If you’re like many people, you may have purchased a term life insurance policy when you were younger and your financial obligations were higher. Term life insurance is an affordable way to obtain substantial coverage for a specific period, typically 10, 20, or 30 years. However, as you approach the end of the term, you may find yourself wondering, “Can I convert my term life to whole life insurance?”

The short answer is yes, most term life insurance policies allow you to convert to a permanent life insurance policy, such as whole life insurance, during a specified conversion period. However, the decision to convert your term life policy to whole life insurance is not a simple one, and there are several factors to consider before making the switch.

Understanding Whole Life Insurance

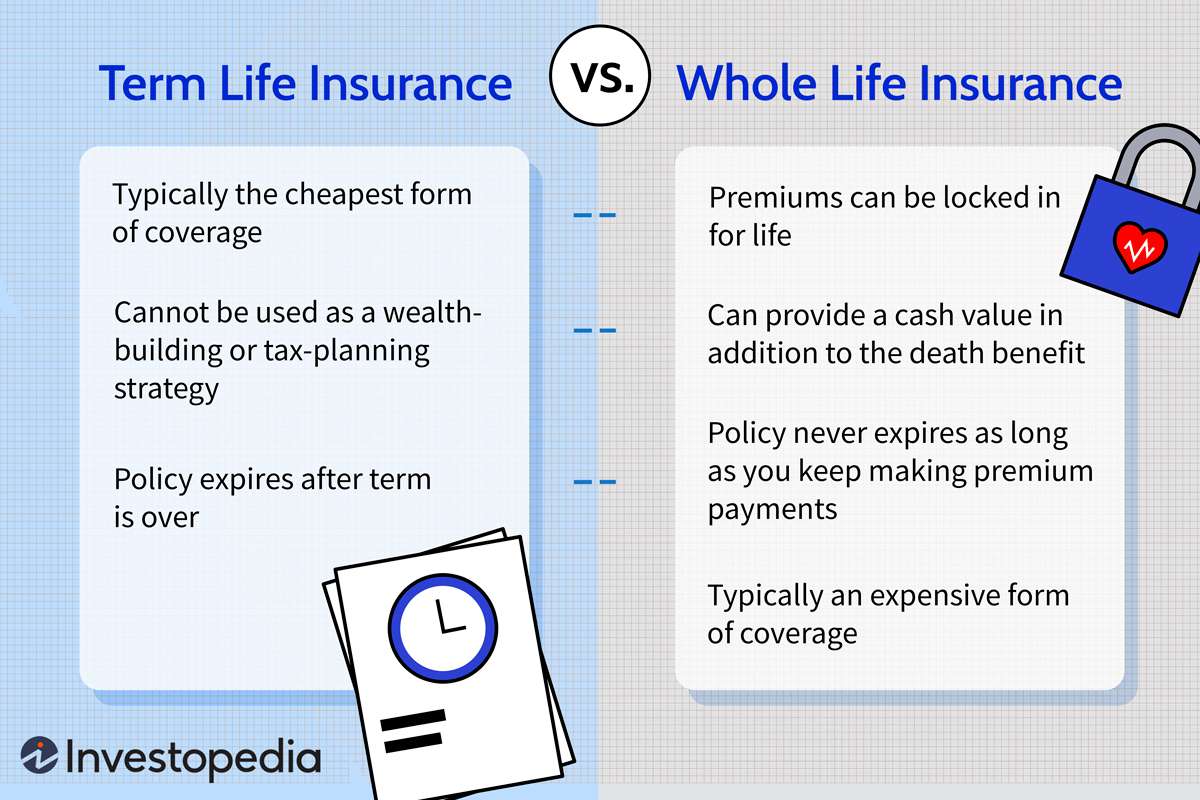

Before diving into the conversion process, it’s essential to understand what whole life insurance is and how it differs from term life insurance. Whole life insurance, also known as permanent life insurance, provides lifelong coverage as long as you continue to pay the premiums.

Unlike term life insurance, which provides coverage for a specific period, whole life insurance accumulates cash value over time. This cash value component allows you to borrow against the policy or withdraw funds if needed. Additionally, the premiums for whole life insurance remain level throughout the life of the policy.

The Conversion Process

Most term life insurance policies include a conversion privilege, which allows you to convert your term life policy to a permanent life insurance policy, such as whole life insurance, during a specified conversion period. This conversion period is typically the first half or two-thirds of the term length.

For example, if you have a 20-year term life insurance policy, you may be able to convert it to whole life insurance within the first 10 to 13 years of the policy’s term. The conversion process is relatively straightforward and does not require a new medical examination or additional underwriting.

To initiate the conversion process, you will need to contact your life insurance provider and request the conversion. The insurance company will provide you with the necessary paperwork and guide you through the process.

It’s important to note that when converting your term life insurance policy to whole life insurance, you may need to pay higher premiums due to the permanent nature of the coverage and the cash value component. The exact premium amount will depend on several factors, including your age, health status, and the amount of coverage you wish to convert.

Reasons to Convert Term Life to Whole Life Insurance

There are several reasons why you might consider converting your term life insurance policy to whole life insurance:

-

Lifelong Coverage: If you anticipate needing life insurance coverage beyond the term of your current policy, converting to whole life insurance can provide you with lifelong protection. This can be especially beneficial if you have dependents or outstanding financial obligations that may extend beyond the term period.

-

Cash Value Accumulation: Whole life insurance policies accumulate cash value over time, which can be accessed through policy loans or withdrawals. This cash value can serve as an additional source of funds for retirement, emergencies, or other financial needs.

-

Level Premiums: Unlike term life insurance, where premiums typically increase with each renewal, whole life insurance premiums remain level throughout the life of the policy. This can provide greater financial stability and predictability in your long-term financial planning.

-

Simplified Underwriting: Converting your term life policy to whole life insurance typically does not require a new medical examination or additional underwriting, making the process more convenient and less time-consuming.

Factors to Consider Before Converting

While converting your term life insurance policy to whole life insurance can be advantageous in certain situations, it’s crucial to carefully evaluate your specific circumstances and financial goals before making the decision. Here are some important factors to consider:

-

Cost: Whole life insurance premiums are generally higher than term life insurance premiums, particularly when converting later in life. It’s essential to ensure that you can comfortably afford the higher premiums over the long term.

-

Financial Needs: Assess your current and future financial obligations, such as outstanding debts, potential inheritances, and retirement expenses, to determine if whole life insurance is necessary or if a more affordable option, such as an extended term life policy or a different permanent life insurance product, might be more suitable.

-

Investment Options: Whole life insurance policies may not offer the same level of investment growth potential as other investment vehicles, such as mutual funds or individual retirement accounts (IRAs). Consider whether the cash value component of whole life insurance aligns with your overall investment strategy.

-

Beneficiary Needs: If your primary goal is to provide financial protection for your dependents during a specific time frame, such as until your children become financially independent or your mortgage is paid off, a term life insurance policy may still be the more appropriate choice.

Consulting with a Professional

The decision to convert your term life insurance policy to whole life insurance is a significant financial decision that should be carefully evaluated. It’s recommended to consult with a qualified financial advisor or insurance professional who can analyze your specific circumstances, financial goals, and risk tolerance.

A professional can help you weigh the pros and cons of converting your term life policy to whole life insurance and provide valuable insights into alternative options, such as extending your term life coverage or exploring other permanent life insurance products like universal life insurance.

Conclusion

Before making the decision to convert, carefully assess your financial situation, future obligations, and investment strategies. Consult with a qualified professional to ensure that you make an informed decision that aligns with your long-term financial objectives and provides the most appropriate life insurance coverage for your unique circumstances.