Online bill pay has become an indispensable tool for managing personal finances in the digital age. With just a few clicks, you can schedule and pay all your bills right from your computer or phone. This convenient service offers numerous advantages that save time and hassle compared to the old-fashioned way of paying bills by paper check

Convenience

One of the biggest benefits of online bill pay is convenience. You no longer have to write checks, find stamps, mail payments, or drive to a payment center. Everything can be handled electronically on your schedule.

As part of their online banking services, most banks and credit unions let you pay your bills online. All your payments are managed in one place for easy access. You can check in at any time to see when payments are due or make payments at the last minute if you need to.

Online bill pay allows you to automate recurring payments as well. Regular bills like rent, car payments, and utilities can be scheduled to pay automatically each month or on whatever custom schedule you prefer.

Control

With online bill pay, you have more control over when and how your bills get paid. You can choose exact payment dates to align with your paycheck deposit schedule and avoid overdrafts. Or schedule payments to arrive early so you never miss a due date and damage your credit.

You also have more transparency into your payment activity. Online banking makes it easy to see what bills are due, how much you’ve paid, what transactions are still pending, and more. Plus, you can cancel or edit scheduled payments if needed.

Cost Savings

Since payments happen electronically you save money on stamps and check costs. And when you automate bills you avoid late fees caused by forgetting a due date. Some banks even reimburse late fees if a properly scheduled payment doesn’t arrive on time.

Many service providers offer discounts for setting up automatic payments or e-bills, And going paperless means you reduce clutter and avoid the hassle of filing or shredding

Security

Online bill pay offers more security than mailing paper checks. Payments happen electronically in a protected digital environment. And if any unauthorized payment activity occurs, banks are quick to respond and refund lost money.

With paper checks, vital information is exposed on each payment. And once mailed, you lose control. Lost or stolen checks can easily lead to fraud. Online bill pay keeps your money and data safer.

Flexibility

Online bill pay works for all types of bills and providers. Most major companies accept electronic payments from banks. Smaller local businesses can receive paper checks mailed on your behalf.

You have options for when and how often payments get sent. Make one-time immediate payments, schedule future payments, or set up automatic recurring payments. Mix and match options to suit each bill.

Simplicity

Online bill pay drastically simplifies the bill payment process. All your bills and payment activity consolidates in one digital banking portal for easy access anytime.

You avoid the tedious tasks of checking the mail, organizing paper bills, filling out payment info, finding stamps, and visiting the post office. Just log in online or via your banking app to view and pay bills in seconds.

Reliability

Online bill pay helps ensure bills get paid accurately and on time every month. Recurring payments happen like clockwork on the dates you select so you never miss important due dates.

For bills that vary each month, most banks allow you to set payment reminders. Or you can schedule one-time future payments in advance for reliability. Either way, online bill pay takes the guesswork out of bill management.

Drawbacks

While online bill pay simplifies life enormously, there are a couple potential drawbacks to note:

-

Must monitor account regularly – Without paper bills arriving in the mail, it’s important to log into your account routinely to check for new bills and scheduled payments.

-

Variable bills require manual changes – Bills that change each month will need to be updated manually for accurate payment amounts unless you opt for automatic withdrawal.

-

Account overdrafts still possible – Be sure to check account balances to avoid overdrafts before payments are processed.

How to Get Started

Signing up for online bill pay is quick and easy through your bank or credit union. You can begin paying bills electronically right away and start streamlining your finances. Follow these steps:

-

Log into online or mobile banking and locate the payments/transfers section.

-

Select the “Pay Bills” feature and enter payee info like name, address, account number.

-

Pick payment date and amount for any immediate or future one-time payments.

-

To automate recurring payments, choose frequency and set up automatic delivery.

-

Confirm any e-bill activation offers directly through payee websites for paperless convenience.

-

Check account routinely to monitor upcoming bills and review payment history.

