When it comes to applying for a loan or credit, lenders heavily rely on your debt-to-income ratio (DTI) to assess your ability to manage monthly payments. However, understanding what expenses are included in this crucial calculation can be confusing, especially when it comes to car insurance. In this comprehensive guide, we’ll break down the components of the DTI ratio and clarify whether car insurance is a factor that lenders consider.

Understanding the Debt-to-Income Ratio

Before we delve into the specifics of car insurance, let’s first define the debt-to-income ratio. The DTI ratio is a percentage that represents the amount of your gross monthly income that goes towards paying recurring debts. Lenders use this ratio to determine your capacity to take on additional debt, such as a mortgage, car loan, or personal loan.

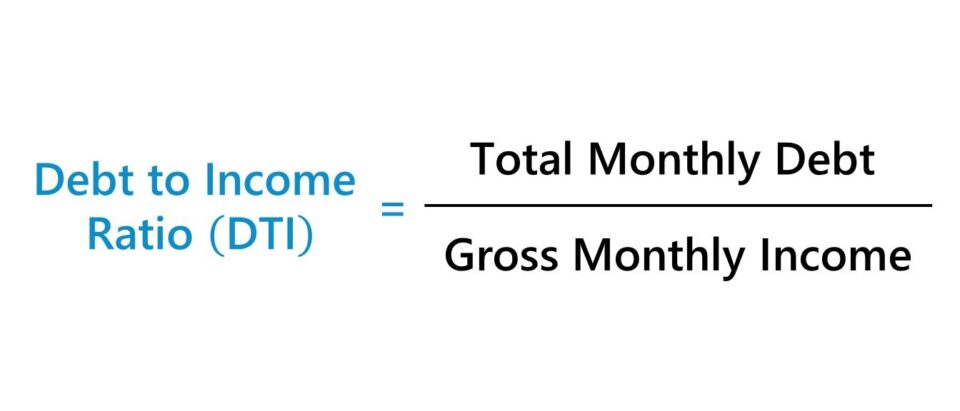

The formula for calculating your DTI is simple:

DTI = Total Monthly Debt Payments / Gross Monthly Income

A lower DTI ratio generally indicates a stronger ability to manage your debts, making you a more attractive borrower in the eyes of lenders.

What Expenses Are Included in the DTI Calculation?

When calculating your DTI, lenders typically consider the following recurring monthly debt payments:

- Mortgage payments (principal, interest, taxes, and insurance)

- Rent payments

- Minimum credit card payments

- Auto loan payments

- Student loan payments

- Personal loan payments

- Alimony or child support payments

- Any other recurring loan or debt payments

It’s important to note that lenders may have slightly different criteria for which debts they include in the DTI calculation, but the above list covers the most common expenses.

Is Car Insurance Considered in the Debt-to-Income Ratio?

Now, let’s address the burning question: Is car insurance included in the debt-to-income ratio?

The short answer is no. Car insurance premiums are generally not considered part of the DTI calculation by most lenders.

The reason for this exclusion is that car insurance is typically classified as a non-debt-related expense, similar to utilities, groceries, or cell phone bills. While these expenses contribute to your overall monthly financial obligations, they are not viewed as recurring debt payments by lenders when evaluating your ability to take on new debt.

Other Excluded Expenses

In addition to car insurance, several other expenses are typically excluded from the DTI calculation:

- Utilities (electricity, water, gas)

- Cable or internet bills

- Cell phone bills

- Groceries and dining out

- Health insurance premiums

- Household maintenance costs

- Entertainment and recreation expenses

These expenses, while essential for your daily living, are not considered recurring debt payments and are therefore not factored into the DTI ratio used by lenders.

Key Takeaways

To summarize, here are the key points to remember about car insurance and the debt-to-income ratio:

- The debt-to-income ratio is a crucial factor lenders use to evaluate your ability to manage monthly debt payments when applying for a loan or credit.

- The DTI ratio is calculated by dividing your total monthly debt payments by your gross monthly income.

- Car insurance premiums are generally not included in the DTI calculation by most lenders.

- Lenders typically consider recurring debt payments such as mortgage, rent, credit card minimums, auto loans, student loans, and personal loans when calculating the DTI.

- Other non-debt-related expenses like utilities, groceries, health insurance, and entertainment are also excluded from the DTI calculation.

While car insurance is an essential expense that should be accounted for in your overall monthly budget, it does not directly impact your debt-to-income ratio as evaluated by lenders. By understanding what expenses are included and excluded from the DTI calculation, you can better manage your finances and increase your chances of loan approval.

How to Calculate Your Debt to Income Ratios (DTI) First Time Home Buyer Know this!

FAQ

What payments should not be included in debt-to-income ratio?

What’s included in debt-to-income ratio?

Are insurance payments included in a DTI calculation?

What bills are not included in debt-to-income ratio?