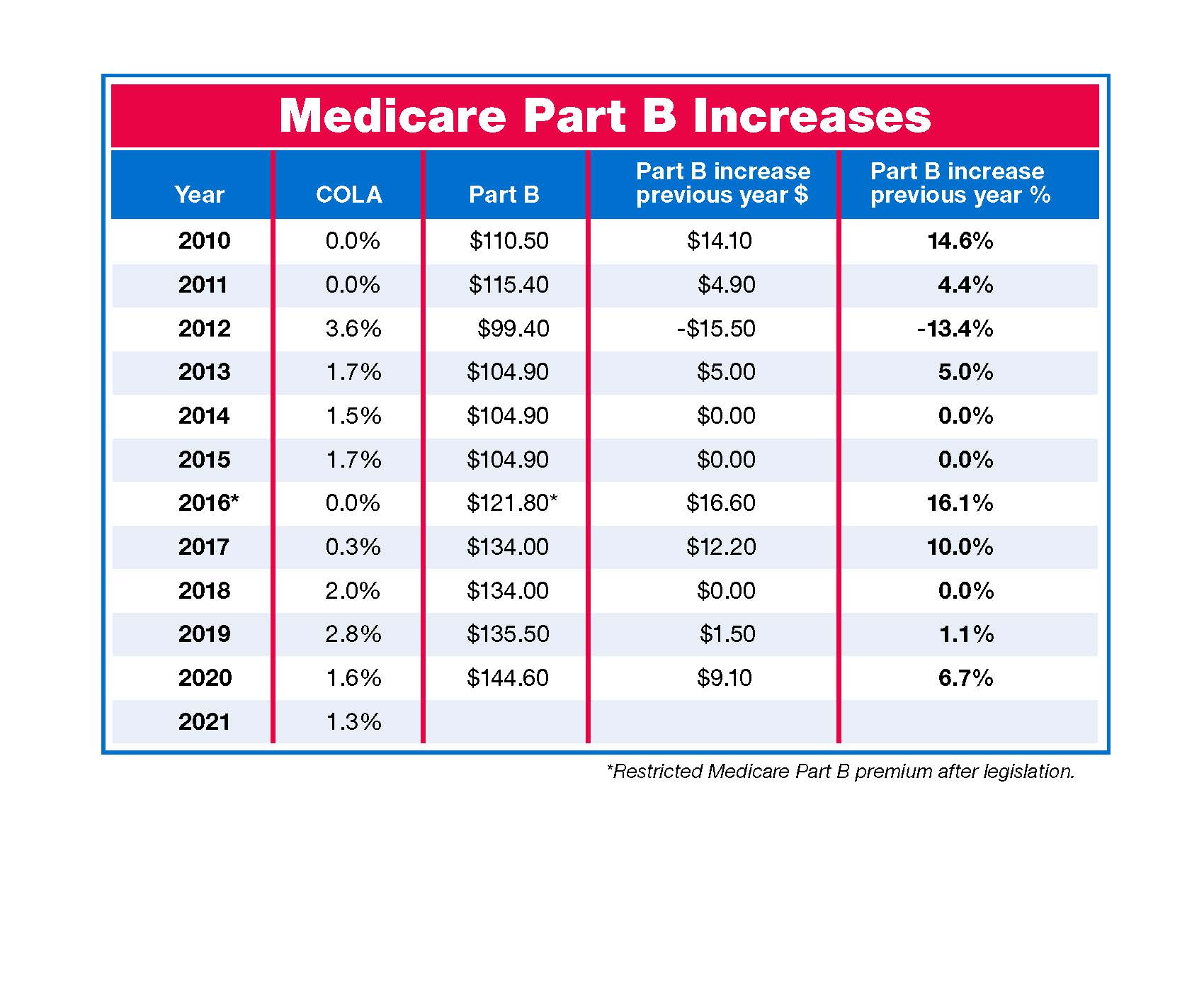

In 2020, the standard monthly premium for Medicare Part B enrollees was $144.60, an increase of $9.10 from the 2019 amount of $135.50. If you were subject to the standard Part B premium in 2020, you could deduct the full amount paid for the year, provided your total medical expenses exceeded the 7.5% AGI threshold.

However, it’s important to note that some Medicare beneficiaries pay higher Part B premiums based on their income levels. These income-related monthly adjustment amounts (IRMAA) can range from $202.40 to $491.60 per month for individuals with higher incomes in 2020. If you fell into one of these higher IRMAA tiers, the entire premium amount you paid would still be deductible as a medical expense.

Medicare Part D Premiums

Medicare Part D provides prescription drug coverage, and the premiums for these plans can also be deductible as medical expenses. Part D premiums vary based on the specific plan you choose, but they are subject to the same 7.5% AGI threshold as other medical expenses.

Additionally, if your income exceeds certain thresholds, you may be required to pay an income-related monthly adjustment amount (IRMAA) for your Part D coverage. These additional premium costs are also deductible as medical expenses.

Other Deductible Medicare Expenses

In addition to premiums for Medicare Parts B and D, you may be able to deduct other out-of-pocket expenses related to your Medicare coverage, such as:

- Medicare Part A premiums (if you’re required to pay them)

- Medicare Advantage (Part C) premiums

- Medicare Supplement Insurance (Medigap) premiums

- Deductibles, copayments, and coinsurance for Medicare-covered services

- Eligible long-term care insurance premiums (subject to age-based limits)

It’s essential to keep accurate records of all your medical expenses, including receipts, bills, and statements from Medicare and your insurance providers, to substantiate your deductions.

Planning for Medical Expense Deductions

To maximize your potential tax savings from medical expense deductions, it’s crucial to plan ahead and consider your healthcare needs for the upcoming year. Here are some tips to help you prepare:

-

Estimate your medical expenses: Review your previous year’s medical expenses and consider any anticipated changes in your healthcare needs for the upcoming year. This will help you determine if you’re likely to exceed the 7.5% AGI threshold and benefit from itemizing deductions.

-

Bunch expenses if possible: If you’re close to the AGI threshold, consider bunching eligible medical expenses into a single tax year. This could include scheduling non-emergency procedures or purchasing durable medical equipment in one year rather than spreading the costs over multiple years.

-

Explore tax-advantaged accounts: If you’re still working, consider contributing to a flexible spending account (FSA) or health savings account (HSA) to pay for medical expenses with pre-tax dollars.

-

Keep accurate records: Maintain detailed records of all your medical expenses, including receipts, bills, and explanations of benefits from Medicare and other insurance providers. This documentation will be essential if you’re audited by the IRS.

By understanding the deductibility of Medicare premiums and other medical expenses, you can potentially reduce your tax liability and maximize your savings. Remember to consult with a tax professional if you have specific questions or concerns about your individual situation.

Conclusion

As a Medicare beneficiary, being aware of the tax-deductibility of your healthcare expenses can provide valuable financial relief. In 2020, Medicare Part B and Part D premiums, including any income-related adjustment amounts, were generally deductible as medical expenses, subject to the 7.5% AGI threshold.

By carefully tracking your medical expenses, considering potential tax-planning strategies, and maintaining accurate records, you can take advantage of these deductions and potentially reduce your overall tax burden. Stay informed, plan ahead, and make the most of the tax benefits available to you as a Medicare beneficiary.