Medicaid, a joint federal-state health insurance program, plays a crucial role in providing coverage to millions of low-income individuals across the country. However, the question of how this vital program is funded often sparks curiosity. In this comprehensive article, we’ll delve into the intricate mechanisms that govern Medicaid funding in the United States.

The Joint Federal-State Funding Model

Medicaid is a unique program that operates on a joint funding model, with both the federal government and individual states contributing to its financial resources. This partnership is designed to ensure that states have the necessary support to provide healthcare coverage to their eligible residents while maintaining a level of flexibility in program administration.

Federal Medical Assistance Percentage (FMAP)

At the heart of Medicaid funding lies the Federal Medical Assistance Percentage (FMAP). This formula-driven approach determines the share of program costs that the federal government will contribute for each state. The FMAP is calculated annually based on a state’s per capita income relative to the national average, with states having lower per capita incomes receiving a higher federal matching rate.

For the federal fiscal year 2023, the FMAP ranges from 50% to 78%, with the federal government covering a larger portion of costs for states with lower average incomes. This mechanism ensures that states with fewer financial resources receive a greater level of federal support, promoting equitable access to healthcare services.

State Contributions

While the federal government provides a significant portion of Medicaid funding, states are responsible for contributing their share of the program’s costs. This state contribution, known as the “state match,” is calculated based on the FMAP rate. States with a higher FMAP receive a smaller federal contribution, requiring them to allocate a larger portion of their own funds to sustain the program.

It’s important to note that states have the flexibility to determine certain aspects of their Medicaid programs, such as covered services, provider payment rates, and eligibility criteria, within federal guidelines. This flexibility allows states to tailor their programs to meet the unique needs of their populations while adhering to federal requirements.

Enhanced Federal Funding During Crises

During times of economic hardship or public health emergencies, the federal government has implemented measures to provide additional support to states through enhanced Medicaid funding. For instance, during the COVID-19 pandemic, the Families First Coronavirus Response Act (FFCRA) offered a temporary 6.2 percentage point increase in the FMAP for states that maintained continuous Medicaid enrollment during the public health emergency.

Such enhanced federal funding initiatives aim to alleviate the financial burden on states during challenging times and ensure the continuity of healthcare coverage for vulnerable populations.

Financing Mechanisms and Considerations

In addition to the FMAP, several other financing mechanisms play a role in Medicaid funding:

-

Disproportionate Share Hospital (DSH) Payments: These payments are made to hospitals that serve a disproportionate number of Medicaid and low-income uninsured patients, helping to offset the costs of uncompensated care.

-

Provider Taxes and Intergovernmental Transfers (IGTs): States have the option to leverage provider taxes and IGTs to help finance their share of Medicaid costs, within certain federal limits and rules.

-

Administrative Costs: While the majority of Medicaid funding is allocated to medical services, the federal government also contributes to administrative costs incurred by states in managing their Medicaid programs, typically at a 50% matching rate.

It’s important to note that the Medicaid funding landscape is dynamic, with ongoing discussions and policy proposals aimed at adjusting funding mechanisms and addressing the program’s long-term sustainability.

The Impact on State Budgets and Economies

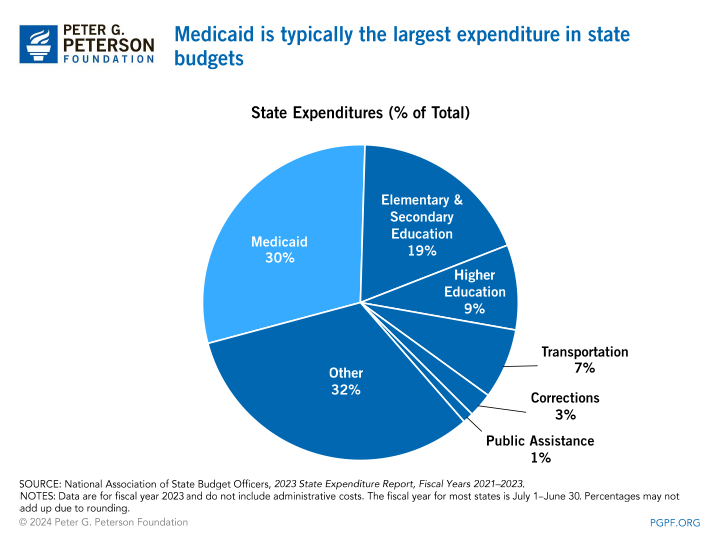

Medicaid plays a significant role in state budgets, accounting for a substantial portion of both expenditures and federal revenue for many states. According to data from the National Association of State Budget Officers (NASBO), in state fiscal year 2021, Medicaid accounted for 27% of total state spending and 45% of all expenditures from federal funds.

Furthermore, the influx of federal Medicaid dollars has been shown to have positive effects on state economies. The infusion of federal funds into a state’s economy can generate a multiplier effect, directly impacting healthcare providers and indirectly benefiting other businesses and industries.

Looking Ahead

As the healthcare landscape continues to evolve, the funding mechanisms for Medicaid will likely remain a topic of ongoing discussion and potential reform. Proposals to modify federal spending on Medicaid, whether through funding caps or alternative approaches, could significantly impact the program’s ability to provide comprehensive coverage to eligible individuals.

It’s crucial for policymakers, healthcare professionals, and the public to stay informed about the intricacies of Medicaid funding and to engage in constructive dialogue to ensure the program’s long-term viability and ability to serve those in need.

In conclusion, Medicaid funding in the United States is a intricate tapestry woven from federal and state contributions, designed to provide healthcare access to millions of Americans while balancing the needs of individual states. By understanding the mechanisms that govern this vital program, we can better appreciate the collaborative efforts required to sustain and improve healthcare for vulnerable populations across the nation.