Paying bills can be a tedious task. You have to keep track of different payment amounts, remember all the due dates, and log in to several websites. It’s easy to forget a bill and get hit with late fees. Fortunately, bill pay services offered by banks make paying bills much simpler.

Bill pay allows you to view all your bills in one place and schedule payments through your bank’s website or mobile app. But how long do these online payments actually take to process? The answer depends on several factors.

In this comprehensive guide, we’ll explain everything you need to know about bill pay processing times.

What is Bill Pay?

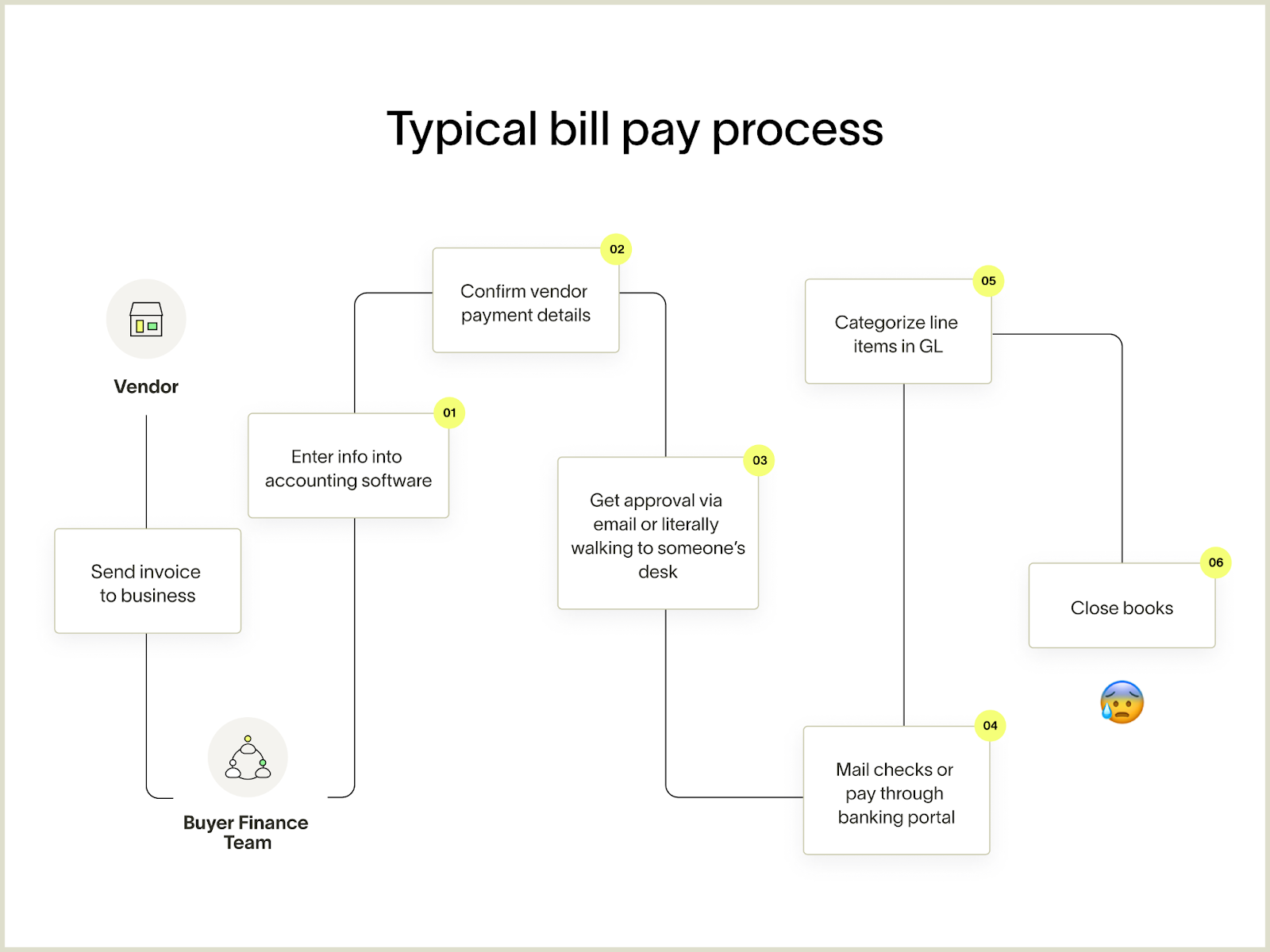

Bill pay is an online banking feature that lets you pay your bills directly from your checking account. Rather than mailing checks or logging into each company’s website you can manage payments through your bank’s portal.

Here’s how it works:

-

You provide details about each biller like account numbers, names, and addresses

-

You enter the amount and date for each payment.

-

The bank withdraws the funds from your account and sends payments to the billers on your behalf.

You can pay all sorts of bills with bill pay, like rent, credit card, and utility bills. You can set up one-time or recurring payments based on your preference.

Now let’s look at how long it takes for these online bill payments to process.

Factors That Impact Bill Pay Processing Times

Several variables affect the time it takes for bill payments to go through:

Type of Payee

-

Same Bank: Payments to recipients who bank with the same institution are usually processed fastest, often within 1 business day.

