Managing finances can be tricky, especially when you get paid every two weeks and have monthly bills to pay A bi weekly bill pay template is the perfect solution to keep your bills organized and ensure on-time payments

Having trouble making a budget when your income and expenses don’t match up is something I know all too well. That’s why I made my own template for paying bills every two weeks; it has completely changed the way I do things. In this detailed guide, I’ll show you how to make your own template and give you advice on how to make a good biweekly budget.

What is a Bi Weekly Bill Pay Template?

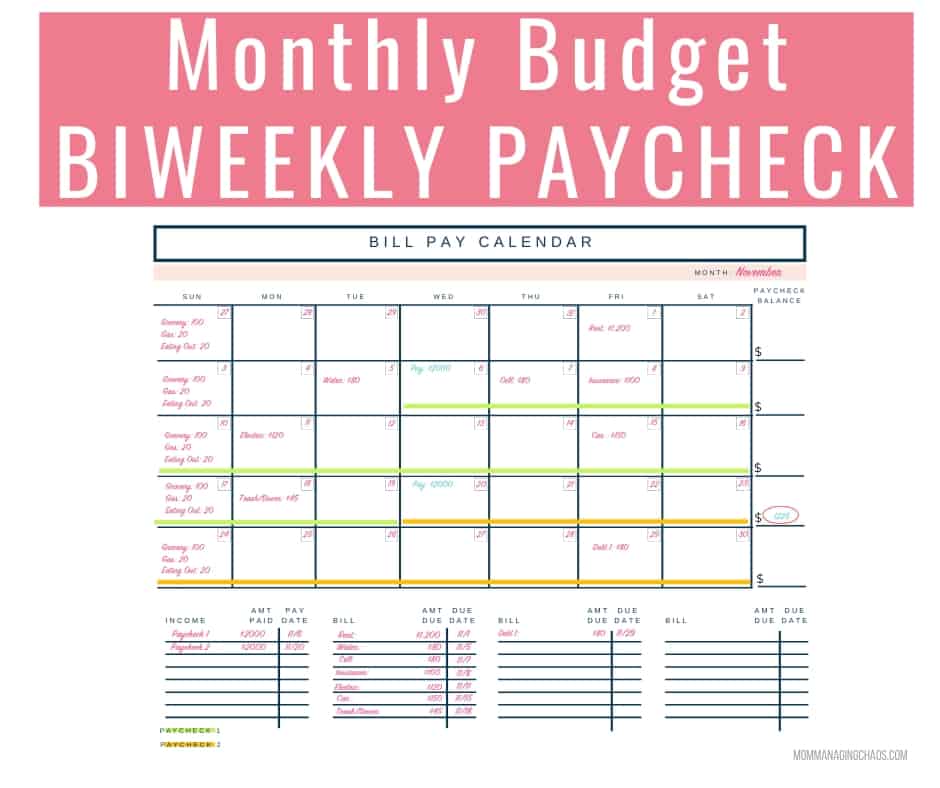

A bi weekly bill pay template allows you to map out your recurring bills and assign each one a payment date aligned with your pay schedule. This prevents bills from being forgotten or paid late.

The template lists all your regular monthly and annual bills, along with their due dates and payment amounts. You can then designate which bills will be paid from each bi weekly paycheck Any variable or one-off expenses can be budgeted for as well.

I like to use a spreadsheet for my template so I can easily edit it as needed. But you could also use a printed calendar or budgeting app. The key is that it’s set up based on your specific pay schedule and bills.

Benefits of Using a Bi Weekly Bill Pay Template

There are many advantages to mapping your bills to your pay schedule. Some of the key benefits include:

- Avoid late fees and penalties

- Take control of bill due dates

- Ensure all bills are covered with each paycheck

- Track variable expenses easily

- Identify room in your budget for savings or debt payoff

- Reduce stress about forgetting payments

- See your full financial picture in one place

When you get paid every two weeks, it’s much easier to stick to your budget when everything is clear.

How to Set Up Your Bi Weekly Bill Pay Template

Creating your own bill pay template takes a bit of upfront work, but once it’s set up it makes bi weekly budgeting a breeze. Just follow these steps:

1. List Your Bills

Gather details on all your recurring fixed bills. This includes things like:

- Rent/mortgage

- Car payment

- Insurance (health, auto, home)

- Utilities

- Internet and cell phone

- Subscriptions

- Childcare

- Loan payments

- Gym membership

- Any other monthly or annual bills

Don’t forget quarterly and annual bills too, like:

- Property taxes

- Amazon Prime

- Costco membership

- Vehicle registration

- Insurance premiums

List out all bills with the payment amount and due date. You can print copies of recent statements to help gather this info quickly.

2. Add Your Pay Schedule

Next, map out your pay schedule for the month. Mark all paydays on your template.

For bi weekly schedules, some months you’ll have 3 pay periods rather than the normal 2. Make sure your template reflects the accurate pay schedule each month.

