Medicare Part D, the prescription drug coverage offered by Medicare, provides essential assistance to beneficiaries in managing their medication costs. However, one aspect that can vary considerably across different Part D plans is the annual deductible. In this article, we’ll explore whether all Medicare Part D plans have the same deductible, and what factors influence these deductible amounts.

What is a Deductible in Medicare Part D?

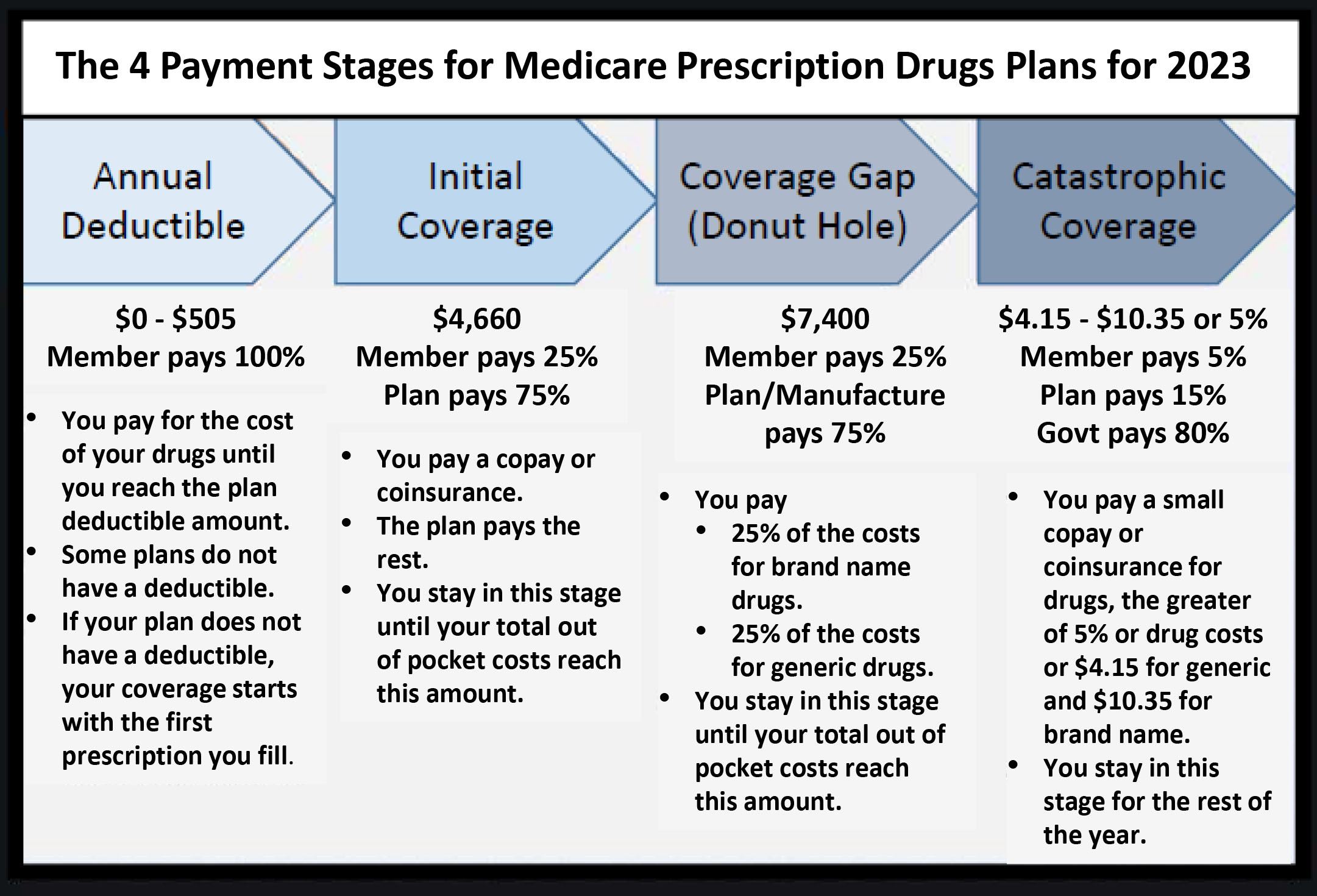

The deductible is the amount you must pay out-of-pocket for your prescription drugs before your Medicare Part D plan begins to cover its share of the costs. It is an annual expense, meaning that you’ll need to meet the deductible each year before your plan’s coverage kicks in.

Do All Part D Plans Have the Same Deductible?

The short answer is no. Medicare Part D plans do not have a standardized deductible amount. Each plan can set its own deductible, within certain limits established by Medicare.

According to Medicare.gov, in 2024, no Medicare drug plan may have a deductible more than $545. However, some Part D plans may choose to have a lower deductible, or even no deductible at all.

This variation in deductible amounts is one of the key factors that differentiate Part D plans from one another. Plans with higher deductibles may have lower monthly premiums, while those with lower or no deductibles often come with higher monthly premiums.

Understanding Deductible Tiers

It’s important to note that some Part D plans have a unique feature called “deductible tiers.” This means that certain prescription drugs, typically those in the lower tiers (such as preferred generics), may be covered by the plan before you meet the deductible. However, you’ll still need to pay the full cost of these medications until the deductible is met.

Once the deductible is satisfied, you’ll move into the initial coverage phase, where you’ll typically pay a copayment or coinsurance for your covered medications.

Factors Influencing Deductible Amounts

Several factors can influence the deductible amount set by a Medicare Part D plan. These include:

-

Plan Type: Stand-alone Prescription Drug Plans (PDPs) and Medicare Advantage Plans with prescription drug coverage (MA-PDs) may have different deductible structures.

-

Plan Provider: Insurance companies offering Part D plans can set their own deductible amounts within the Medicare limits.

-

Formulary: The list of covered medications (formulary) can impact the deductible amount, as plans may offer lower deductibles for certain drugs or tiers.

-

Location: Part D plans may vary in their deductible amounts based on the geographical region they serve.

Making an Informed Choice

When choosing a Medicare Part D plan, it’s crucial to carefully evaluate the deductible amount along with other factors such as monthly premiums, copayments, coinsurance rates, and the plan’s formulary. Beneficiaries with higher prescription drug needs may benefit from a plan with a lower or no deductible, even if it comes with a higher monthly premium.

It’s recommended to use the Medicare Plan Finder tool to compare different Part D plan options available in your area and find the one that best suits your specific needs and budget.

Remember, the deductible is just one component of the overall cost structure of a Medicare Part D plan. By understanding how deductibles work and how they vary across plans, you can make an informed decision and potentially save money on your prescription drug expenses.

Medicare Part D Drug Deductible Explained

FAQ

Are Part D plans priced the same for everyone?

What is the maximum out-of-pocket cost for Medicare Part D?

Does everyone have the same Medicare deductible?

What is the average cost of a Medicare Part D plan?