If you’re planning for retirement in the UK, understanding the requirements for a full State Pension is crucial. The State Pension is a regular payment from the government that you can claim when you reach the eligible age, currently set at 66 for both men and women. However, to receive the maximum amount, you need to have made a specific number of qualifying years of National Insurance contributions. In this article, we’ll explore how many years you need and what counts as a qualifying year.

The Importance of the State Pension

The State Pension is a vital source of income for many retirees in the UK. It provides a foundation for your retirement finances, complementing any private pensions or savings you may have. While the full State Pension amount may not be enough to maintain your desired lifestyle, it can certainly help cover essential living expenses.

How Many Qualifying Years for a Full State Pension?

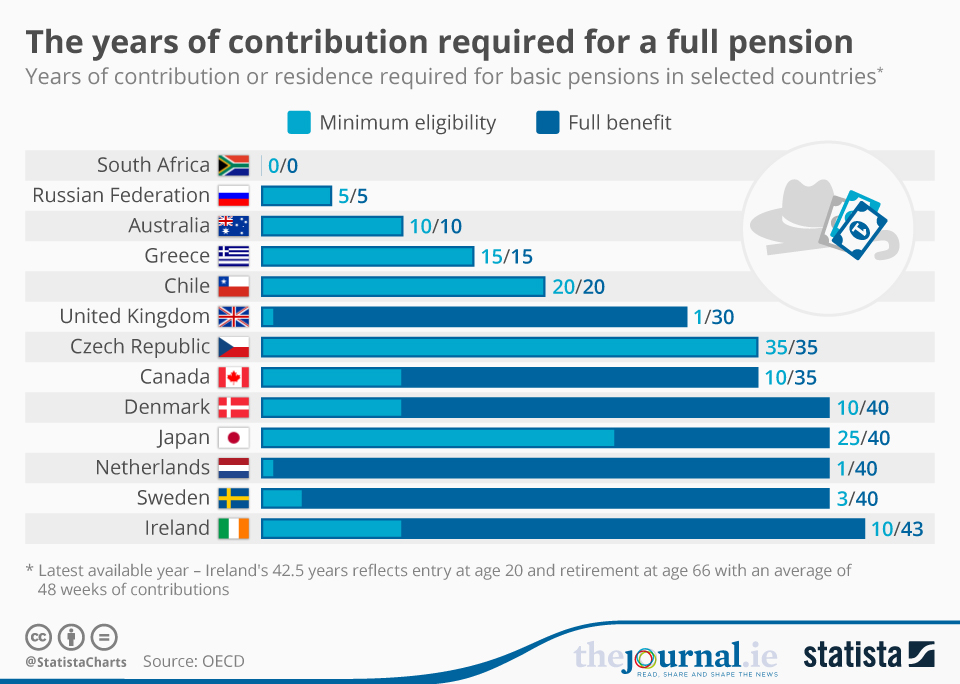

To receive the full basic State Pension, you need a total of 30 qualifying years of National Insurance contributions or credits. This applies to both the old Basic State Pension system (for those who reached State Pension age before April 6, 2016) and the new State Pension system (for those who reached State Pension age on or after April 6, 2016).

What Counts as a Qualifying Year?

A qualifying year is a tax year (from April to April) during which you have paid or been credited with enough National Insurance contributions. You can achieve a qualifying year through various means:

- Working and paying National Insurance contributions through your employment

- Receiving National Insurance credits while unemployed, ill, or acting as a parent or carer

- Paying voluntary National Insurance contributions

Additionally, if you have lived or worked abroad or paid reduced-rate National Insurance contributions as a married woman, you may still qualify for certain years.

Checking Your National Insurance Record

To determine how many qualifying years you have accumulated, you can check your State Pension forecast on the gov.uk website. This online service provides an estimate of your potential State Pension amount based on your National Insurance record to date.

If you discover gaps in your record or have fewer than 30 qualifying years, you may still have the opportunity to make voluntary contributions to increase your State Pension entitlement.

Partial State Pension for Fewer Qualifying Years

If you have fewer than 30 qualifying years, you won’t receive the full State Pension amount. However, you can still claim a partial State Pension based on the number of qualifying years you have accumulated. The more qualifying years you have, the higher your partial State Pension will be.

Other Factors Affecting Your State Pension

While the number of qualifying years is a crucial factor in determining your State Pension entitlement, there are other factors to consider as well:

- Deferring your State Pension: If you choose to delay claiming your State Pension beyond your State Pension age, your eventual payment will be higher.

- Inheriting or increasing State Pension from a spouse/civil partner: In certain cases, you may be able to inherit or increase your State Pension based on your spouse’s or civil partner’s National Insurance record.

- Living or working overseas: Your State Pension entitlement may be affected if you have lived or worked abroad during your working life.

It’s essential to consider all these factors when planning for your retirement and seeking professional advice if necessary.

Conclusion

To receive the full basic State Pension in the UK, you need a total of 30 qualifying years of National Insurance contributions or credits. A qualifying year is a tax year in which you have made sufficient contributions or received credits. By understanding the requirements and checking your National Insurance record, you can take steps to ensure you maximize your State Pension entitlement and have a more secure retirement.

35 Qualifying Years To Get The Full State Pension

FAQ

How many full years of NI do I need?

Why am I not getting a full state pension?

What age will I get my pension?

Is it worth making voluntary National Insurance contributions?