Insurance is an essential aspect of personal and business finance, providing protection against potential risks and financial losses. Among the various types of insurance, prepaid insurance holds a unique position. In this article, we’ll delve into the intricacies of prepaid insurance and answer the burning question: is prepaid insurance an expense?

Understanding Prepaid Insurance

Prepaid insurance refers to premiums paid in advance for insurance coverage over a specified period. Instead of making monthly payments, individuals or businesses opt to pay the entire premium upfront, often for a duration of six months or a year. This upfront payment grants them the benefit of insurance protection for the designated timeframe.

The concept of prepaid insurance is beneficial for both insurers and policyholders. For insurers, it generates working capital and enhances customer retention. In exchange, they often offer discounts on premiums, making it a financially attractive option for policyholders.

The Accounting Perspective

From an accounting standpoint, prepaid insurance is treated as a prepaid asset rather than an expense. This distinction is crucial for accurate financial reporting and understanding the impact of prepaid insurance on a company’s financial statements.

Recording Prepaid Insurance

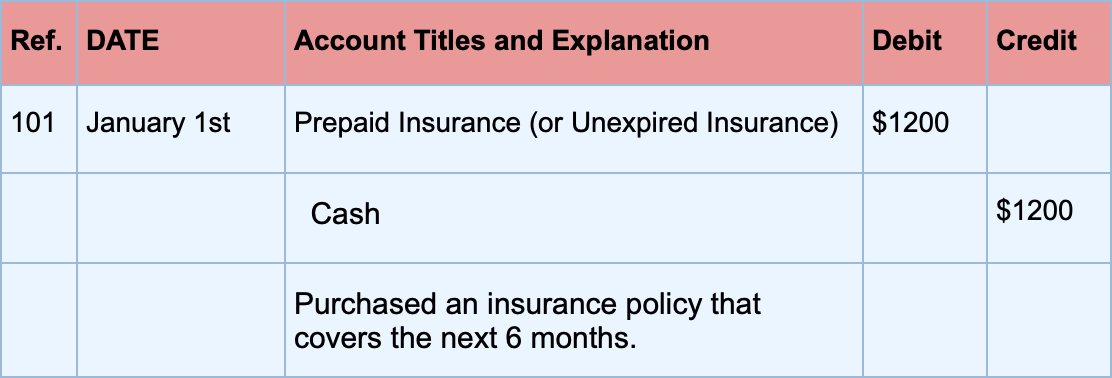

When a business purchases prepaid insurance, the transaction is recorded as follows:

- A debit entry is made in the “Prepaid Insurance” asset account for the total amount paid upfront.

- A credit entry is made in the “Cash” account for the same amount, reflecting the outflow of cash.

For example, if a business pays $12,000 for a one-year insurance policy, the initial journal entry would be:

Debit: Prepaid Insurance $12,000Credit: Cash $12,000Adjusting Entries and Expensing

As time passes, the prepaid insurance asset is gradually consumed or “used up.” To reflect this, adjusting entries are made periodically, typically monthly or quarterly, to transfer a portion of the prepaid insurance asset to an expense account.

Continuing with the example above, if the insurance policy covers one year, the adjusting entry each month would be:

Debit: Insurance Expense $1,000 (1/12 of $12,000)Credit: Prepaid Insurance $1,000By the end of the one-year period, the entire $12,000 prepaid insurance asset will have been transferred to the “Insurance Expense” account, accurately reflecting the cost of insurance for that period.

Benefits of Prepaid Insurance

Treating prepaid insurance as an asset offers several benefits:

-

Future Economic Value: Prepaid insurance represents a future economic benefit, as it provides coverage for a specified period. If the policy is canceled before the expiration date, the policyholder can receive a refund for the unused portion, making it a redeemable asset.

-

Accurate Financial Reporting: By recording prepaid insurance as an asset and gradually expensing it over time, a company’s financial statements accurately reflect the cost of insurance in the appropriate accounting periods.

-

Cash Flow Management: Paying premiums upfront can improve cash flow management by eliminating the need for monthly or periodic payments, allowing businesses to better allocate their resources.

-

Potential Discounts: Insurers often offer discounts on premiums when policyholders opt for prepaid insurance, resulting in cost savings.

Key Takeaways

- Prepaid insurance refers to insurance premiums paid in advance for a specified coverage period.

- From an accounting perspective, prepaid insurance is treated as a prepaid asset, not an expense.

- The initial payment is recorded as a debit to the “Prepaid Insurance” asset account and a credit to the “Cash” account.

- Adjusting entries are made periodically to transfer a portion of the prepaid insurance asset to an “Insurance Expense” account, accurately reflecting the cost of insurance over time.

- Treating prepaid insurance as an asset offers benefits such as future economic value, accurate financial reporting, cash flow management, and potential discounts.

In conclusion, while prepaid insurance involves an upfront payment, it is not considered an expense from an accounting standpoint. Instead, it is recognized as a prepaid asset that gradually becomes an expense over the coverage period. Understanding this distinction is crucial for proper financial reporting and effective cash flow management.

How Prepaid Expenses Work | Adjusting Entries

FAQ

Is prepaid insurance an asset or expense?

Is prepaid expense a liability or expense?

Is prepaid insurance an expense on an income statement?

Is prepaid expenses an expense or revenue?