3. Assign Bills to Paychecks

Now comes the fun part – assigning each bill to a specific paycheck! This is where you align due dates with pay dates to ensure all bills are covered.

Aim to have due dates spaced evenly from one payday to the next. You may need to request due date changes from some companies to achieve this, which most are willing to accommodate.

Assign as many bills as possible to each paycheck, keeping fixed expenses first priority.

4. Budget Variable Expenses

With your recurring bills assigned to paychecks, next budget for variable spending like groceries, gas, dining out, etc.

Determine average amounts you spend in these categories each month. Then divide across your paydays, with more budgeted for paydays farther from the previous check.

Building in buffer amounts for variable spending gives needed flexibility in your bi weekly budget.

5. Plan for True Expenses

“True expenses” are irregular expenses that happen periodically, like car repairs, medical bills, home maintenance, etc.

To cover these in your template, determine their average annual cost. Then divide that annual amount by 12 or 26 to get a monthly or bi weekly savings target. This ensures you’re steadily setting aside funds to afford true expenses when they arise.

6. Set Up Your Template

Now lay it all out in your template of choice. I like using an Excel spreadsheet so I can easily see my full financial picture.

Include columns for:

- Bill/Expense name

- Payment amount

- Due date

- Paycheck #1 assignment

- Paycheck #2 assignment

I use color coding to clearly distinguish what gets paid from each check. This visual representation makes the template extremely easy to use for bi weekly bill management.

Tips for Successful Bi Weekly Budgeting

Using a bill pay template effectively takes some planning and discipline. These tips will help you master bi weekly budgeting:

Get ahead on bills when possible – Try paying some bills or portions of bills a month in advance. This builds a cushion in case of any shortfalls.

Use automatic payments – Set up automatic deductions for the bills assigned to each paycheck. This prevents accidentally forgetting payments.

Save windfalls – Occasional 5 paycheck months provide a nice bonus. Stash extra funds from these in your emergency fund or for true expenses.

Review regularly – Update the template at least quarterly as bills change. Review weekly against actual spending.

Use a buffer – Add at least 10% buffer amounts to categories like groceries and gas to cover fluctuations.

Track every expense – Record all variable spending to catch any budget creep.

With consistent use, a bi weekly bill pay template provides tremendous clarity and control over your finances. Try automating payments whenever possible, and review the template weekly to ensure you’re aligning perfectly with your assigned bill due dates. Reap the benefits of structured, stress-free bi weekly budgeting!

Bi Weekly Budgeting FAQs

How do you budget semi monthly?

- Make a list of all bills with due dates and amounts

- Assign each bill to Paycheck 1 or Paycheck 2

- Budget variable/irregular expenses

- Use automatic payments and buffer amounts

- Review regularly vs. actual spending

What is the 50/30/20 budget rule?

The 50/30/20 budgeting guideline recommends spending:

- 50% of after-tax income on needs like housing and bills

- 30% on wants like hobbies and dining out

- 20% toward savings and debt repayment

This split can help with bi weekly budgeting, though percentages may vary based on your individual financial situation.

Can you pay bills with a credit card?

Yes, you can use a credit card to pay your monthly bills. Just be sure to pay the balance off in full each month to avoid interest charges. Automating credit card payments for recurring bills can simplify bi weekly budgeting.

How do you create a monthly budget in Excel?

- List bill names, due dates, and amounts

- Add columns for Paycheck 1 and Paycheck 2 assignments

- Use cell formatting and color coding for visual appeal

- Add rows for variable expenses

- Use formulas to calculate totals and category spending

- Set up separate tabs for annual summaries

Updating the Excel template each month provides an accurate picture of your full financial situation.

What day of the month is best to pay bills?

When you’re paid bi weekly, the ideal bill due dates are:

- 1 week before Paycheck 1

- 1 week before Paycheck 2

- A few days after Paycheck 2

This spacing ensures you have funds to cover each bill without stretching to the next pay period.

##Bi Weekly Bill Pay Templates to Use

Rather than creating your own template from scratch, you can start with a premade bi weekly budget template and customize it to your situation. Here are some great options:

-

Free Printable Bi Weekly Budget Template from Vertex42 (Excel) – Easy to edit and print

-

Bi Weekly Budget Planner Printable on Etsy – Stylish digital planner

-

Bi Weekly Budget Template PDF from PDFelement – Easy to edit PDF

-

Goodbudget Bi Weekly Budget Template – Excel calendar template

-

Bi Weekly Budget Spreadsheet on Pinterest – Colorful Google Sheet

Try out a few options to find the perfect bi weekly bill pay template for your needs. Customize the template to suit your specific bills and pay schedule.

Take Control with a Bi Weekly Bill Pay Template

A bi weekly pay schedule can make monthly budgeting tricky. But

Free Bi-Weekly Paycheck Budget Template

Size: 182.9KB

Sample Bi-Weekly Budget Template DetailsFile Format

- Google Docs

- Google Sheets

- MS Excel

- MS Word

- Numbers

- Photoshop

Size: US, A4