As you approach retirement age and prepare to enroll in Medicare, one of the most common questions that arise is: “Is Medicare based on income or assets?” The answer is not as straightforward as it may seem, and understanding the nuances can help you plan for your healthcare expenses more effectively. In this comprehensive guide, we’ll explore the relationship between your income, assets, and Medicare premiums, ensuring you’re well-informed and ready to navigate the system.

Income: The Primary Factor in Determining Medicare Premiums

The primary factor used to calculate your Medicare premiums is your Modified Adjusted Gross Income (MAGI). This is a specific calculation based on your tax return from two years prior to the current year. For example, if you’re paying premiums in 2024, your MAGI from your 2022 tax return will be used.

Here’s a breakdown of how MAGI works:

- It starts with your total gross income, including tax-exempt interest and certain non-taxable Social Security benefits.

- Certain deductions, like student loan interest, are subtracted.

- Then, some income and deductions are added back, such as non-taxable Social Security benefits and tax-exempt interest.

The result is your MAGI, which is used to determine your Medicare premium rates.

Income Thresholds and Premium Adjustments

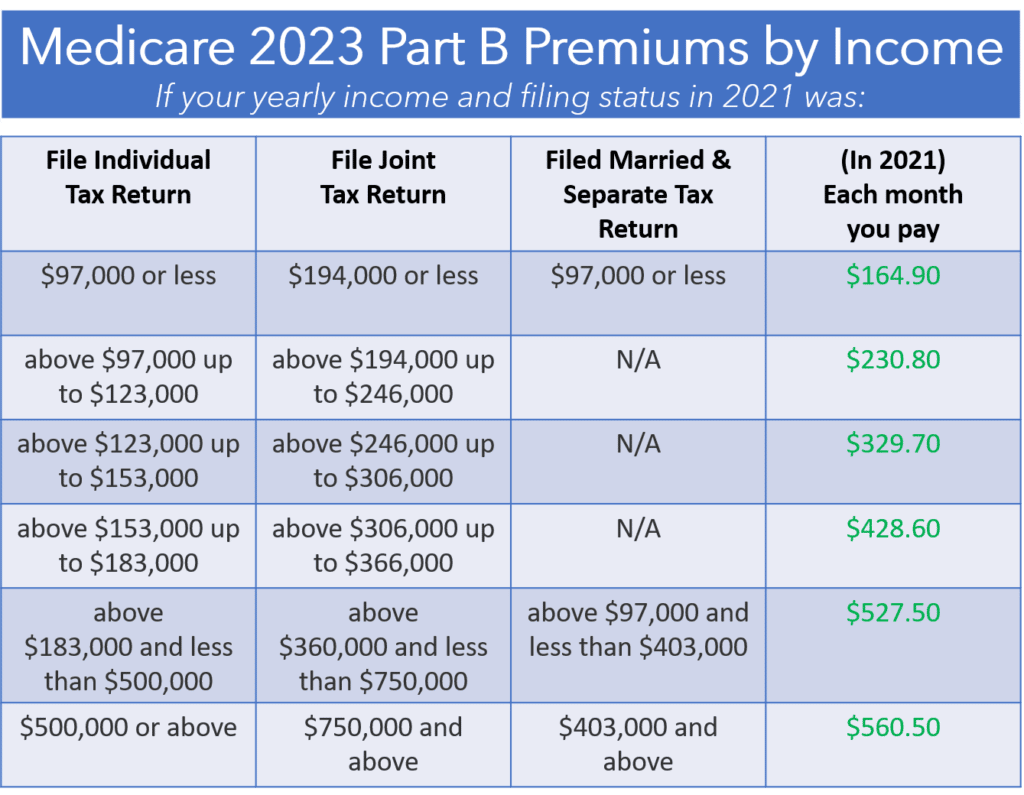

Medicare uses income thresholds to determine if you’ll pay the standard premium or if an Income-Related Monthly Adjustment Amount (IRMAA) applies. If your MAGI exceeds the threshold for your filing status, you’ll pay a higher premium for Medicare Parts B and D.

Here are the income thresholds and corresponding premium adjustments for 2024:

| Filing Individual Tax Return | Filing Joint Tax Return | Total Monthly Premium |

|---|---|---|

| $103,000 or less | $206,000 or less | $174.70 |

| $103,001 – $129,000 | $206,001 – $258,000 | $244.60 |

| $129,001 – $161,000 | $258,001 – $322,000 | $349.40 |

| $161,001 – $193,000 | $322,001 – $386,000 | $454.20 |

| $193,001 – $500,000 | $386,001 – $750,000 | $559.00 |

| $500,001+ | $750,001+ | $594.00 |

It’s important to note that these thresholds and premiums are adjusted annually, so it’s wise to check for updates each year.

Assets: Not a Direct Factor, but Still Important

While your assets, such as savings, investments, and property, are not directly used to calculate your Medicare premiums, they can still impact your overall healthcare costs in retirement.

Here are a few ways assets can indirectly affect your Medicare expenses:

- Income from Assets: If your assets generate income, such as interest, dividends, or capital gains, these will be included in your MAGI calculation, potentially increasing your Medicare premiums.

- Long-Term Care Costs: Medicare does not cover long-term care services, such as nursing home care or extended in-home care. Your assets may need to be used to cover these costs if they arise.

- Supplemental Coverage: Many retirees choose to purchase a Medicare Supplement (Medigap) plan or enroll in a Medicare Advantage plan to cover additional healthcare expenses. The premiums for these plans can be a significant expense, potentially requiring you to tap into your assets.

Strategies to Manage Medicare Premiums

While you can’t directly control your MAGI from two years prior, there are strategies you can consider to potentially manage your Medicare premiums:

- Adjust Income Sources: If possible, shift your income sources to minimize your MAGI. For example, consider taking distributions from Roth accounts or tax-exempt municipal bonds.

- Contribute to Retirement Accounts: Making contributions to tax-deferred accounts, such as 401(k)s or IRAs, can reduce your taxable income and, consequently, your MAGI.

- Manage Asset Withdrawals: Be mindful of withdrawals from taxable accounts, as they can increase your MAGI and potentially trigger higher Medicare premiums.

- Seek Professional Advice: Work with a financial advisor or tax professional to understand your unique situation and develop strategies tailored to your circumstances.

Key Takeaways

To summarize, here are the key points about Medicare premiums and their relationship to income and assets:

- Medicare premiums for Parts B and D are primarily determined by your Modified Adjusted Gross Income (MAGI) from two years prior.

- Higher incomes above specific thresholds result in Income-Related Monthly Adjustment Amounts (IRMAA), increasing your Medicare premiums.

- While assets are not directly used to calculate premiums, they can indirectly impact your healthcare costs through income generation, long-term care expenses, and supplemental coverage costs.

- Strategies like adjusting income sources, contributing to retirement accounts, and managing asset withdrawals can potentially help manage your Medicare premiums.

- Seeking professional guidance from financial advisors and tax professionals can ensure you make informed decisions tailored to your unique situation.

By understanding the intricacies of how income and assets relate to Medicare premiums, you can better prepare for your healthcare expenses in retirement and make well-informed choices to maximize your benefits.

Your Income Impacts What You Pay for Medicare | Part B & D

FAQ

Does Medicare depend on income?

Do high income earners pay more for Medicare?

What happens to Medicare if your income is too high?

What income is used to determine Medicare premiums 2024?