As you navigate the world of Medicare supplement plans, it’s essential to understand what each plan covers and what it doesn’t. One question that often arises is whether Medicare Supplement Plan G covers prescription drug costs under Part D. In this article, we’ll dive deep into this topic and help you make an informed decision.

What is Medicare Part D?

Before we explore Plan G’s coverage, let’s briefly discuss Medicare Part D. Part D is the prescription drug coverage component of Medicare. It helps cover the cost of outpatient prescription drugs, including those you get at a retail pharmacy or through mail order.

Medicare Part D plans are offered by private insurance companies approved by Medicare. These plans have their own formularies (list of covered drugs) and cost-sharing structures, such as deductibles, copayments, and coinsurance.

Does Medicare Supplement Plan G Cover Part D?

The short answer is no. Medicare Supplement Plan G does not include coverage for outpatient prescription drugs typically covered under Medicare Part D.

Plan G is designed to help cover some of the out-of-pocket costs associated with Medicare Parts A (hospital insurance) and Part B (medical insurance). It does not provide coverage for the prescription drug component, which falls under Part D.

What Does Plan G Cover?

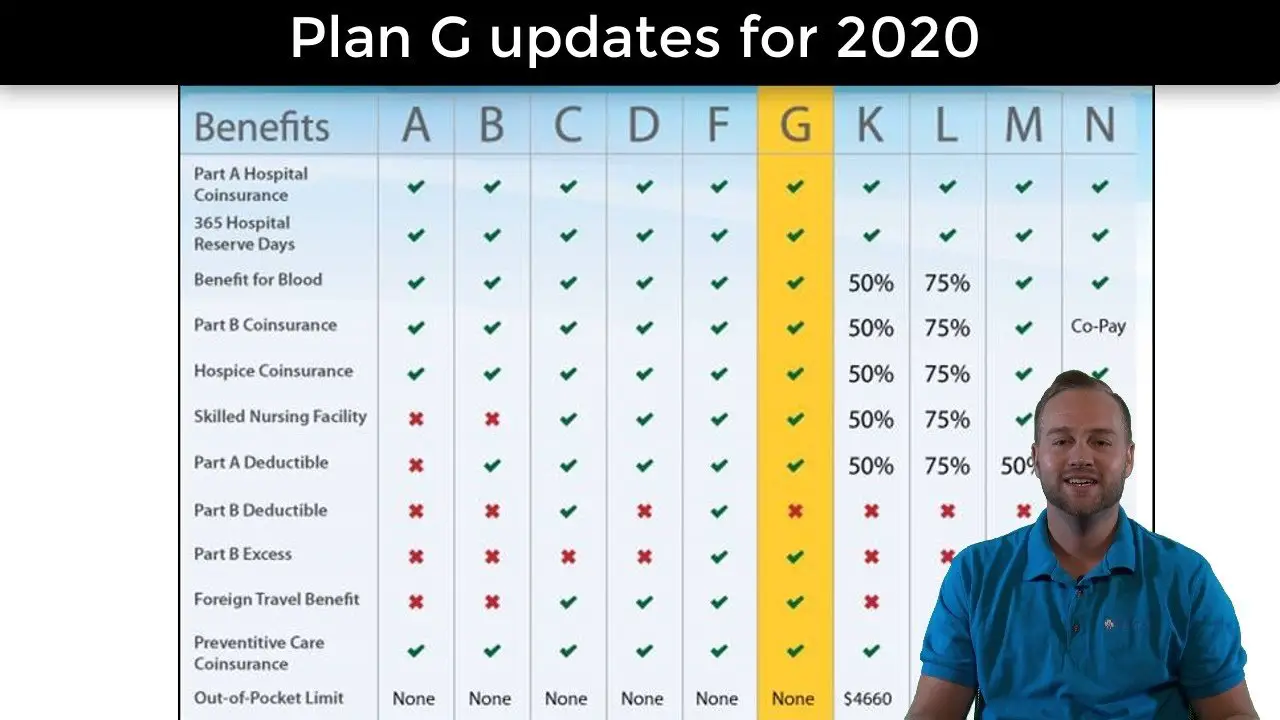

While Plan G doesn’t cover Part D prescription drugs, it does offer comprehensive coverage for other Medicare-approved services. Here’s what Medicare Supplement Plan G covers:

- Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are exhausted

- Part A deductible

- Part A hospice care coinsurance or copayments

- First three pints of blood

- Skilled nursing facility care coinsurance

- Part B coinsurance or copayments

- Part B excess charges (up to 15% above the Medicare-approved amount)

One key benefit of Plan G is that it covers Part B excess charges, which are the additional costs some healthcare providers may charge above the Medicare-approved amount. Only two Medigap plans, Plan G and the soon-to-be-discontinued Plan F, offer this coverage.

Covering Prescription Drug Costs

If you want coverage for outpatient prescription drugs, you’ll need to enroll in a separate Medicare Part D plan. These plans are offered by private insurance companies and have their own monthly premiums, deductibles, and cost-sharing structures.

However, it’s worth noting that Medicare Supplement Plan G does cover the coinsurance for Part B medications. These are typically medications administered in a clinical setting, such as chemotherapy drugs or certain injectable medications.

Making an Informed Decision

When choosing a Medicare supplement plan, it’s essential to consider your overall healthcare needs and budget. While Plan G does not cover Part D prescription drugs, it may still be a suitable option if you don’t have significant prescription drug costs or if you plan to enroll in a separate Part D plan.

On the other hand, if you have high prescription drug expenses, you may want to explore other Medigap plans or consider a Medicare Advantage plan that includes prescription drug coverage.

Remember, Medicare plan options and costs can change annually, so it’s essential to review your coverage and make adjustments as needed during the annual enrollment period.

By understanding what Medicare Supplement Plan G covers and doesn’t cover, you can make an informed decision and ensure you have the right coverage to meet your healthcare needs.

Medicare Supplement Plan G – Medicare Part D – Do Medigap Plans Cover Part D?

FAQ

Does Medicare Plan G include Part D?

What are the disadvantages of Medicare Part G?

What is the one gap benefit that Plan G does not cover?

Can you switch from a Medicare Advantage Plan to a Medigap plan?