As you approach the golden age of 65, the topic of Medicare coverage becomes increasingly important. While enrolling in Medicare Part A (Hospital Insurance) and Part B (Medical Insurance) is a crucial step, a common question arises: Is having just these two parts enough to meet your healthcare needs?

The short answer is – it depends. While Medicare Part A and Part B provide a solid foundation for your health coverage, they may not be sufficient for everyone. Understanding the scope and limitations of these two parts is essential in determining whether you need additional coverage.

What Medicare Part A and Part B Cover

Let’s start by exploring what Medicare Part A and Part B cover:

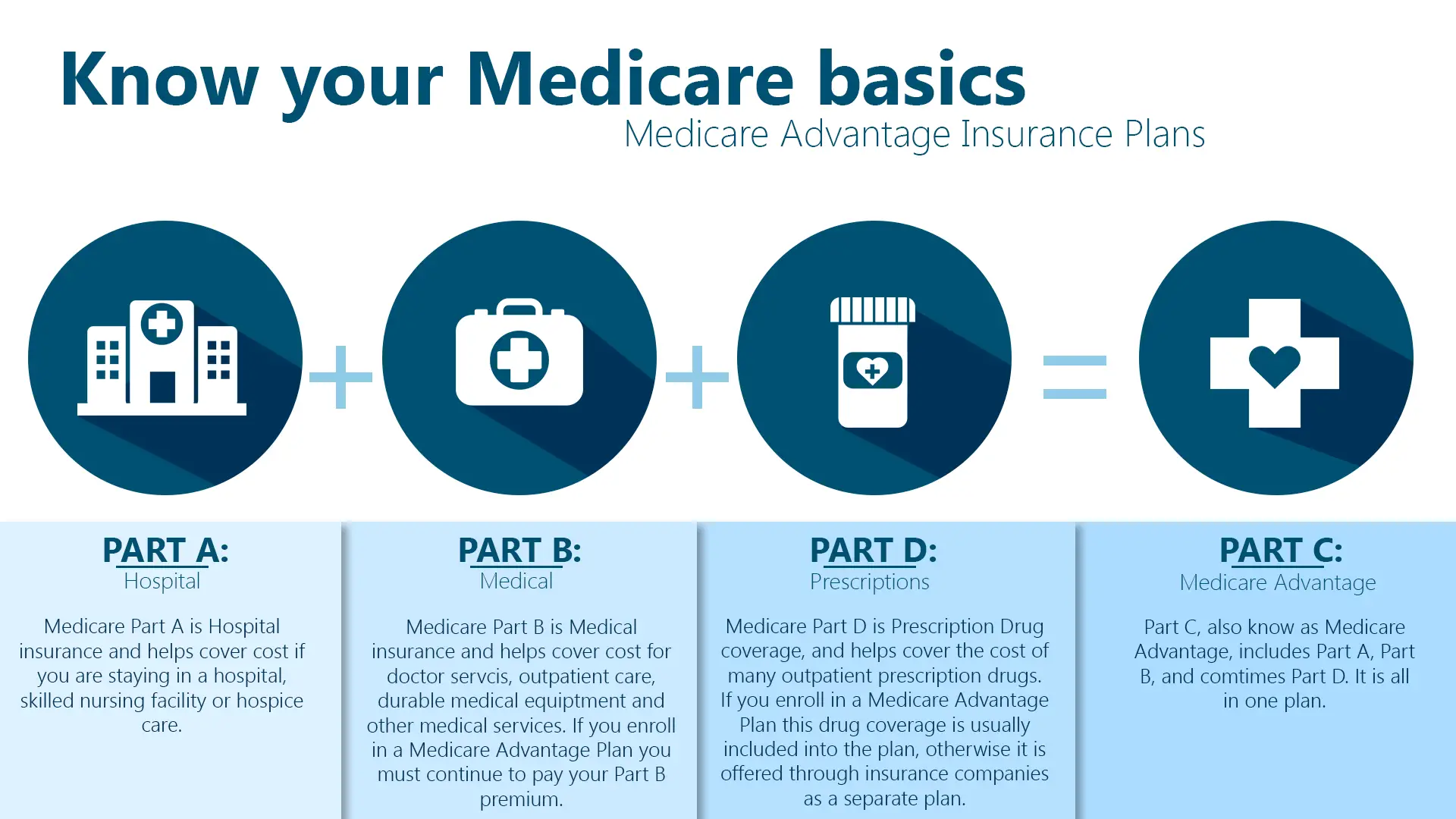

Medicare Part A helps cover inpatient hospital care, skilled nursing facility care, hospice care, and some home health care services. For most people who have worked and paid Medicare taxes for at least 10 years, Part A is premium-free, meaning you don’t have to pay a monthly premium.

