If you’re exploring whole life insurance policies, you’ve likely come across the term “cash value.” This unique feature is one of the primary attractions of whole life insurance, offering policyholders the opportunity to build a tax-deferred savings component within their policy. However, the burning question on many minds is: How long does it take for whole life insurance to build cash value?

The answer is not as straightforward as you might think, as the rate of cash value growth varies depending on several factors. In this comprehensive guide, we’ll delve into the intricacies of cash value accumulation, equipping you with the knowledge to make informed decisions about your financial future.

Understanding Cash Value Growth

Cash value is a savings element that accumulates within a whole life insurance policy over time. As you faithfully pay your premiums, a portion of each payment is allocated to the policy’s cash value component, which then grows at a predetermined fixed rate.

While the cash value growth is guaranteed, it typically starts slowly and picks up pace gradually. Most permanent life insurance policies, including whole life insurance, begin to accrue cash value within the first 2 to 5 years. However, it can take decades to see significant cash value accumulation.

The rate of cash value growth is influenced by several factors, including:

- Premium Payments: The higher your premium payments, the more funds are allocated to the cash value component, accelerating its growth.

- Policy Dividends: If you have a “participating” whole life insurance policy, the insurer may pay out dividends from its profits, which can be reinvested into the policy, boosting the cash value growth.

- Interest Rates: Whole life insurance policies typically guarantee a minimum interest rate, ensuring steady growth of the cash value regardless of market conditions.

It’s important to note that the cash value growth is tax-deferred, meaning you don’t have to pay taxes on the gains as long as they remain within the policy.

Factors Influencing Cash Value Accumulation

While the concept of cash value growth is straightforward, several factors can impact the rate at which it accumulates. Here are some key considerations:

-

Policy Age: In the early years of a whole life insurance policy, a larger portion of your premiums goes toward covering the cost of insurance and associated fees. As the policy matures, a more significant portion is allocated to the cash value component, accelerating its growth.

-

Premium Structure: Some policies offer the option of paying higher premiums in the early years, which can kickstart the cash value growth more rapidly. However, this approach may not be suitable for everyone’s financial situation.

-

Dividends Reinvestment: If your policy pays dividends, you can choose to reinvest them into the policy through paid-up additions (PUAs). This strategy can significantly boost the cash value growth, as the reinvested dividends purchase additional insurance coverage, further increasing the dividend payouts in subsequent years.

-

Policy Loans or Withdrawals: If you take out a loan against your policy’s cash value or make withdrawals, it can impede the growth rate, as the cash value is reduced by the amount borrowed or withdrawn.

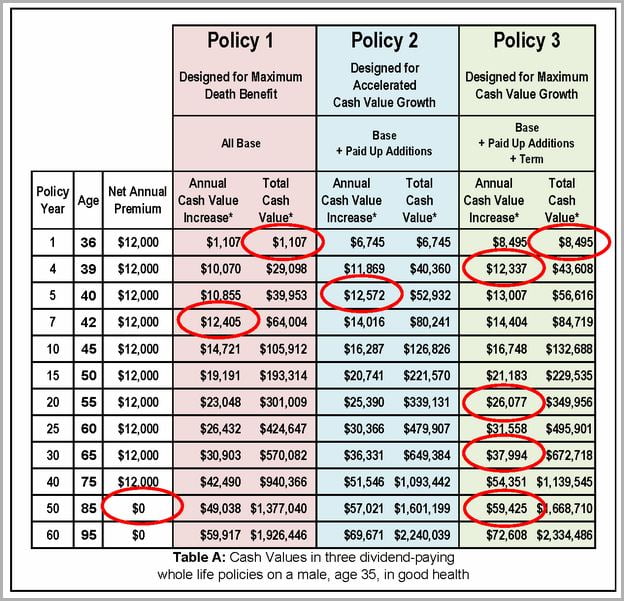

Whole Life Insurance Cash Value Growth Charts

To better illustrate the cash value growth trajectory, let’s examine a sample whole life insurance cash value chart:

| Policy Year | Age | Annual Premium | Cash Value (End of Year) | Death Benefit (End of Year) |

|---|---|---|---|---|

| 1 | 31 | $10,580 | $0 | $1,000,000 |

| 5 | 35 | $10,580 | $24,160 | $1,001,190 |

| 10 | 40 | $10,580 | $71,320 | $1,002,890 |

| 15 | 45 | $10,580 | $126,260 | $1,006,090 |

| 20 | 50 | $10,580 | $188,500 | $1,007,210 |

| 25 | 55 | $10,580 | $257,690 | $1,008,470 |

| 30 | 60 | $10,580 | $336,740 | $1,010,450 |

| 35 | 65 | $10,580 | $424,160 | $1,013,580 |

| 40 | 70 | $10,580 | $517,330 | $1,016,940 |

| 45 | 75 | $10,580 | $613,830 | $1,020,540 |

| 50 | 80 | $10,580 | $708,190 | $1,024,330 |

Source: MassMutual sample illustration for a 30-year-old male in excellent health with coverage of $1 million.

As you can see from the chart, the cash value growth starts modestly but gains momentum over time. By the end of the policy’s 50th year, the cash value has reached a substantial $708,190, while the death benefit has also increased to $1,024,330.

It’s important to note that this chart illustrates a scenario where dividends are withdrawn annually, rather than reinvested into the policy. If dividends are reinvested, the cash value and death benefit growth rates would be higher.

Accessing and Utilizing Cash Value

One of the significant advantages of whole life insurance’s cash value is the ability to access and utilize it during your lifetime. Policyholders can borrow against the cash value or make withdrawals, providing a source of funds for various purposes, such as:

- Supplementing retirement income

- Funding educational expenses

- Covering medical bills

- Investing in business ventures

- Paying off debts

However, it’s crucial to understand the implications of accessing the cash value. Withdrawals or loans can reduce the policy’s death benefit and may have tax consequences if the amount withdrawn exceeds the premiums paid into the policy.

Making the Most of Your Whole Life Insurance Cash Value

To maximize the potential of your whole life insurance policy’s cash value, consider the following strategies:

-

Pay Higher Premiums (If Possible): Paying higher premiums, especially in the early years, can accelerate the cash value growth, allowing you to build a more substantial savings component within your policy.

-

Reinvest Dividends: If your policy pays dividends, consider reinvesting them through paid-up additions. This strategy can significantly boost the cash value growth and increase the death benefit over time.

-

Minimize Loans and Withdrawals: While the ability to access the cash value is advantageous, it’s essential to minimize loans and withdrawals to maintain the policy’s integrity and growth potential.

-

Review Your Policy Regularly: Periodically review your whole life insurance policy with your financial advisor or insurance agent to ensure it aligns with your long-term goals and make any necessary adjustments.

Conclusion

Whole life insurance’s cash value component offers a unique opportunity to build a tax-deferred savings vehicle within your life insurance policy. However, the rate of cash value growth can vary based on factors such as premium payments, policy dividends, interest rates, and your withdrawal or loan activity.

While it may take several years to see significant cash value accumulation, the long-term potential for growth can make whole life insurance an attractive option for those seeking a combination of life insurance protection and a tax-advantaged savings component.

By understanding the intricacies of cash value growth and implementing strategies to maximize its potential, you can unlock the full benefits of your whole life insurance policy and pave the way for a more secure financial future.

How Long Does It Take to Build Cash Value with Infinite Banking? | Wealth Nation

FAQ

How much cash is a $100 000 life insurance policy worth?

What is the cash value of a $25000 life insurance policy?

What is the average return on a whole life cash value?

When should you cash out a whole life insurance policy?