Life insurance is one of those things that many people know they should have, but often put off acquiring. It’s not the most exciting topic, but it’s a crucial aspect of financial planning and protecting your loved ones. So, how much life insurance does the average American actually have? The answer might surprise you.

The Average Life Insurance Coverage in the U.S.

According to the American Council of Life Insurers, the average size of new individual life insurance policies purchased in 2019 was $178,150. This figure represents the amount of coverage that the average American deems necessary to protect their family’s financial future.

However, it’s important to note that this is just an average, and the appropriate amount of life insurance coverage can vary significantly depending on individual circumstances. Factors such as age, income, number of dependents, outstanding debts, and financial goals all play a role in determining the right amount of coverage.

Breaking Down the Numbers

To better understand the average life insurance coverage, let’s take a closer look at some key statistics:

-

Term Life Insurance vs. Whole Life Insurance: In 2019, the percentage of Americans with term life insurance policies was 48%, while 20% had whole life insurance policies. Term life insurance is generally more affordable and provides coverage for a specific period, while whole life insurance is more expensive but offers lifelong coverage and a cash value component.

-

Coverage by Age: As individuals age, their life insurance needs may change. The median coverage amount for those under 35 was $100,000, while it increased to $150,000 for those between 35 and 44 years old. For individuals aged 45-54, the median coverage was $200,000, and it dropped to $100,000 for those aged 55 and above.

-

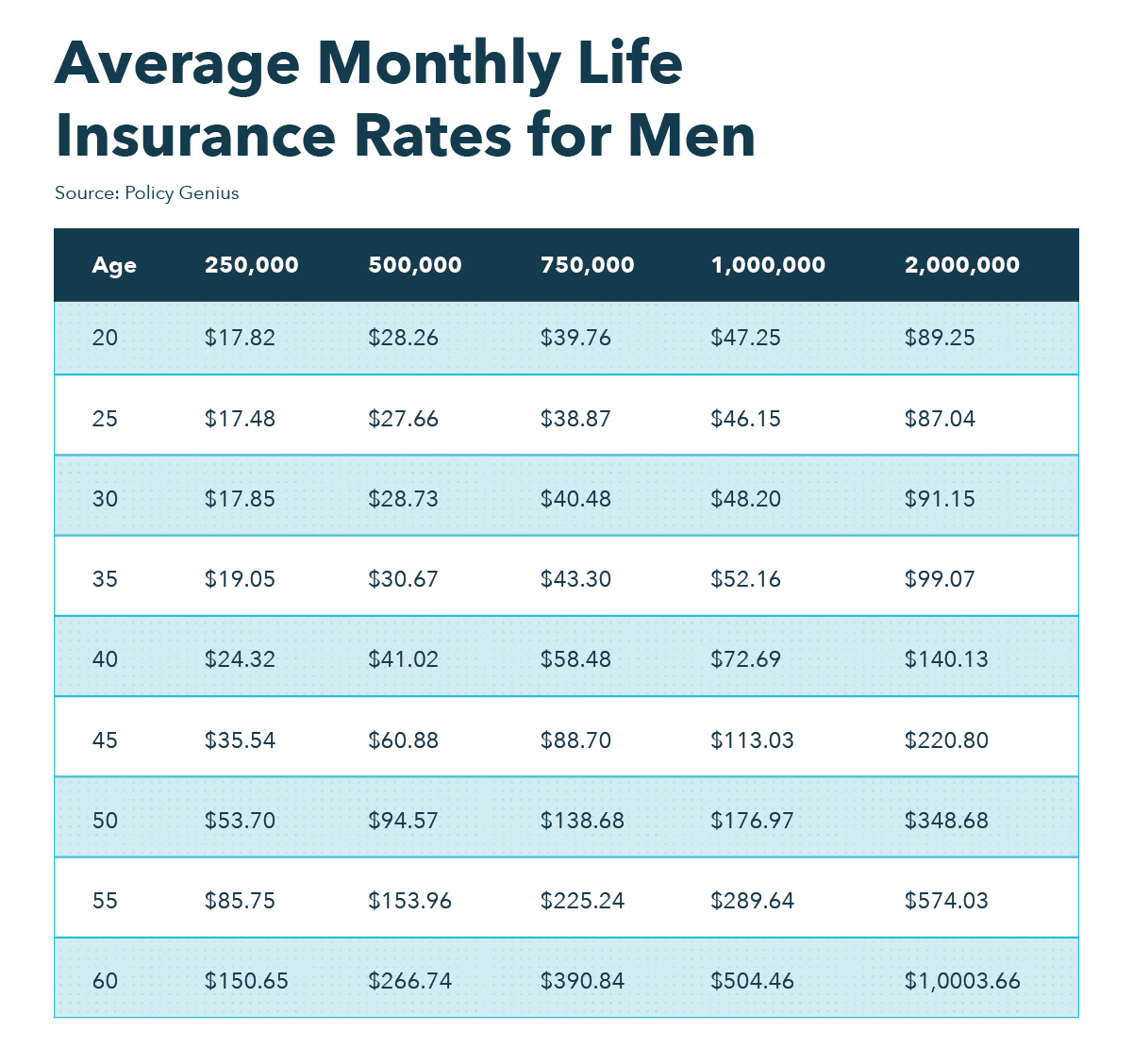

Gender Differences: There is a notable gap in life insurance coverage between men and women. In 2019, the median coverage amount for men was $150,000, while for women, it was only $100,000.

-

Income and Coverage: As one might expect, higher-income households tend to carry more life insurance coverage. Households with an annual income of $100,000 or more had a median coverage of $350,000, while those earning less than $50,000 had a median coverage of just $75,000.

Determining the Right Amount of Coverage

While the average life insurance coverage provides a general guideline, it’s essential to evaluate your individual circumstances to determine the appropriate amount of coverage for your needs. Here are some factors to consider:

-

Income Replacement: One of the primary purposes of life insurance is to replace your income in case of your untimely death. A common rule of thumb is to secure coverage worth 10-15 times your annual income.

-

Outstanding Debts: If you have outstanding debts, such as a mortgage, car loans, or student loans, you’ll want to factor those into your life insurance coverage to ensure your loved ones are not burdened with those financial obligations.

-

Future Expenses: Consider future expenses, such as your children’s education costs or your spouse’s retirement needs, when determining the appropriate coverage amount.

-

Existing Assets: If you have substantial assets, such as investments or savings, you may need less life insurance coverage since those assets can provide financial support for your loved ones.

The Bottom Line

While the average life insurance coverage in the U.S. is $178,150, the right amount of coverage for you will depend on your unique circumstances. It’s essential to carefully evaluate your financial situation, goals, and responsibilities to ensure that your loved ones are adequately protected in the event of your untimely passing.

If you’re unsure about the appropriate amount of coverage, consider consulting with a financial advisor or an insurance professional. They can help you assess your needs and recommend the right type and amount of life insurance to provide peace of mind for you and your family.

How Much Term Insurance Do I Need?

FAQ

What is a normal amount of life insurance?

What is the most common life insurance amount?

Is $100 000 life insurance enough?

What percentage of the US population has life insurance?