Ending your relationship with an internet service provider can be a hassle, especially when it comes to paying your final bill. Spectrum in particular has a reputation for poor customer service, outdated billing systems and excessive fees. However, with the right preparation you can make your Spectrum departure as seamless as possible. This guide will walk you through the process of paying your final Spectrum internet bill before cancelling service.

Confirm Account Balance

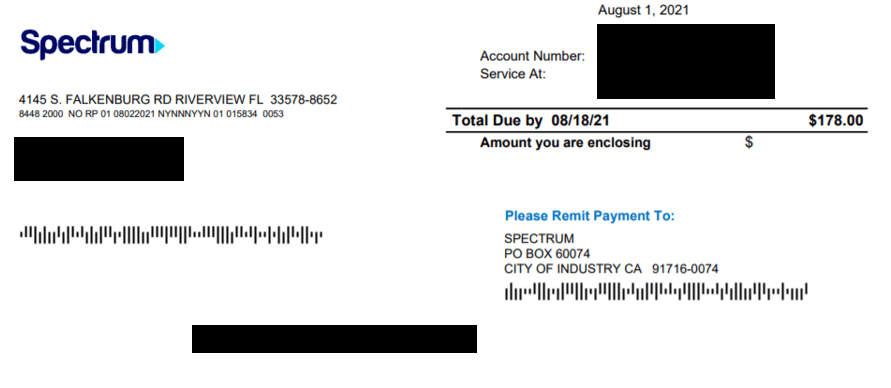

The first step is confirming your account balance. This will allow you to budget for any early termination fees or outstanding charges. To check your balance:

- Go to Spectrum’s website and log into your account.

- On the Overview page, locate the Amount Due. This is your current balance.

- Click into the Bill Details page and scan all charges, credits and adjustments. Make note of any discrepancies or surprising fees.

If you don’t see an up-to-date balance, you may need to wait for your latest bill to generate. Bills are usually released around the same time each month. Keep checking back until the balance reflects your most recent service period.

Understand Early Termination Fees

When cancelling service before your contract term is up, Spectrum charges an early termination fee. This is typically $200 per service ended early. So if you cancel internet and TV six months into a two year contract, you’d owe $400 in ETFs.

Before paying your bill, make sure any early termination fees have been applied properly:

- Verify the start and end dates of your Spectrum contract term. This is available on your account overview page.

- Calculate the number of months left on your term. If cancelling six months into a two year term, you’d have 18 months remaining.

- Multiply the number of services you use by $200. That’s your early termination fee amount.

If Spectrum charges more than expected for early termination, you can contest the charges But avoid delays by verifying their math ahead of time.

Check for Equipment Charges

Spectrum often charges customers for unreturned equipment. Make sure you’ve accounted for all modems, routers, cable boxes and DVRs leased from them.

Comb through your home and confirm you’ve located every Spectrum device. If any are missing, expect added fees on your final bill.

You’ll need to return equipment in person at a local Spectrum store. Get a receipt showing each item was returned to avoid improper equipment fees on your final bill.

Pay Immediately to Avoid Late Fees

Once your balance is finalized, pay right away to avoid late fees. Spectrum charges up to $10 for bills that are even one day past due.

To pay your bill:

- Sign in as the Primary or Admin user.

- Select Billing.

- Select Make a Payment.

- From here, you can adjust the Payment Amount, Payment Date and Payment Method.

- Once you’ve set your preferences and checked that your info is correct, select Make Payment.

Ideally pay a few days before your actual due date. Processing and posting delays could push your payment past the deadline, even if you submit on the due date. Give yourself a buffer to be safe

Request a Final Bill if Not Generated

If you don’t see a final bill amount after cancelling service, you may need to request it. Spectrum’s system doesn’t always automatically generate a final bill.

To request your final bill:

- Contact Spectrum support by phone, online chat or through their Twitter support.

- Let the rep know you’ve cancelled service and need a final bill generated. Provide your account details.

