In the ever-evolving landscape of personal finance and taxation, understanding the impact of health insurance on your adjusted gross income (AGI) can be a game-changer. As healthcare costs continue to rise, many individuals and families seek ways to mitigate the financial burden while maximizing their tax benefits. In this comprehensive article, we’ll explore the intricate relationship between health insurance premiums and AGI, shedding light on potential deductions and strategies to optimize your tax situation.

Understanding Adjusted Gross Income (AGI)

Before delving into the nuances of health insurance deductions, it’s essential to grasp the concept of AGI. Adjusted Gross Income is a critical figure in the tax calculation process, as it serves as the foundation for determining various tax credits, deductions, and ultimately, your taxable income.

AGI is calculated by subtracting eligible deductions from your total gross income. These deductions can include contributions to qualified retirement plans, student loan interest, health savings account (HSA) contributions, and, notably, certain health insurance premiums.

Health Insurance Premiums and AGI: The Connection

The Internal Revenue Service (IRS) recognizes the financial burden of health insurance premiums and allows certain deductions to reduce your AGI. However, the eligibility criteria and deduction limits vary depending on your employment status and the type of health insurance coverage you have.

Self-Employed Individuals

For self-employed individuals, the IRS offers a significant deduction opportunity. If you are self-employed and pay health insurance premiums for yourself, your spouse, and your dependents, you can deduct the entire premium amount from your gross income. This deduction is claimed on Schedule 1 (Form 1040) and directly reduces your AGI.

Example: If your gross income is $80,000, and you paid $6,000 in health insurance premiums for the year, your AGI would be reduced to $74,000 ($80,000 – $6,000).

Employed Individuals

If you are employed and receive health insurance coverage through your employer, the premiums are typically deducted from your paycheck on a pre-tax basis. This means that the premiums are excluded from your gross income calculations, effectively reducing your AGI without the need for an itemized deduction.

However, if you pay premiums for additional coverage outside of your employer-sponsored plan, such as supplemental insurance or coverage for dependents, you may be eligible to claim a deduction for those premiums. However, this deduction is subject to specific limitations and is only available if you itemize your deductions and your total qualified medical expenses exceed 7.5% of your AGI.

Self-Employed vs. Employed: A Comparison

To illustrate the difference between self-employed and employed individuals, let’s consider the following example:

- John is self-employed and paid $8,000 in health insurance premiums for the year.

- Jane is employed and paid $4,000 in health insurance premiums through her employer’s plan.

In this scenario, John can deduct the entire $8,000 from his gross income, reducing his AGI by $8,000. On the other hand, Jane’s premiums are already excluded from her gross income calculations, so her AGI remains unchanged.

Additional Considerations

It’s important to note that the deductibility of health insurance premiums is subject to various rules and limitations. For instance, premiums paid for long-term care insurance or health savings accounts (HSAs) may have separate deduction rules.

Furthermore, if you itemize deductions, certain medical expenses exceeding 7.5% of your AGI may also be deductible, including co-payments, deductibles, and other out-of-pocket healthcare costs not covered by insurance.

Maximizing Your Tax Benefits

To maximize the tax benefits associated with health insurance premiums, it’s essential to stay informed about the latest tax laws and consult with a qualified tax professional. They can assess your unique situation and provide tailored advice on deduction strategies, eligibility criteria, and documentation requirements.

By understanding the impact of health insurance premiums on your AGI, you can make informed decisions about your healthcare coverage and potentially reduce your overall tax burden. Remember, proactive tax planning and awareness of deduction opportunities can contribute significantly to your long-term financial well-being.

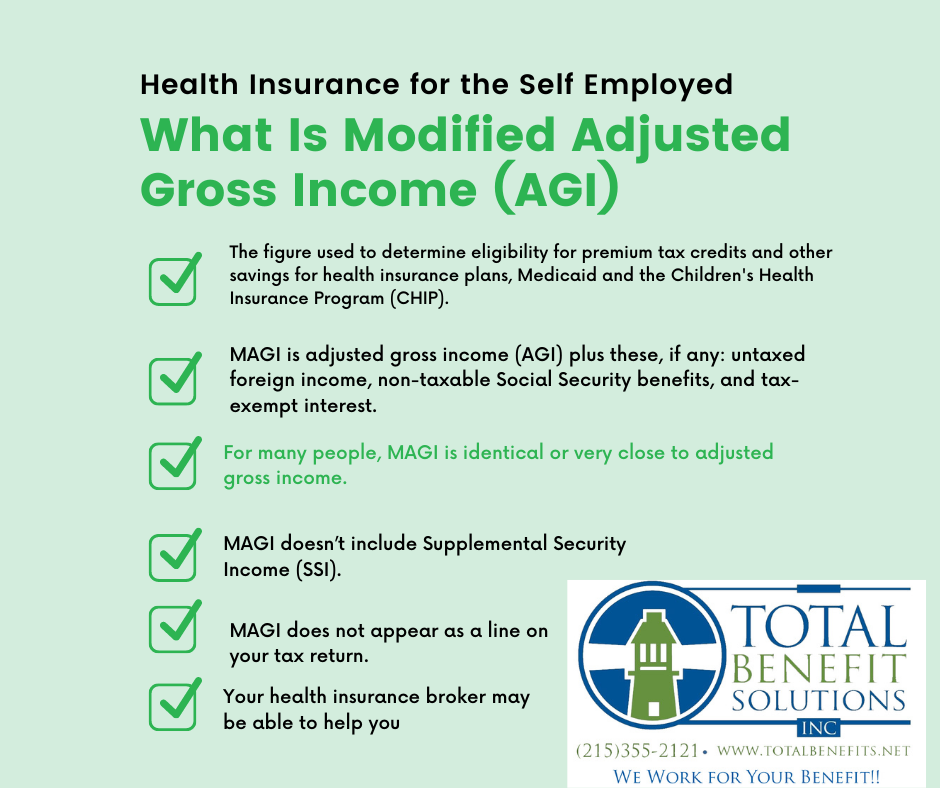

How to Calculate MAGI (Modified Adjusted Gross Income) for Health Insurance

FAQ

Do health insurance premiums affect AGI?

Does health insurance lower tax return?

Can medical expenses reduce AGI?

Can I deduct health insurance premiums on my taxes?