-

Different Bank: Payments to a different bank typically take 1-3 business days.

-

Individuals: Payments to individuals can take 1-5 business days depending on their bank.

-

Businesses: Business payments tend to process slower, usually within 3-5 days.

Payment Method

-

Electronic Transfers: These are the fastest, normally processed in 1-2 business days.

-

Paper Checks: Mailed check payments take the longest, up to 5-10 business days.

Bank Policies

Banks have different timelines for when they debit funds from your account versus when recipients get credited. This impacts how long the payments appear to take from your perspective.

Holidays and Weekends

Payments initiated on Fridays or before holidays may take an extra business day to process.

Scheduled Date

If you schedule a payment for a future date, processing begins on that date. So the payment won’t actually leave your account until the scheduled date.

Average Bill Pay Processing Times

Now let’s look at typical timeframes for common bill payment scenarios:

-

Within same bank: 1 business day

-

To different bank: 2-3 business days

-

To individuals: 3-4 business days

-

To businesses: 4-5 business days

Of course, these are just estimates. Actual processing times can vary based on the above factors. Many billers specify their own timelines, so check their websites for details.

For very urgent payments, it’s best not to cut it too close to the due date. Schedule online payments at least 5 business days in advance whenever possible.

Card vs. Bank Account Payments

An important distinction is whether you’re paying your bills with a debit/credit card versus directly from your bank account.

Card payments typically process in 1-3 business days, similar to other online transactions.

Bank account payments can take longer – up to 5 business days – since it involves transferring funds between institutions.

So if you need to pay a bill immediately, paying directly with a card will usually get there sooner than a bank account transfer.

How to Check Payment Status

Wondering if your bill payment has gone through yet? Here are some ways to check the status:

-

Your bank’s website/app: View payment history and check if the funds have left your account.

-

Biller’s website: Log into your account with the payee to see if payment is reflected.

-

Email notifications: Many banks and billers send emails when they receive payments.

-

Paper statements: Check your monthly statement for processed payments.

-

Customer service: Call your bank or biller and ask a representative to confirm status.

Checking online or enabling email alerts can provide the fastest updates on payment processing.

Speed Up Bill Payments

Here are some tips to help expedite bill payments:

-

Pay early – Initiate payments 5+ days before the due date.

-

Pay electronically – Avoid paper checks which take longer to process.

-

Enroll in AutoPay – Set up automatic monthly payments directly with the biller.

-

Provide complete information – Double check recipient details to prevent delays.

-

Ask about expedited options – Some billers offer faster processing for a fee.

-

Pay with a card – Pay directly with a debit/credit card for quicker processing.

-

Communicate with recipient – Let them know a payment is coming to watch for it.

How to Avoid Late Fees

To avoid late fees and other penalties, make sure you pay your bills well before the due date.

Here are some best practices:

-

Pay at least 5 business days early, especially for new payees.

-

Set payment reminders a week ahead to initiate payments.

-

If unsure, call the biller and ask how long their processing takes.

-

Build in a buffer of a few extra days for additional safety.

-

Set up AutoPay directly with billers for automatic monthly payments.

Troubleshooting Tips

Here are some steps to take if your payment doesn’t process properly:

-

Check your bank account to confirm the payment was debited.

-

Contact the biller to verify they received it on their end.

-

Look for any error notifications from your bank or biller.

-

Ensure you entered the right recipient details when setting up the payment.

-

Ask your bank to trace the payment and investigate why it’s delayed.

-

Consider stopping payment and reissuing if it’s stuck in limbo.

The Bottom Line

Bill pay can simplify your financial life by enabling easy online payments. But it does take time for transfers to process between institutions.

The general rule of thumb is to allow 1-5 business days for bill payments with 5 days being safest for critical bills. Monitor your payment status closely and set up reminders to pay bills early.

Using electronic payments compared to checks will help expedite the process. And enrolling directly in a biller’s AutoPay program can provide more control over timing.

Understanding bill pay processing times will help you avoid late fees and stay on top of your finances. With proper planning, bill pay can make paying your monthly obligations much less stressful.

How does bill payment work?

FAQ

How long does it take for bill com payment to process?

How long does it take for a Bill pay check to clear?

Why do bill payments take so long to process?

How long does post Bill pay take to process?

How long does it take to pay a bank bill?

Most banks advise customers to allow some extra time when setting up bill payments. It takes up to five business days for a scheduled bill payment to reach the payee. Keep in mind that adding a couple of extra days of padding would be a good idea for recurring payments, in case your scheduled date falls on a weekend.

How long does it take to receive a payment?

A mailed payment must be received by the issuer by 5 p.m. on your due date to be properly credited. Then, it may take five to seven business days to be processed. When possible, paying electronically or by phone will help to ensure on-time payment and reduce processing time.

What is bill pay & how does it work?

What is bill pay? Bill pay is a service offered by many banks and credit unions that lets you set up automatic payments for bills. If you juggle rent or a mortgage, cable and electricity bills, credit card payments and more, online bill pay can save time and help you avoid late fees.

How long does it take to process a credit card payment?

Precise processing times vary by issuer, but call your credit card company if you’re curious about a pending payment. In general, it is safe to assume that most credit card companies process electronic payments in one to two business days.