When you’ve diligently contributed to your retirement accounts like a 401(k) or an Individual Retirement Account (IRA), the prospect of tapping into those funds before reaching retirement age can be tempting. However, the IRS generally imposes a 10% early withdrawal penalty on distributions taken before age 59 ½, in addition to regular income taxes. This penalty is designed to discourage individuals from dipping into their retirement savings prematurely. Nevertheless, there are certain situations where the early withdrawal penalty may be waived.

Understanding the Early Withdrawal Penalty

The 10% early withdrawal penalty applies to any distribution from tax-advantaged retirement accounts, including:

- 401(k) plans

- Traditional IRAs

- Simplified Employee Pension (SEP) IRAs

- Savings Incentive Match Plan for Employees (SIMPLE) IRAs

- Qualified annuities

This penalty is imposed on top of the regular income taxes you would owe on the withdrawn amount. For example, if you withdraw $10,000 from your 401(k) before age 59 ½, you may owe an additional $1,000 (10%) in early withdrawal penalties, plus regular income tax on the $10,000 distribution.

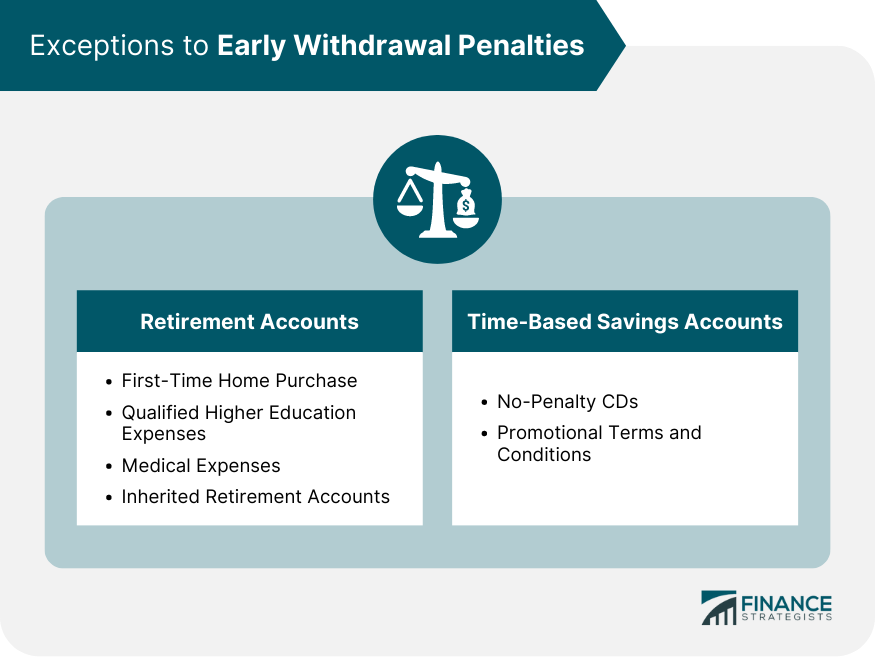

Exceptions to the Early Withdrawal Penalty

While the 10% early withdrawal penalty is generally applicable, the IRS has carved out several exceptions where the penalty may be waived. These exceptions recognize that there may be legitimate reasons for withdrawing retirement funds early, such as financial hardships or specific life events.

Here are some common exceptions to the early withdrawal penalty:

- Separation from Service: If you leave your job during or after the year you turn 55 (or 50 for qualified public safety employees), you can withdraw from your employer’s retirement plan without penalty.

- Disability: If you become totally and permanently disabled, you can take penalty-free withdrawals from your retirement accounts.

- Unreimbursed Medical Expenses: If your unreimbursed medical expenses exceed 7.5% of your adjusted gross income (AGI), you can withdraw funds penalty-free to cover those costs.

- Qualified Higher Education Expenses: You can take penalty-free withdrawals from IRAs (but not 401(k)s) to pay for qualified higher education expenses for yourself, your spouse, or your dependents.

- First-Time Home Purchase: You can withdraw up to $10,000 penalty-free from IRAs (but not 401(k)s) to buy, build, or rebuild a first home for yourself, your spouse, or your dependents.

- Substantially Equal Periodic Payments (SEPP): If you take a series of substantially equal periodic payments based on your life expectancy, you can avoid the early withdrawal penalty.

- Birth or Adoption: You can withdraw up to $5,000 penalty-free from eligible retirement accounts for qualified birth or adoption expenses.

- Domestic Abuse Victims: Beginning in 2024, you can withdraw up to $10,000 or 50% of your account balance penalty-free if you self-certify that you experienced domestic abuse.

- Emergency Withdrawals: Also starting in 2024, you can take penalty-free emergency withdrawals of up to $1,000 per year from eligible retirement accounts.

It’s important to note that while the penalty may be waived in these situations, you will still owe regular income tax on the withdrawn amount, unless it’s a qualified distribution from a Roth account.

Avoiding Unnecessary Penalties

While the exceptions provide some flexibility, early withdrawals should generally be avoided unless absolutely necessary. Dipping into your retirement savings can significantly impact your long-term financial security and jeopardize your ability to maintain your desired standard of living in retirement.

If you find yourself in a situation where an early withdrawal seems necessary, carefully review the exceptions and consult with a qualified financial advisor or tax professional. They can help you understand the potential consequences and explore alternative solutions that may better align with your long-term financial goals.

Remember, the early withdrawal penalty is designed to encourage individuals to preserve their retirement savings for their intended purpose – supporting you in your golden years. By understanding the exceptions and making informed decisions, you can better protect your financial future while navigating life’s challenges.

New IRA & 401K Early Withdrawal Rules Starting in 2024 | Early Retirement Guide

FAQ

How do I get around early withdrawal penalty?

Are there exceptions to the 401k early withdrawal penalty?

Do you have to pay a penalty for early withdrawal?

How do I avoid 10% penalty on early 401k withdrawal?