If you’re considering enrolling in an Obamacare plan, one of the most pressing questions on your mind might be, “How much will it cost me per month?” The answer, as with most things in life, is not as straightforward as one might hope. The cost of an Obamacare plan, also known as a Marketplace health insurance plan, can vary significantly depending on several factors. In this article, we’ll dive deep into the nitty-gritty of Obamacare costs, exploring the variables that influence monthly premiums and equipping you with the knowledge to make an informed decision.

The Factors That Determine Obamacare Costs

Before we delve into the actual numbers, it’s essential to understand the variables that play a role in determining the cost of your Obamacare plan. Here are the key factors that influence your monthly premium:

1. Metal Tier

Obamacare plans are categorized into four metal tiers: Bronze, Silver, Gold, and Platinum. These tiers represent the level of coverage and the associated costs. Bronze plans have the lowest monthly premiums but the highest out-of-pocket expenses when you receive medical care. On the other hand, Platinum plans have the highest monthly premiums but the lowest out-of-pocket costs.

To give you an idea of how the metal tiers affect costs, let’s look at some average monthly premiums from the state of South Carolina:

- Average Lowest Cost Bronze Plan: $328

- Average Lowest Cost Gold Plan: $513

2. Your Location

The cost of healthcare can vary significantly from one state to another, and this is reflected in the monthly premiums for Obamacare plans. For instance, the average monthly cost for the lowest-cost Bronze plan in South Dakota is $454, while in Texas, it’s $301.

3. Age and Tobacco Use

Your age and whether you are a tobacco user can also impact your monthly premium. Generally, older individuals and those who use tobacco products will pay higher premiums than their younger, non-smoking counterparts.

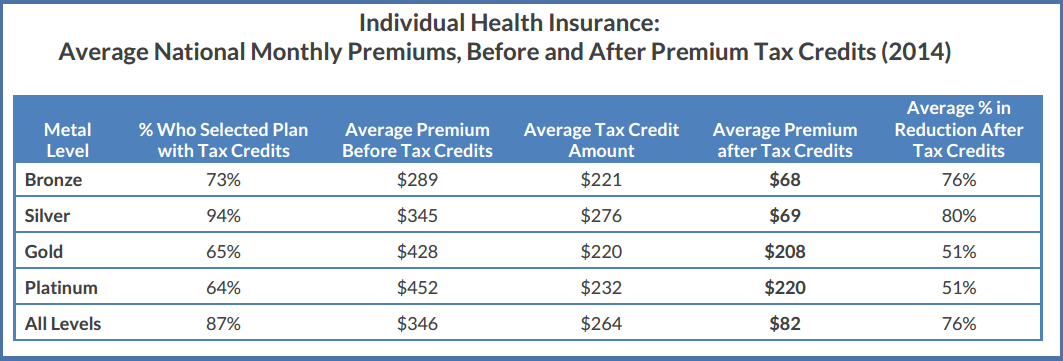

4. Household Income and Subsidies

One of the most significant factors affecting the cost of your Obamacare plan is your household income. Individuals and families with lower incomes may qualify for premium tax credits, also known as subsidies, which can significantly reduce their monthly premiums.

According to the U.S. Centers for Medicare & Medicaid Services, you may be eligible for a premium tax credit if your household income falls between 100% and 400% of the federal poverty level. For example, in 2023, the federal poverty level for a family of four is $27,750. If your household income is between $27,751 and $111,000, you could qualify for a premium tax credit.

Average Obamacare Costs Per Month

Now that we’ve covered the factors influencing Obamacare costs, let’s dive into the actual numbers. According to data from the U.S. Department of Health and Human Services, the average monthly premium for an Obamacare plan in 2023 is:

- $469 for a 40-year-old individual

- $937 for a couple aged 40

- $1,214 for a 40-year-old couple with one child

- $1,491 for a 40-year-old couple with two children

It’s important to note that these are average figures and do not account for premium tax credits or subsidies. If you qualify for such assistance, your monthly premiums could be significantly lower.

Strategies to Reduce Your Obamacare Costs

While Obamacare costs can be substantial, there are several strategies you can employ to potentially reduce your monthly premiums:

-

Choose a Higher Deductible Plan: Consider opting for a Bronze or Silver plan, which typically have lower monthly premiums but higher deductibles and out-of-pocket expenses when you receive medical care.

-

Explore Health Savings Accounts (HSAs): If you choose a high-deductible health plan (HDHP), you may be eligible to open a Health Savings Account (HSA). Contributions to an HSA are tax-deductible, and the funds can be used to pay for qualified medical expenses.

-

Look into Catastrophic Plans: If you’re under 30 years old or qualify for a hardship exemption, you may be eligible for a catastrophic Obamacare plan. These plans have lower monthly premiums but very high deductibles, making them suitable for individuals who don’t anticipate significant medical expenses.

-

Compare Plans and Providers: Take the time to compare different Obamacare plans and providers in your area. Sometimes, even slight differences in deductibles, copays, and provider networks can result in significant cost savings.

-

Consider Alternative Options: If Obamacare plans are still too expensive, explore alternative healthcare options like Mira, which offers affordable virtual and urgent care visits, discounted prescriptions, and same-day lab testing starting at an average of $45 per month.

The Bottom Line

Determining the cost of an Obamacare plan is a complex process that involves various factors, such as your location, age, household income, and the plan’s metal tier. While the average monthly premiums can be substantial, premium tax credits and subsidies can help make Obamacare plans more affordable for individuals and families with lower incomes.

If you’re struggling to find an affordable Obamacare plan or health insurance option, don’t hesitate to explore alternatives like Mira. Their affordable healthcare plans can provide you with access to quality care without breaking the bank.

Remember, your health is invaluable, and having the right healthcare coverage can provide peace of mind and protect you from unforeseen medical expenses. Take the time to research your options, compare plans, and choose the one that best fits your needs and budget.

ACA 101: A Comprehensive Guide to the Affordable Care Act

FAQ

What is the highest income to qualify for Obamacare?

|

Household size

|

Min. income

|

Typical max. income

|

|

1 person

|

$14,580

|

$58,320

|

|

2

|

$19,720

|

$78,880

|

|

3

|

$24,860

|

$99,440

|

|

4

|

$30,000

|

$120,000

|

Is Obamacare affordable for everyone?

Is the cost of Obamacare based on income?

Who actually pays for Obamacare?