As you embark on your investment journey, one of the most crucial considerations is the safety and security of your hard-earned money. With Fidelity being a prominent name in the financial industry, it’s natural to wonder: “Is my money safe with Fidelity?” In this article, we’ll delve into the various measures Fidelity employs to safeguard your assets, ensuring you have a comprehensive understanding of the firm’s commitment to your financial well-being.

The Customer Protection Guarantee: A Powerful Safeguard

At the core of Fidelity’s security measures lies the Customer Protection Guarantee. This guarantee serves as a robust safety net, providing reimbursement for any losses resulting from unauthorized activity in your accounts. Whether it’s identity theft, online fraud, or any other unauthorized access, Fidelity stands by its commitment to protect your assets.

The Customer Protection Guarantee demonstrates Fidelity’s dedication to maintaining a secure environment for your investments, instilling confidence and peace of mind in their clients.

Participation in Asset Protection Programs

In addition to the Customer Protection Guarantee, Fidelity participates in industry-recognized asset protection programs designed to further safeguard your investments. These programs include:

-

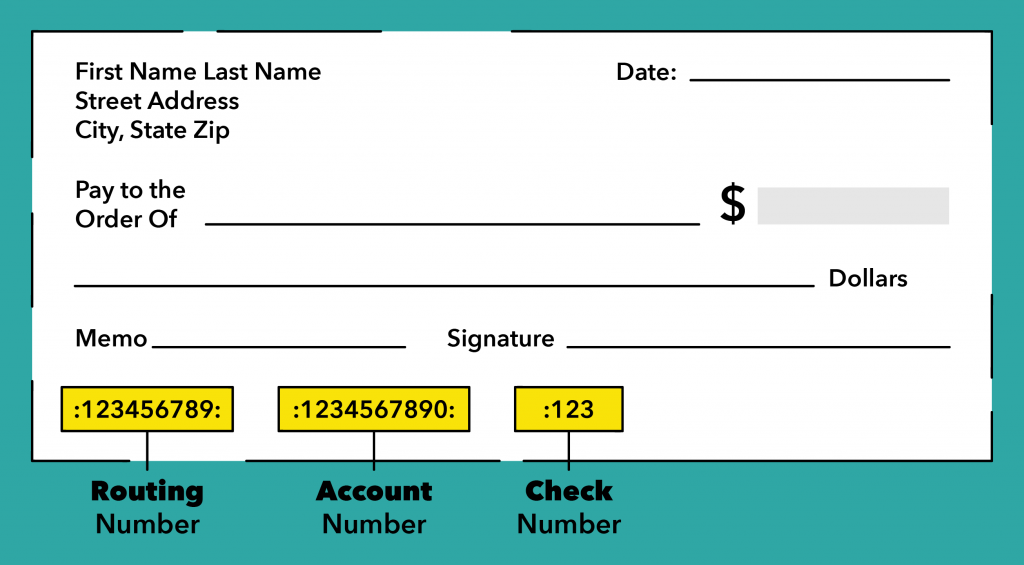

FDIC (Federal Deposit Insurance Corporation): This insurance program protects your cash deposits held at Fidelity, ensuring that your funds are secure up to the applicable limits set by the FDIC.

-

SIPC (Securities Investor Protection Corporation): As a member of SIPC, Fidelity offers additional protection for your securities and cash held for investment purposes. In the unlikely event of a broker-dealer failure, SIPC coverage helps ensure the return of your eligible assets.

By actively participating in these asset protection programs, Fidelity demonstrates its commitment to providing an additional layer of security for your investments, giving you added confidence in their services.

Advanced Security Measures and Protocols

Fidelity understands the importance of staying ahead of the curve when it comes to cybersecurity threats. To this end, the firm employs a range of advanced security measures and protocols to protect your personal information and financial transactions:

-

Encryption: Fidelity utilizes robust encryption technologies to secure your data, ensuring that your sensitive information remains protected during transmission and storage.

-

Multi-Factor Authentication: An additional layer of security is provided through multi-factor authentication, requiring multiple forms of verification to access your accounts, further mitigating the risk of unauthorized access.

-

Continuous Monitoring: Fidelity’s security systems are designed to continuously monitor for potential threats, allowing for prompt detection and response to any suspicious activities.

-

Secure Data Centers: Your data is housed in secure data centers with stringent physical and digital security measures, ensuring the utmost protection for your sensitive information.

These comprehensive security protocols demonstrate Fidelity’s commitment to leveraging the latest technologies and best practices to safeguard your assets and personal data.

Transparency and Education

Fidelity recognizes the importance of transparency and education when it comes to security and privacy. The firm provides clear information on its website, detailing its security practices, privacy policies, and the measures it takes to protect your assets. Additionally, Fidelity offers resources and guidance to help you stay informed and take proactive steps to secure your accounts and personal information.

By fostering an environment of openness and empowering you with knowledge, Fidelity ensures that you have the tools and information necessary to make informed decisions and actively participate in the safeguarding of your investments.

Investing your hard-earned money is a significant decision, and it’s natural to have concerns about the security of your assets. With Fidelity’s comprehensive security measures, including the Customer Protection Guarantee, participation in asset protection programs, advanced security protocols, and a commitment to transparency and education, you can rest assured that your investments are in capable hands. Fidelity’s dedication to protecting your assets is a testament to their commitment to your financial well-being, allowing you to focus on achieving your investment goals with confidence and peace of mind.

Is Your Money Safe If Schwab, Fidelity or Vanguard Fail | SIPC Protection

FAQ

Is keeping money in Fidelity safe?

Is Fidelity no longer FDIC insured?

Is Fidelity financially stable?

Is Fidelity too big to fail?