Online bill pay makes organizing finances faster and easier than ever. Automating payments saves time, avoids late fees, and simplifies your life. Just a few minutes setting up online bill pay can provide long-term convenience and control over when and how your bills get paid. Utilize your bank’s digital tools to streamline bill management and optimize your budget.

How does bill pay work?

How online bill pay works is straightforward: Log in to your bank account, navigate to its online bill pay feature, then select the provider you would like to pay. If you haven’t paid the provider through online bill pay before, you’ll need to add it by choosing it from a list or by plugging in the account number and billing address, then authorizing your bank to send payments for you.

» Looking for an online-friendly account? Check out NerdWallet’s favorite online checking accounts.

Payments can be sent by your bank electronically or via paper check, so you can pay even if the biller isn’t online — virtually eliminating the need for a checkbook. You can also choose a one-time payment or set up a recurring one.

Many banks offer basic bill pay service for free with their checking accounts. If you’re trying to minimize unnecessary fees, signing up for free bill pay service is a good way to keep track of your accounts and avoid charges for missing or late payments.

Many merchants and service providers offer the option of letting you receive an e-bill, or an electronic version of your paper bill, into your online bill pay account. If an e-bill arrives, you can have your bank alert you by email, text message or push notification via the bank app. Typically, you can choose whether to pay the entire balance, just the minimum due or another amount. You can even opt to have your bills paid automatically.

» Considering a cash management account? See our top picks for these high-APY checking-savings hybrids

SoFi Checking and Savings

4.60%SoFi members with Direct Deposit or $5,000 or more in Qualifying Deposits during the 30-Day Evaluation Period can earn 4.60% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Direct Deposit amount required to qualify for the stated interest rate. Members without either Direct Deposit or Qualifying Deposits, during the 30-Day Evaluation Period will earn 1.20% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Interest rates are variable and subject to change at any time. These rates are current as of 10/24/2023. There is no minimum balance requirement. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet.

$0These cash accounts combine services and features similar to checking, savings and/or investment accounts in one product. Cash management accounts are typically offered by non-bank financial institutions.These cash accounts combine services and features similar to checking, savings and/or investment accounts in one product. Cash management accounts are typically offered by non-bank financial institutions.

Betterment Cash Reserve – Paid non-client promotion

5.50%*Current promotional rate; annual percentage yield (variable) is 5.50% as of 4/2/24, plus a .50% boost available as a special offer with qualifying deposit. Terms apply; if the base APY increases or decreases, you’ll get the .75% boost on the updated rate. Cash Reserve is only available to clients of Betterment LLC, which is not a bank; cash transfers to program banks conducted through clients’ brokerage accounts at Betterment Securities.

$0CDs (certificates of deposit) are a type of savings account with a fixed rate and term, and usually have higher interest rates than regular savings accounts.CDs (certificates of deposit) are a type of savings account with a fixed rate and term, and usually have higher interest rates than regular savings accounts.

Marcus by Goldman Sachs High-Yield CD

5.10%5.10% APY (annual percentage yield) as of 04/29/2024

5.05%5.05% Annual Percentage Yield

4.90%Annual Percentage Yields (APY) is subject to change at any time without notice. Offer applies to personal non-IRA accounts only. Fees may reduce earnings. For CD accounts, a penalty may be imposed for early withdrawals. After maturity, if your CD rolls over, you will earn the offered rate of interest in effect at that time. Visit synchronybank.com for current rates, terms and account requirements. Member FDIC.

Marcus by Goldman Sachs High-Yield CD

5.00%5.00% APY (annual percentage yield) as of 04/29/2024

1 yearChecking accounts are used for day-to-day cash deposits and withdrawals.Checking accounts are used for day-to-day cash deposits and withdrawals.

Deposits are FDIC Insured

$0Money market accounts pay rates similar to savings accounts and have some checking features.Money market accounts pay rates similar to savings accounts and have some checking features.