- Ask them to email you the final bill once available. This way you have a record of the amount owed.

Keep following up with Spectrum every few days until you receive that final bill. Pay immediately once in hand.

Use Auto-Pay to Set and Forget

The easiest way to avoid missed payments on your final bill is by setting up automatic payments. With auto-pay enabled, the full balance will withdraw from your bank account each month without any action needed on your part.

To enable auto-pay:

- Go to the My Services section of your Spectrum account.

- Select Manage Auto Pay.

- Enter your preferred payment method and date.

- Check the box to enable auto-pay.

- Spectrum will now automatically deduct your monthly bill on the set date.

With auto-pay enabled, you can ‘set and forget’ your final Spectrum bill. The balance will automatically pay on time without late fees.

Pay Online to Avoid Human Error

For your final payment, pay online through your Spectrum account. This ensures correct application of your payment vs. relying on a customer service rep.

With online bill pay you can:

- View your up-to-the-minute account balance.

- Check that all credits, fees and adjustments are applied.

- Carefully select the payment amount yourself.

- Receive instant payment confirmation.

Phone support and in-store payments open the door for human error that can lead to misapplied payments. Avoid the risk by managing your final payment entirely online.

Don’t Pay in Cash

While Spectrum does accept cash payments in-store, avoid this option when paying your final bill. Cash payments carry higher risk of:

- Incorrect amounts paid from miscounting bills and change.

- Lost or misplaced cash without proof of payment.

- Misapplied payments if the store clerk makes a manual error.

- Lack of payment confirmation and receipts.

Stick to online account payments, checks or credit cards. These provide receipts and assurances your final payment will process accurately.

Escalate Errors Immediately

Hopefully everything goes smoothly when paying off and closing out your Spectrum account. But if errors occur, escalate immediately to protect your credit and avoid collections.

Potential account errors include:

- Incorrect final account balance.

- Early termination fees charged without cause.

- Improperly applied payments.

- Payments credited to the wrong account.

- Failure to close the account after final payment.

If you spot any issues, contact Spectrum support through every means possible: phone, online chat, Twitter, Facebook and email. Don’t let an unpaid balance be sent to collections over Spectrum’s mistakes.

Request a Refund of Credit Balances

If your final payments to Spectrum result in a credit on your account, request a refund check. Any credit over $1 must be refunded to you by law.

To get credit balances refunded:

- Locate the credit amount under the Payment and Billing section of your Spectrum account.

- Contact billing support to request a refund of that amount.

- Ask that the refund be sent via check to your current address.

- Follow up if the refund doesn’t arrive within 2 billing cycles.

Don’t let Spectrum keep money owed back to you. Take initiative and collect credit balances before closing your account forever.

How to Pay Charter Spectrum Bill Online

What if I miss paying my Spectrum Internet Bill?

If you miss paying your internet bill, Spectrum gives you a 30-day grace period to pay before incurring a late fee. The fee is $8.95—not too bad. And the grace period gives you plenty of time to correct the issue. Since Spectrum is a contract-free provider, there are no cancellation fees or early termination fees (ETFs) to worry about.

What if I’m Late on a spectrum payment?

If you know you’ll be late on a payment, contact Spectrum’s customer service before the due date to discuss your situation. They may be able to offer a payment arrangement or extend your grace period. To contact Spectrum customer support, follow these simple steps:

What happens if I miss a spectrum payment?

Late payment arrangements are only available after you miss a payment due date. Don’t worry — Spectrum services are not typically canceled the day after a missed payment. You’ll still have internet in the meantime. To opt for the Spectrum Payment Arrangement (once you’ve missed a payment), log into your online Spectrum account.

What payment options does Spectrum offer?

Spectrum offers several payment options for customers struggling to pay on time, including payment arrangements and bill extensions. I’ll explain exactly how both options work below, along with some alternative solutions like their payment deferral plan. On a low or fixed income?