Medicare Part B helps cover services from doctors and other health care providers, outpatient care, preventive services, durable medical equipment, and some home health care services. Unlike Part A, everyone enrolled in Part B pays a monthly premium, which can vary based on your income level.

Together, Medicare Part A and Part B are known as “Original Medicare,” and they provide comprehensive coverage for many healthcare services. However, there are still some significant gaps and out-of-pocket costs that you may need to consider.

Gaps and Out-of-Pocket Costs

While Medicare Part A and Part B cover a wide range of services, they don’t cover everything. Here are some of the gaps and potential out-of-pocket costs you may face:

-

Deductibles and Coinsurance: Both Part A and Part B have deductibles and coinsurance amounts that you’re responsible for paying. These costs can add up quickly, especially if you require frequent medical care or hospitalization.

-

Prescription Drug Coverage: Original Medicare does not cover most prescription drugs. If you need prescription medication, you’ll need to enroll in a separate Medicare Part D plan or a Medicare Advantage plan that includes prescription drug coverage.

-

Long-Term Care: Medicare does not cover long-term care services, such as nursing home care or assisted living facilities, unless you require skilled nursing care for a limited time after a qualifying hospital stay.

-

Dental, Vision, and Hearing Care: Original Medicare generally does not cover routine dental care, eye exams, glasses, or hearing aids, although it may cover some services if they’re related to a medical condition.

-

Out-of-Network Services: If you receive care from providers who do not accept Medicare assignment, you may be responsible for paying the full cost of those services.

Additional Coverage Options

To address these gaps and potential out-of-pocket costs, you may want to consider additional coverage options. Here are some common choices:

-

Medicare Supplement Insurance (Medigap): Medigap policies are private insurance plans that work alongside Original Medicare to cover some of the out-of-pocket costs, such as deductibles, coinsurance, and copayments. These plans can help reduce your overall healthcare expenses, but they do not cover prescription drugs or additional benefits like dental or vision care.

-

Medicare Advantage Plans (Part C): Medicare Advantage plans are an alternative to Original Medicare, offered by private insurance companies approved by Medicare. These plans typically include Part A, Part B, and often Part D (prescription drug coverage) in a single plan. Many Medicare Advantage plans also offer additional benefits like dental, vision, and hearing coverage, as well as fitness memberships and other perks.

-

Medicare Part D (Prescription Drug Plans): If you need prescription drug coverage, you can enroll in a standalone Medicare Part D plan. These plans are offered by private insurers and help cover the cost of prescription medications.

-

Employer or Retiree Health Insurance: If you or your spouse has employer or retiree health insurance, it may provide additional coverage beyond Original Medicare. However, it’s important to understand how your employer or retiree plan works with Medicare to avoid any gaps or penalties.

It’s important to note that there are specific enrollment periods and deadlines for these additional coverage options, so it’s crucial to plan ahead and make informed decisions based on your individual needs and budget.

Making the Right Choice

Deciding whether Medicare Part A and Part B are enough for you is a personal decision that depends on various factors, such as your overall health, expected medical needs, and financial situation. Here are some points to consider:

-

Evaluate Your Health Conditions: If you have chronic conditions or anticipate frequent medical services, you may benefit from additional coverage to help manage out-of-pocket costs.

-

Consider Your Prescription Drug Needs: If you take regular prescription medications, enrolling in a Medicare Part D plan or a Medicare Advantage plan with drug coverage can help ensure your medications are covered.

-

Factor in Your Budget: While additional coverage can help reduce out-of-pocket costs, it also comes with premiums and other expenses. Carefully evaluate your budget and the potential costs of each option.

-

Review Your Provider Network: If you prefer to see specific doctors or healthcare facilities, ensure they are covered by your chosen plan.

-

Seek Professional Advice: If you’re unsure about your coverage needs, consider consulting a licensed insurance agent or a Medicare specialist who can guide you through the process and help you make an informed decision.

Remember, your healthcare needs and financial situation are unique, and what works for one person may not be the best choice for another. By understanding the scope of Medicare Part A and Part B, as well as the additional coverage options available, you can make an informed decision that aligns with your specific requirements and ensures you have the appropriate healthcare coverage during your golden years.

Does Medicare A and B Provide Enough Coverage?

FAQ

Does a person really need Medicare Part B?

Does Medicare cover 100% of Part B?

Do I really need supplemental insurance with Medicare?

Does Medicare Part A and B pay for everything?