Discover® Money Market Account

What is bill pay?

Bill pay is a service offered by many banks and credit unions that lets you set up automatic payments for bills. If you juggle rent or a mortgage, cable and electricity bills, credit card payments and more, online bill pay can save time and help you avoid late fees.

Online bill pay also allows you to manage your payments to various companies — all in one place. There’s no need to pay a Verizon bill on Verizon’s website, a Wells Fargo credit card with Wells Fargo bill pay, then write a check to your landlord. Instead, you could do it all from your financial institution’s website or mobile app.

An added bonus: Many banks and credit unions guarantee your payments will arrive on time and will reimburse your late fee if they don’t.

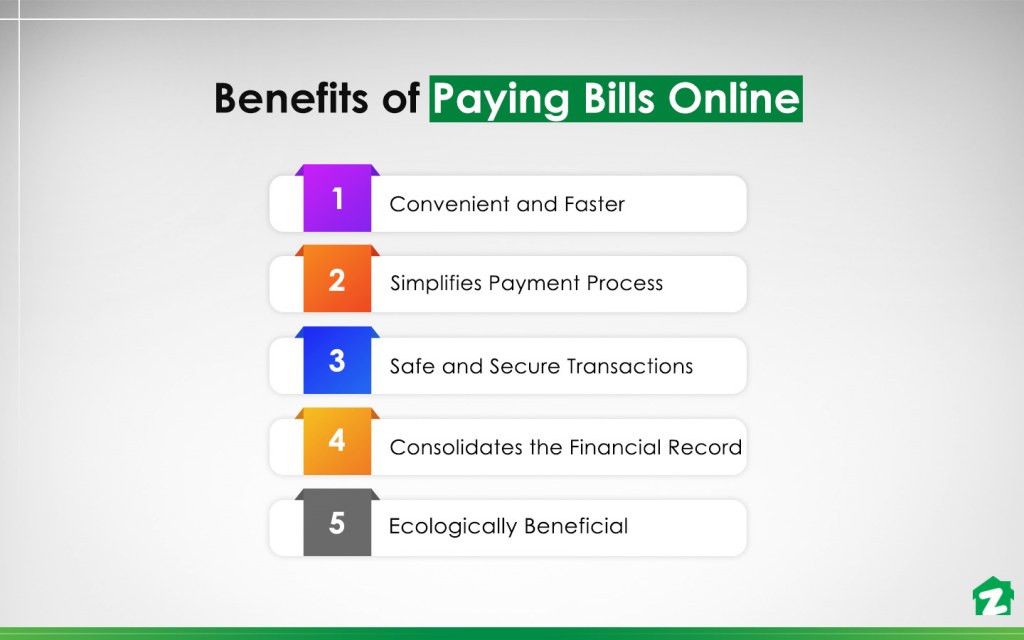

Benefits of Online Bill Pay

FAQ

What is an advantage of online bill pay?

Are there any disadvantages to online bill pay?

What benefits does using the internet to pay bills have?

Is online bill pay better than checks?

What are the benefits of online bill pay?

The biggest advantage of online bill pay is that it can help you automate your payments. Bills that are the same amount each month, like your mortgage or car payment, are great candidates for setting up a recurring payment schedule with online bill pay.

How do online bill-pay services work?

Usually, online bill-pay services work by having a linked checking account where the funds are withdrawn from. Some banks refer to the account that pays the bill as the “pay from” account, while the business or individual who receives the bill payment is designated as the “pay to” account.

What is online bill pay?

Online bill pay lets you make individual or recurring electronic payments from your bank or credit union. Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations.

Is online bill pay safe?

Online bill pay can be a safe and easy way to pay your bills. You can set up recurring or automatic payments so your bills are paid on time. Keeping enough money in your account to cover online bill pay can help you avoid fees or other penalties. Get the Capital One Mobile app to save time and stay informed. How does online bill pay work?