Bill payment services like Doxo claim to make your life easier by allowing you to pay all your bills in one place online. But are these services safe and legitimate? As online scams become more sophisticated it’s smart to do your research before handing over sensitive information.

In this article, we’ll take an in-depth look at Doxo bill pay to help you determine if it’s right for you. We’ll cover:

- What is Doxo and how does it work?

- The pros of using Doxo bill pay

- The potential cons and risks

- Doxo’s reputation, reviews and complaints

- Is Doxo bill pay ultimately legitimate and safe to use?

What is Doxo?

Doxo is an online bill payment service founded in 2008 and based in Bellevue Washington. The company states its mission is to “simplify bill payment for everyone.”

Here’s a quick rundown of how Doxo works

-

Consolidate bills in one place: Doxo allows you to add and track all your bill accounts in one online dashboard. You can add billers by searching Doxo’s database or entering bill details manually.

-

Receive reminders: Doxo will send you reminders when bills are due to help avoid late fees.

-

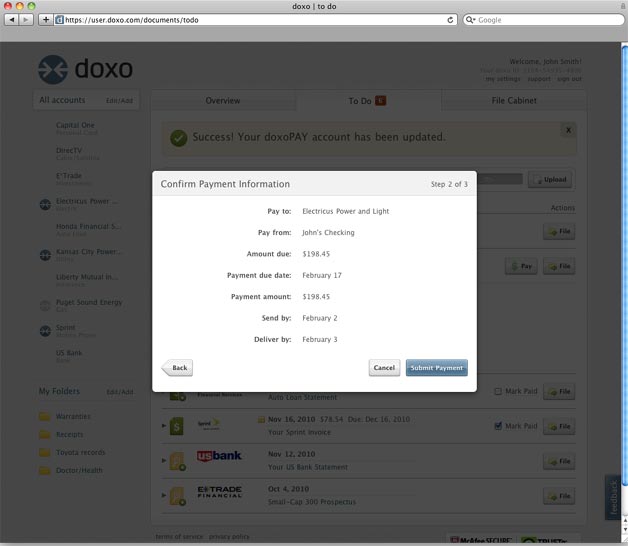

Pay bills: You can pay bills directly from Doxo using your bank account, debit card, or credit card. Doxo also offers AutoPay to pay bills automatically each month.

-

Access records: Doxo stores your payment history and bill records so you can access them anytime.

-

Mobile app: Doxo offers iOS and Android apps so you can manage bills on the go.

-

doxoPLUS subscription: For a monthly fee, you can upgrade to doxoPLUS to access features like overdraft protection, identity theft monitoring, and credit score tracking.

The Potential Pros of Using Doxo

There are some advantages to using a service like Doxo for managing bills:

-

Convenience: With Doxo, all your bills and payment history are in one secure place online and accessible via mobile. You don’t have to hunt down statements or log into multiple websites.

-

Avoid late fees: Doxo’s reminders can help prevent forgetting a bill and incurring late fee penalties. No more scrambling at the last minute.

-

Time savings: Doxo can save you time spent organizing bills and filing paperwork each month. Automating payments through AutoPay also saves time.

-

Paperless billing: Doxo encourages going paperless by storing bills digitally. This can reduce clutter and is better for the environment.

-

Cash flow control: Seeing all your bills in one place can help you better track monthly expenses and manage cash flow. Doxo provides a consolidated view of what you owe and when.

-

Bill negotiation help: Doxo offers tools to help negotiate bills like cable and cell phone plans to potentially lower your costs.

-

Budgeting assistance: By analyzing your bills and spending patterns, Doxo can make customized recommendations to help cut costs and stick to a budget.

For those who find bill pay to be a hassle each month, Doxo provides a simple, consolidated solution. The convenience and automation can appeal to busy households.

Potential Cons and Risks of Using Doxo

However, there are also some downsides to consider with Doxo bill pay:

-

Service fees: While Doxo is free to join, you’ll pay service fees of $1.99 per electronic bill payment. To avoid fees, you need to upgrade to their premium doxoPLUS plan at $5.99/month.

-

Account security: Giving any service access to your bill accounts could be a security risk, especially if they have your login credentials. Make sure to use unique passwords for added protection.

-

Personal data collection: Doxo may collect a significant amount of personal data from your bills and payment transactions. Be sure to read their privacy policy to understand how they use your data.

-

Reliability issues: Some reviews cite problems with Doxo wrongly calculating bill amounts or payments failing to send. Technical glitches could lead to late fees.

-

Lack of biller support: Most billers don’t directly integrate with Doxo, so there’s little support if payments go awry. You may still need to contact billers directly.

-

Harder account management: Requesting statement copies or making account changes often has to be done directly through the biller rather than through Doxo.

-

Potential bank overdrafts: Doxo draws money right from your linked bank account, so an incorrectly scheduled or duplicate payment could risk an overdraft.

For certain users, the risks and inconvenience factors may outweigh the convenience Doxo provides. As we’ll explore later, Doxo complaints also raise some red flags.

