When it comes to Medicare, understanding how an inheritance might impact your benefits is crucial. Many people are unsure whether they need to report an inheritance to Medicare or if it will affect their coverage. In this comprehensive guide, we’ll explore the ins and outs of inheritance and Medicare, addressing your concerns and providing you with the information you need.

Medicare: An Overview

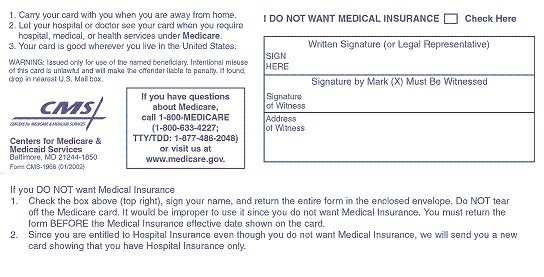

Medicare is a federal health insurance program primarily designed for individuals aged 65 and older, as well as certain younger individuals with disabilities or specific medical conditions. It is an entitlement program, which means that eligibility is not based on your income or assets.

There are four main parts to Medicare:

- Part A: Covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care services.

- Part B: Covers outpatient medical services, preventive care, and durable medical equipment.

- Part C (Medicare Advantage): An alternative to Original Medicare (Parts A and B) offered by private companies approved by Medicare.

- Part D: Covers prescription drug costs.

Does Inheritance Affect Medicare Eligibility or Benefits?

The straightforward answer is no, an inheritance will not impact your eligibility for Medicare or the benefits you receive. Medicare is an entitlement program, which means your eligibility is not based on your income or assets. Unlike Medicaid, which is a need-based program, Medicare does not consider your financial resources when determining your eligibility.

According to the Theus Law Offices, “Medicaid is a need-based benefit. However, Medicare and Social Security Disability Income (“SSDI”) are not need-based. As such, an inheritance will not affect Medicare benefits, which is an entitlement.”

Similarly, SmartAsset confirms that “Inheriting money or receiving any other windfall, such as a lottery payout, does not bar you in any way from receiving Medicare benefits.”

Potential Impact on Medicare Premiums

While an inheritance won’t affect your Medicare eligibility or the benefits you receive, it could potentially impact the premiums you pay for certain parts of Medicare. This is primarily due to the Income-Related Monthly Adjustment Amount (IRMAA), which is an additional premium charged to individuals with higher incomes.

Medicare Part B (medical insurance) and Medicare Part D (prescription drug coverage) are subject to IRMAA. If your modified adjusted gross income (MAGI) exceeds certain thresholds, you may be required to pay a higher monthly premium for these parts of Medicare.

For example, in 2023, individuals with a MAGI above $97,000 (or $194,000 for married couples filing jointly) will pay an additional IRMAA premium for Medicare Part B and Part D. The higher your MAGI, the higher the IRMAA premium you’ll need to pay.

It’s important to note that the MAGI used to calculate your IRMAA is based on your tax return from two years prior. So, if you receive an inheritance in 2023, it could potentially affect the IRMAA premiums you pay for Medicare in 2025.

Reporting Inheritance to Medicare

While you don’t need to report an inheritance directly to Medicare, it’s essential to accurately report your income on your tax return. The Internal Revenue Service (IRS) shares this information with the Social Security Administration, which then determines your IRMAA premiums based on your MAGI.

If you receive an inheritance that significantly increases your MAGI, it’s advisable to consult with a tax professional or financial advisor to ensure you’re correctly reporting the inheritance and preparing for any potential changes to your Medicare premiums.

Inheritance and Medicaid: A Different Story

It’s important to differentiate between Medicare and Medicaid, as inheritance can affect Medicaid eligibility and benefits. Medicaid is a need-based program that provides health coverage to individuals with limited income and resources.

Unlike Medicare, Medicaid does consider your financial resources when determining eligibility. If you receive an inheritance while receiving Medicaid benefits, it could potentially disqualify you from the program or require you to spend down the inheritance before regaining eligibility.

According to the Theus Law Offices, “If an inheritance puts you over the limit, it can disqualify you for Medicaid.” They further explain that if you cannot spend down the inheritance by the following month, “any remaining amount would be counted as assets for Medicaid eligibility.”

Therefore, if you’re receiving Medicaid benefits and expect to receive an inheritance, it’s crucial to consult with a Medicaid planning expert or an attorney specializing in this area to understand the potential implications and explore strategies to preserve your eligibility.

Conclusion

While you don’t need to report an inheritance directly to Medicare, it’s essential to accurately report your income on your tax return, as the IRS shares this information with the Social Security Administration for IRMAA premium calculations.

It’s important to note that inheritance can affect Medicaid eligibility and benefits, as Medicaid is a need-based program that considers your financial resources. If you’re receiving Medicaid benefits and expect to receive an inheritance, consulting with a Medicaid planning expert or an attorney is highly recommended to ensure you maintain your eligibility and benefits.

By understanding the relationship between inheritance and Medicare, you can make informed decisions and take proactive steps to manage your healthcare coverage and financial resources effectively.

Will an Inheritance to Someone on SSDI and Medicare Jeopardize Their Benefits?

FAQ

Does Medicare consider inheritance income?

Will inheritance affect my health insurance?

Does inheritance count as income?

Do you have to report to Social Security if you get an inheritance?