As you enter your 30s, life can take on a new level of responsibility. Whether you’re starting a family, buying a home, or tackling significant debts, it’s natural to consider ways to protect your loved ones financially. One option that often comes into the picture is life insurance. But is it really worth getting life insurance in your 30s? Let’s explore the potential benefits and factors to consider.

The Case for Life Insurance in Your 30s

While the need for life insurance is highly personal, there are several compelling reasons why it may be a wise decision in your 30s:

-

Protecting Your Family’s Financial Future: If you have a spouse, partner, or children who depend on your income, life insurance can provide a financial safety net in the event of your untimely passing. The death benefit from a life insurance policy can help cover living expenses, outstanding debts, and future costs like college tuition, ensuring your loved ones aren’t burdened with financial stress.

-

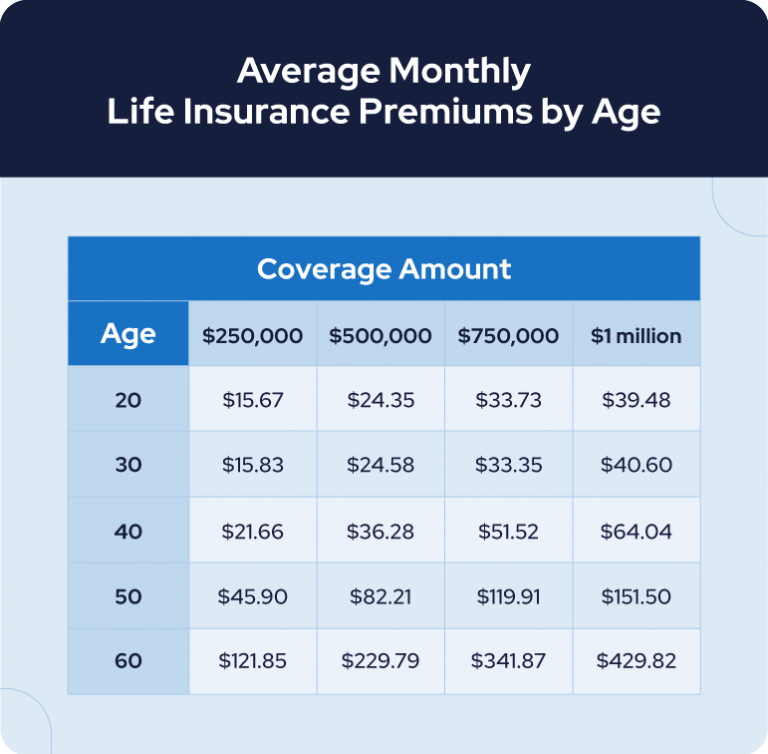

Locking in Lower Premiums: One of the biggest advantages of purchasing life insurance in your 30s is the ability to secure lower premiums. Insurance premiums are based on factors like age, health, and lifestyle, and they typically increase as you get older. By obtaining coverage while you’re young and relatively healthy, you can lock in more affordable rates for the duration of the policy.

-

Covering Debts and Liabilities: If you have outstanding debts, such as a mortgage, student loans, or credit card balances, life insurance can help ensure these obligations are taken care of should something happen to you. This can provide peace of mind knowing your loved ones won’t be left to shoulder the burden of your debts.

-

Protecting Your Business: For entrepreneurs or small business owners, life insurance can be a crucial part of succession planning. It can provide funds to help keep the business afloat, pay off outstanding loans, or facilitate a smooth transition to new ownership.

Factors to Consider

While life insurance can offer valuable protection, it’s essential to carefully evaluate your individual circumstances and needs before committing to a policy. Here are some key factors to consider:

-

Dependents and Financial Obligations: The more people who rely on your income and the greater your financial obligations, the stronger the case for life insurance. If you’re single with no dependents and minimal debt, the need for coverage may be less pressing.

-

Term vs. Whole Life Insurance: Term life insurance provides coverage for a specific period (e.g., 20 or 30 years) and is generally more affordable, making it a popular choice for those seeking temporary protection. Whole life insurance, on the other hand, offers lifelong coverage and can accumulate cash value over time, but it’s more expensive.

-

Coverage Amount: Determining the appropriate coverage amount is crucial. A general rule of thumb is to obtain a policy with a death benefit equal to 10-15 times your annual income, but your specific needs may vary based on your debts, lifestyle, and long-term goals.

-

Budget and Affordability: While life insurance can be relatively inexpensive in your 30s, it’s still essential to factor the premiums into your overall budget and ensure they’re manageable in the long run.

The Bottom Line

Getting life insurance in your 30s can be a wise decision, especially if you have dependents, significant debts, or a desire to secure your family’s financial future. By obtaining coverage while you’re young and relatively healthy, you can lock in lower premiums and enjoy peace of mind knowing your loved ones will be taken care of in the event of the unexpected.

However, the decision to purchase life insurance should be carefully weighed against your individual circumstances, financial obligations, and long-term goals. Consulting with a professional insurance agent or financial advisor can help you determine the right type and amount of coverage for your unique needs.

Remember, life insurance is not a one-size-fits-all solution, but for many people in their 30s, it can be a valuable investment in protecting the ones they love most.

How Much Term Insurance Do I Need?

FAQ

Should a 30 year old get life insurance?

At what point is life insurance not worth it?

What is the most common age to buy life insurance?

How much does a $1000000 life insurance policy cost per month?

|

Age

|

Term length

|

Average monthly rate

|

|

40

|

Term length10 years

|

Average monthly rate$47.41

|

|

40

|

Term length15 years

|

Average monthly rate$61.33

|

|

40

|

Term length30 years

|

Average monthly rate$137.89

|

|

50

|

Term length10 years

|

Average monthly rate$112.67

|