Doxo’s Reputation: Reviews and Complaints

With any financial service, it’s important to research the company’s reputation. Here is a summary of Doxo’s reviews and common complaints:

-

Trustpilot reviews: Doxo has a 4 out of 5 star rating based on over 500 reviews. 73% are 5-star and 13% are 1-star. Positive reviews highlight the convenience and bill reminders. Negative issues mention payment failures and poor customer service.

-

Better Business Bureau (BBB): Doxo has a B+ rating with the BBB, but also has 356 closed complaints over the last 3 years, primarily around billing issues.

-

Consumer Financial Protection Bureau: There are over 130 complaints lodged with the CFPB against Doxo related to incorrect charges, poor customer service, and unauthorized debit card payments.

-

Common complaints: The most frequent issues raised across reviews include inaccurate or failed payments resulting in late fees, unauthorized bank account withdrawals, account linking problems, and poor customer service when trying to resolve errors.

Is Doxo Ultimately Legitimate and Safe for Bill Pay?

With the background provided, is Doxo ultimately a legitimate and safe bill payment option? Here are a few key points to help you decide:

-

Doxo is a real business founded in 2008 that services over 10 million users. They offer a legitimate service, but may have issues executing it reliably.

-

They are BBB accredited with a B+ rating, despite also having hundreds of complaints. The BBB name provides some legitimacy.

-

Doxo does not directly integrate with most billers. This likely contributes to higher error rates and poor customer service.

-

The FTC has not taken legal action against Doxo for fraud or scams, though they have consumer complaints.

-

While reviews cite problems, many users do successfully use Doxo without major issues. The risk depends on your billers.

-

Use caution providing Doxo your bank login credentials and starting with small, non-essential bills first to test reliability.

-

The doxoPLUS subscription at $5.99/month may provide more payment accuracy and support vs. the free plan.

In conclusion, Doxo does appear to offer a legitimate bill pay service, but may come with a higher risk of errors, failed payments, and poor support compared to direct biller sites. Use caution in providing personal information and link low-risk billers first. Weigh the convenience against the potential hassle if payments go wrong. Consider starting with the doxoPLUS plan for added security and support. With vigilance, Doxo can be a reasonable option for consolidating bill pay.

Tips for Safe and Smooth Bill Pay with Doxo

If you decide to try Doxo, here are some tips for the best experience:

-

Start by paying 1-2 small bills like cell phone or internet to test reliability. Avoid large or critical bills like mortgage until confident in their service.

-

Use unique complex passwords for your Doxo account and updated passwords for linked bill accounts.

-

Review Doxo payments regularly to ensure correct amounts are being debited. Spot and report errors immediately.

-

Confirm with billers that Doxo payments are being received on time each month. Follow up if bills show late.

-

If possible, don’t let Doxo save your bank/bill login credentials for added security. Manually approve payments.

-

Browse Doxo’s FAQs and support articles for help avoiding fees, linking accounts, and handling errors.

-

Contact Doxo support promptly if payments fail or issues arise. Escalate to billers and your bank if needed.

-

Be cautious of phishing emails pretending to be from Doxo. Log in through their website and be vigilant of scams.

-

Consider upgrading to the paid doxoPLUS plan for higher payment limits, overdraft protection, and enhanced support.

-

Always review Doxo’s pricing and policies before upgrading plans

Need to file a complaint?

BBB is here to help. Well guide you through the process.

Note that complaint text that is displayed might not represent all complaints filed with BBB. See details.Filter byFilter byComplaint StatusComplaint Type

Functional CookiesWhat are functional cookies ?These cookies enable the site to provide enhanced functionality and personalization. They may be set by us or by third party providers whose services we have added to our pages. If you do not allow these cookies, some or all of these services may not function properly.Use functional cookiesDo not use functional cookies

United States

United States Canada

Canada

HoneypotFind Near

United States

United States Canada

Canada

Share

doxo Inc has locations, listed below.

*This company may be headquartered in or have additional locations in another country. Please click on the country abbreviation in the search box below to change to a different country location.Near

United States

United States Canada

Canada

Please enter a valid location.

How to Add a Biller – doxo

FAQ

Is doxo a legitimate service?

Is doxo payment safe?

How much does doxo charge to pay bills?

How does doxo work?

In a much smaller grey font, it says “doxo enables secure bill payment on your behalf and is not an affiliate of or endorsed by [the testing lab].” Only after providing a substantial amount of personal data – including payment information – the consumer is taken to a page with the heading “Review and Send Your Payment.”

Does doxo charge a consumer for payment?

The FTC’s complaint notes that, even though doxo immediately charges a consumer for payment, in many instances, the company then prints a paper check that is mailed to the biller – arriving days or sometimes weeks after the customer believes their bill is paid.

Is doxo a good bill payment hub?

Doxo is a capable bill payment hub and online filing cabinet for all your household documents. Paying bills is often free, but sometimes can incur a small charge. If you’re trying to go paperless, it’s worth a try. PCMag editors select and review products independently.

Does doxo have a payment ‘network’?

Less than 2% of the billers in Doxo’s purported payment ‘network’ have authorized Doxo to receive payments on their behalf.” What’s more, the FTC says that in many instances, consumers could have paid their bills directly to the actual companies without incurring any additional charges, including the “Payment Delivery Fee” that Doxo pocketed.