In the world of auto insurance, few terms are as crucial yet perplexing as “Actual Cash Value” (ACV). This seemingly simple concept holds the key to understanding how much you’ll receive if your vehicle is deemed a total loss after an accident or theft. At Progressive, a leading insurance provider, they have a well-established method for calculating ACV, and in this comprehensive guide, we’ll demystify the process for you.

What is Actual Cash Value?

Before we delve into the intricacies of Progressive’s ACV calculation, let’s define what Actual Cash Value truly means. ACV represents the market value of your vehicle immediately before the loss occurred, taking into account various factors such as its age, condition, mileage, and optional features. In essence, it’s the amount your vehicle could have been sold for on the open market prior to the incident.

Progressive’s ACV Calculation Method

Progressive has partnered with a third-party vendor to ensure a fair and consistent ACV determination process. This vendor specializes in valuing vehicles and provides Progressive with the necessary data and expertise to accurately assess your car’s worth. Here’s a breakdown of the key factors considered:

1. Vehicle Condition

One of the most significant factors in determining ACV is your vehicle’s pre-loss condition. Progressive’s vendor will evaluate the vehicle’s overall state, including any existing damage, wear and tear, and the maintenance history. A well-maintained vehicle in pristine condition will naturally have a higher ACV than one that has been neglected or involved in previous accidents.

2. Age and Mileage

As vehicles age and accumulate more miles, their value naturally decreases. Progressive takes into account your car’s age and mileage when calculating ACV. Newer vehicles with lower mileage tend to have a higher ACV, while older, high-mileage vehicles will have a lower value.

3. Optional Features and Equipment

Did you opt for that fancy navigation system or upgrade to premium wheels? These additional features and equipment can influence your vehicle’s ACV. Progressive’s vendor considers all factory-installed and aftermarket accessories when determining the final value.

4. Market Data and Comparable Vehicles

To ensure an accurate valuation, Progressive’s vendor analyzes market data for similar vehicles in your area. They’ll look at recent sales prices for comparable make, model, year, and trim levels, factoring in any regional variations that may affect pricing.

5. Deductible and Additional Factors

Once the ACV is calculated, Progressive will subtract your deductible (if applicable) from the total value. Additionally, they may consider other factors such as prior damage or existing loans/leases on the vehicle when determining the final settlement amount.

Transparency and Communication

Progressive understands the importance of transparency in the ACV calculation process. They strive to provide clear communication and documentation throughout the claims process, ensuring that you have a comprehensive understanding of how your vehicle’s value was determined.

If you have any questions or concerns regarding the ACV calculation, Progressive’s knowledgeable claims representatives are available to walk you through the details and address any uncertainties you may have.

Conclusion

Determining a vehicle’s Actual Cash Value is a complex process that requires expertise and access to vast amounts of data. At Progressive, they’ve partnered with a reputable third-party vendor to ensure a fair and consistent ACV calculation for their customers. By taking into account factors such as vehicle condition, age, mileage, optional features, and market data, Progressive aims to provide an accurate valuation that reflects the true worth of your vehicle.

While the concept of ACV may seem daunting, Progressive’s commitment to transparency and communication ensures that you’ll have a clear understanding of how your vehicle’s value was assessed. Armed with this knowledge, you can navigate the claims process with confidence, knowing that your settlement will be based on a thorough and impartial evaluation.

ACV vs. Replacement Cost and How insurance calculates the value of your car, house, atv, motorcycle

FAQ

How does Progressive calculate actual cash value?

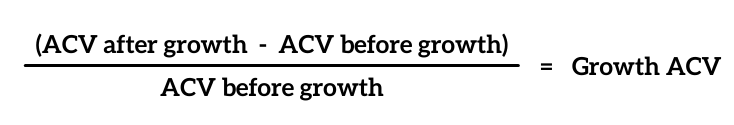

How is ACV calculated?

What does ACV mean Progressive?

How does Progressive decide total loss?