Turning 65 is a significant milestone, and for many, it’s accompanied by the question: “Do I get free Medicare when I reach this age?” The answer, like many things in life, is not a simple yes or no. Instead, it depends on several factors, including your work history and your eligibility for different parts of Medicare. In this comprehensive guide, we’ll break down the intricacies of Medicare eligibility at age 65 and help you understand what you can expect.

Understanding Medicare Parts A and B

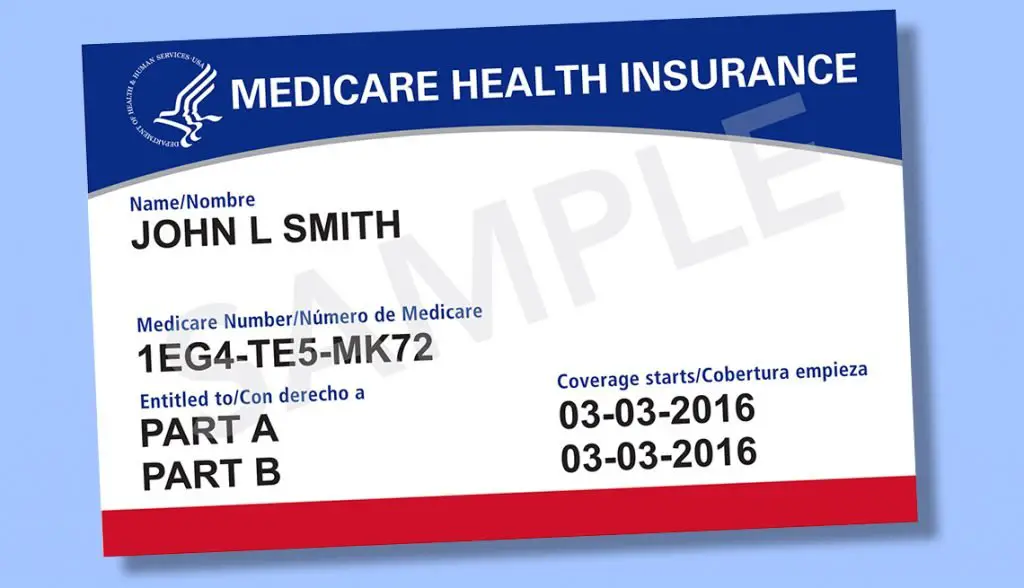

Before diving into the specifics of free Medicare coverage, it’s crucial to understand the different components of Medicare. Medicare is divided into several parts, with Part A (Hospital Insurance) and Part B (Medical Insurance) being the most fundamental.

Part A: Hospital Insurance

Part A covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care services. For most individuals, Part A is premium-free, meaning you don’t have to pay a monthly premium if you or your spouse paid Medicare taxes while working.

However, if you or your spouse didn’t pay enough Medicare taxes during your working years, you may have to pay a monthly premium for Part A. The good news is that even if you have to pay a premium for Part A, it’s typically lower than the standard Part B premium.

Part B: Medical Insurance

Part B covers doctor visits, outpatient care, preventive services, and certain home health care services. Unlike Part A, Part B requires a monthly premium, which is deducted from your Social Security benefits or billed to you directly if you don’t receive Social Security benefits.

Qualifying for Premium-free Part A at Age 65

Now, let’s address the burning question: Do you get free Medicare when you turn 65? The answer depends on your eligibility for premium-free Part A.

If you qualify for premium-free Part A, your Part A coverage will start automatically on the first day of the month you turn 65. However, if your birthday falls on the first of the month, your coverage will begin the month before you turn 65.

To qualify for premium-free Part A, you or your spouse must have worked and paid Medicare taxes for at least 10 years (40 quarters). If you meet this requirement, you’ll receive Part A coverage without having to pay a monthly premium.

Signing Up for Part B at Age 65

While Part A may be premium-free for many, enrolling in Part B requires action on your part. When you turn 65, you’ll have an Initial Enrollment Period (IEP) that lasts for seven months – three months before your 65th birthday month, your birthday month, and three months after your birthday month.

During this period, you’ll need to enroll in Part B to avoid potential late enrollment penalties. The standard Part B premium for 2023 is $164.90 per month, but it may be higher if your income exceeds certain thresholds (more on this later).

Working Past 65 and Medicare Enrollment

If you or your spouse are still working and have health insurance through your employer or union when you turn 65, you may be able to delay enrolling in Medicare without incurring late enrollment penalties. However, it’s essential to understand the specific rules and consult with your employer or insurance provider to ensure you don’t miss any important deadlines or risk gaps in coverage.

In this scenario, you’ll have an 8-month Special Enrollment Period (SEP) to sign up for Medicare after you or your spouse stops working or loses employer/union coverage, whichever comes first. During this SEP, you can enroll in Part B without facing late enrollment penalties.

Higher Income and IRMAA

If your modified adjusted gross income (MAGI) exceeds a certain threshold, you may have to pay an Income-Related Monthly Adjustment Amount (IRMAA) in addition to your standard Part B and Part D (prescription drug coverage) premiums. The IRMAA is a surcharge based on a sliding scale, with higher incomes resulting in higher surcharges.

For 2023, the IRMAA surcharge kicks in if your MAGI as an individual exceeds $97,000 or $194,000 for married couples filing jointly. The surcharge ranges from $65.90 to $395.60 per month, in addition to your standard Part B premium.

Conclusion

It’s essential to understand your specific situation and plan ahead to avoid late enrollment penalties or gaps in coverage. By being proactive and educating yourself about Medicare eligibility at age 65, you can navigate the process smoothly and ensure you have the healthcare coverage you need as you embark on this new chapter of your life.

Do I Automatically Get Medicare When I Turn 65?

FAQ

How much do I have to pay for Medicare when I turn 65?

Does everyone automatically get Medicare at 65?

Does everyone pay $170 for Medicare?

Why are you forced to get Medicare at 65?