When it comes to planning for retirement, the choices can be overwhelming. Should you opt for the tried-and-true 401(k) offered by your employer, or explore the potential benefits of an annuity? Both options have their merits, but which one is better suited for your specific needs and goals? In this comprehensive guide, we’ll delve into the intricacies of annuities and 401(k)s, helping you make an informed decision for your golden years.

Understanding the Fundamentals

Before we dive into the annuity vs. 401(k) debate, let’s establish a solid foundation by defining these retirement vehicles.

401(k): The Employer-Sponsored Powerhouse

A 401(k) is a tax-advantaged retirement savings plan offered by many employers. It allows you to contribute a portion of your pre-tax income, which is then invested in a variety of options, such as mutual funds, stocks, and bonds. Your contributions and investment earnings grow tax-deferred until you reach retirement age and start making withdrawals.

Annuity: The Guaranteed Income Stream

An annuity, on the other hand, is a contract between you and an insurance company. You make a lump-sum payment or a series of payments, and in return, the insurance company promises to provide you with a guaranteed stream of income, typically for life. This process is known as annuitization.

The Battle of Benefits

Now that we’ve laid the groundwork, let’s explore the key advantages and drawbacks of each option.

401(k) Benefits

- Tax-deferred growth: Your contributions and investment earnings grow tax-deferred until you start making withdrawals in retirement, allowing your money to compound more rapidly.

- Employer matching: Many employers offer matching contributions, essentially giving you free money toward your retirement savings.

- Investment flexibility: 401(k) plans often offer a wide range of investment options, allowing you to diversify your portfolio according to your risk tolerance and financial goals.

- Contribution limits: In 2024, you can contribute up to $23,000 to a 401(k) (or $30,500 if you’re 50 or older), providing ample room for substantial savings.

Annuity Benefits

- Guaranteed income for life: Annuities offer the unique benefit of providing a guaranteed stream of income for life, eliminating the risk of outliving your savings.

- No contribution limits: Unlike 401(k)s, annuities typically have no contribution limits, allowing you to invest as much as you desire.

- Tax-deferred growth: Similar to 401(k)s, annuities offer tax-deferred growth on your investment earnings until you start receiving payments.

- Estate planning benefits: Annuities can be structured to provide income for your spouse or beneficiaries after your passing, making them a valuable estate planning tool.

Weighing the Drawbacks

While both options offer compelling advantages, it’s essential to consider their potential drawbacks as well.

401(k) Drawbacks

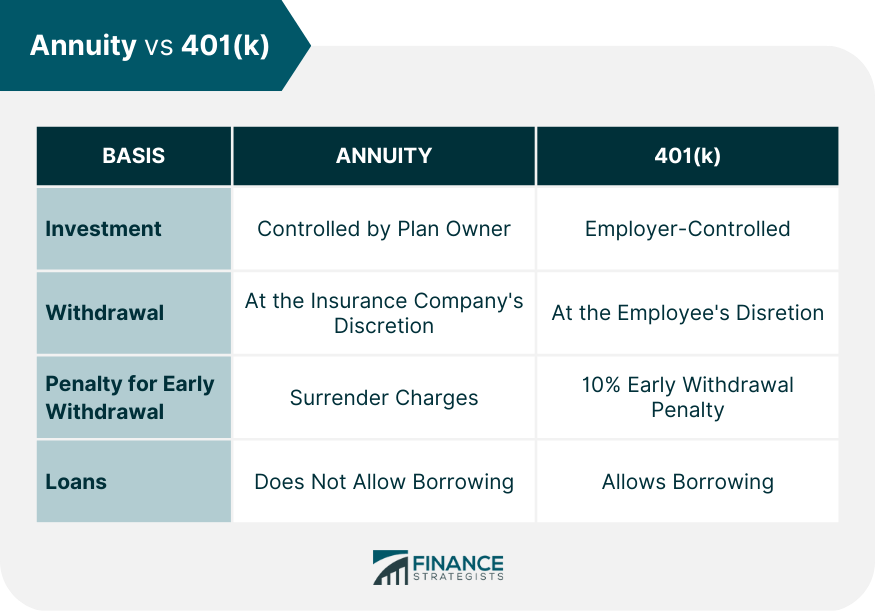

- Early withdrawal penalties: If you withdraw funds from your 401(k) before age 59½, you may be subject to a 10% early withdrawal penalty, in addition to regular income taxes.

- Limited liquidity: 401(k) plans generally restrict your access to your funds until retirement age, limiting your liquidity.

- Investment risk: Your 401(k) investments are subject to market fluctuations, which can impact the value of your savings.

Annuity Drawbacks

- Fees and expenses: Annuities often come with higher fees and expenses compared to 401(k)s, which can eat into your investment returns.

- Inflation risk: Fixed annuity payments may not keep up with inflation, eroding your purchasing power over time (although some annuities offer inflation protection riders).

- Lack of liquidity: Once you annuitize your contract, you typically cannot access the remaining principal, limiting your financial flexibility.

Making the Right Choice

Ultimately, the decision between an annuity and a 401(k) will depend on your specific financial situation, risk tolerance, and retirement goals. Here are some general guidelines to help you navigate this decision:

- If you value the potential for higher returns and investment flexibility, a 401(k) may be a better fit, especially if your employer offers matching contributions.

- If you prioritize a guaranteed income stream and want to ensure you don’t outlive your savings, an annuity could be an attractive option, particularly if you have maxed out your 401(k) contributions.

- Consider combining both options: Many financial advisors recommend a diversified retirement strategy that includes both a 401(k) and an annuity, providing you with the benefits of tax-deferred growth and a guaranteed income stream.

Remember, retirement planning is a highly personalized process, and what works for one individual may not be suitable for another. It’s always advisable to consult with a qualified financial advisor who can evaluate your unique circumstances and provide tailored guidance.

Conclusion

The annuity vs. 401(k) debate is a complex one, with valid arguments on both sides. By understanding the advantages and drawbacks of each option, you can make an informed decision that aligns with your financial goals and retirement aspirations. Whether you opt for the tried-and-true 401(k), the guaranteed income stream of an annuity, or a combination of both, the key is to start planning early and consistently contribute to your retirement savings.

Annuity vs 401k [What’s the Difference?]

FAQ

What are the downside of annuities?

Should I move 401k to annuity?

What is the biggest advantage of an annuity?

What is better than an annuity for retirement?