Recovering from a major illness, injury, or surgery can be a daunting process, often requiring intensive rehabilitation services. For Medicare beneficiaries, understanding the coverage limits for inpatient rehab care is crucial to ensure a smooth recovery journey. In this comprehensive guide, we’ll explore the ins and outs of Medicare’s inpatient rehabilitation coverage, answering the burning question: “How long can you stay in rehab on Medicare?”

The Golden Rule: Medically Necessary Care

Before diving into the specifics of coverage duration, it’s important to understand Medicare’s overarching principle: coverage is provided for care deemed “medically necessary” by your healthcare provider. This means that your doctor must certify that your medical condition requires intensive rehabilitation, continued supervision, and coordinated care from a team of doctors and therapists.

Skilled Nursing Facility (SNF) Rehab: Up to 100 Days

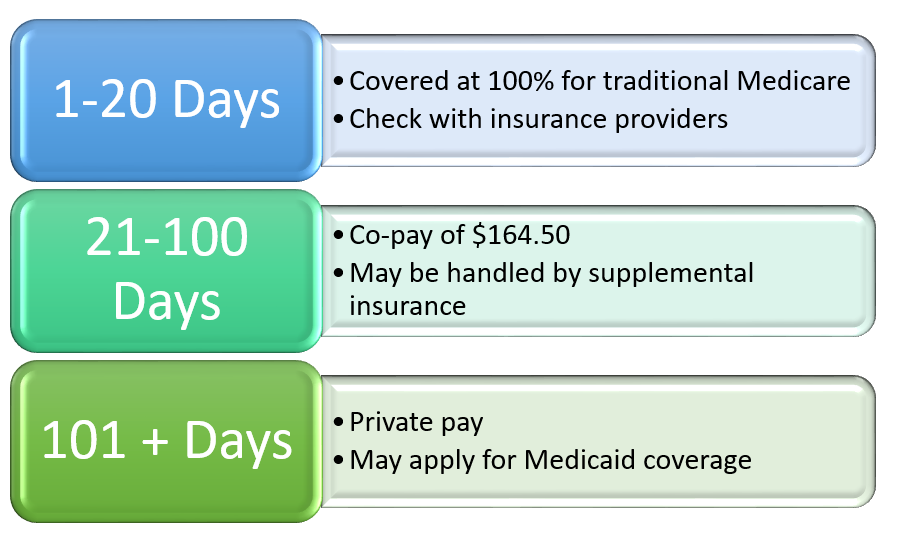

For those requiring inpatient rehabilitation after a hospital stay, a skilled nursing facility (SNF) is often the go-to option. Medicare covers up to 100 days of rehab in an SNF per benefit period, subject to certain conditions:

- Days 1-20: You won’t have to pay anything for your SNF stay, provided you’ve met the Part A deductible.

- Days 21-100: You’ll be responsible for a daily coinsurance payment, determined by Medicare.

- Day 101 and beyond: You’ll be responsible for covering the entire cost of your stay.

It’s important to note that Medicare’s coverage of SNF rehab is contingent upon meeting the “3-day rule.” This rule stipulates that you must have been admitted as an inpatient to a hospital for at least three consecutive days before being transferred to an SNF. If this criterion isn’t met, Medicare may still cover outpatient rehabilitation services.

Inpatient Rehabilitation Facility (IRF) Rehab: Longer Coverage

For more intensive rehabilitation needs, such as recovering from a stroke, spinal cord injury, or other severe medical events, an inpatient rehabilitation facility (IRF) may be recommended. Here’s how Medicare’s coverage for IRF rehab breaks down:

- Days 1-60: You won’t have to pay anything for your IRF stay, provided you’ve met the Part A deductible.

- Days 61-90: You’ll be responsible for a daily coinsurance payment, determined by Medicare.

- Days 91-150: You can utilize your “lifetime reserve days,” with a daily coinsurance payment set by Medicare. You have a total of 60 lifetime reserve days to use.

- Day 151 and beyond: You’ll be responsible for covering the entire cost of your stay.

It’s worth noting that if you were transferred directly from an acute care hospital to an IRF, or admitted to an IRF within 60 days of being discharged from a hospital, you won’t have to pay a deductible for the IRF care if you’ve already paid one during the same benefit period.

Additional Considerations

While Medicare’s coverage for inpatient rehabilitation is comprehensive, there are a few additional factors to keep in mind:

- Medicare Advantage Plans: If you’re enrolled in a Medicare Advantage plan, your coverage and costs for inpatient rehab may differ. Be sure to check with your plan provider for details.

- Medicare Supplement Plans: If you have a Medicare Supplement (Medigap) plan, some of the out-of-pocket costs associated with inpatient rehab may be covered. Check your plan’s specifics for more information.

- Non-Covered Services: Medicare does not cover certain services during inpatient rehab, such as private duty nursing, personal items, or a private room (unless medically necessary).

Maximizing Your Rehab Journey

Navigating the complexities of Medicare’s inpatient rehabilitation coverage can be challenging, but understanding the limits and requirements is crucial for a successful recovery. Remember, your healthcare provider plays a vital role in determining the necessity and duration of your rehab stay.

To ensure you make the most of your rehab journey, it’s essential to communicate openly with your care team, ask questions, and advocate for yourself. By being an informed and engaged patient, you can maximize the benefits of Medicare’s inpatient rehabilitation coverage and pave the way for a smoother, more efficient recovery process.

Does Medicare Cover Short-term Rehab After A Hospital Stay?

FAQ

What is the 21 day rule for Medicare?

How many Medicare days do you get for rehab?

What happens when Medicare days run out?

Do Medicare days reset every year?