Who is the Largest Medicare Supplement Provider in 2023?

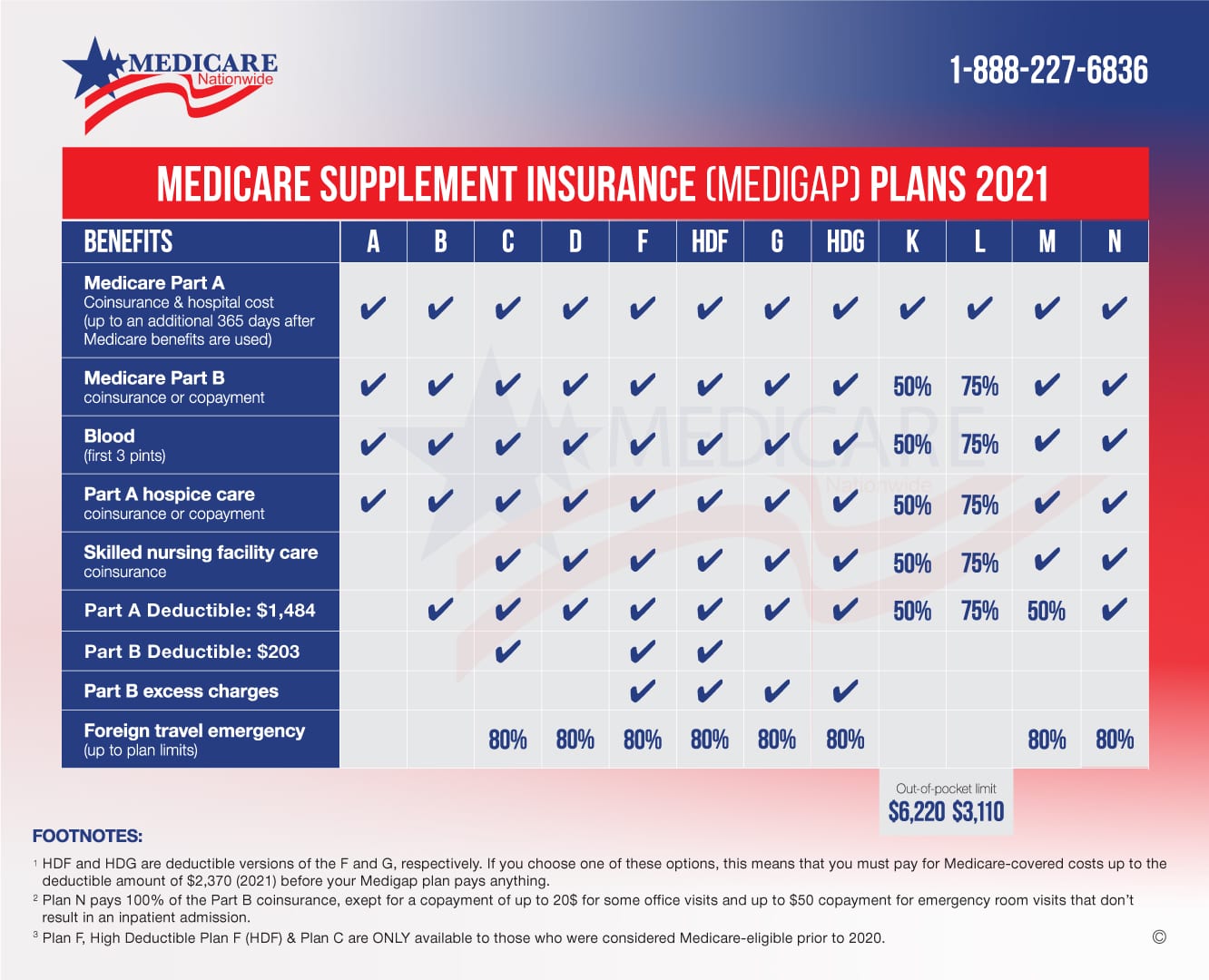

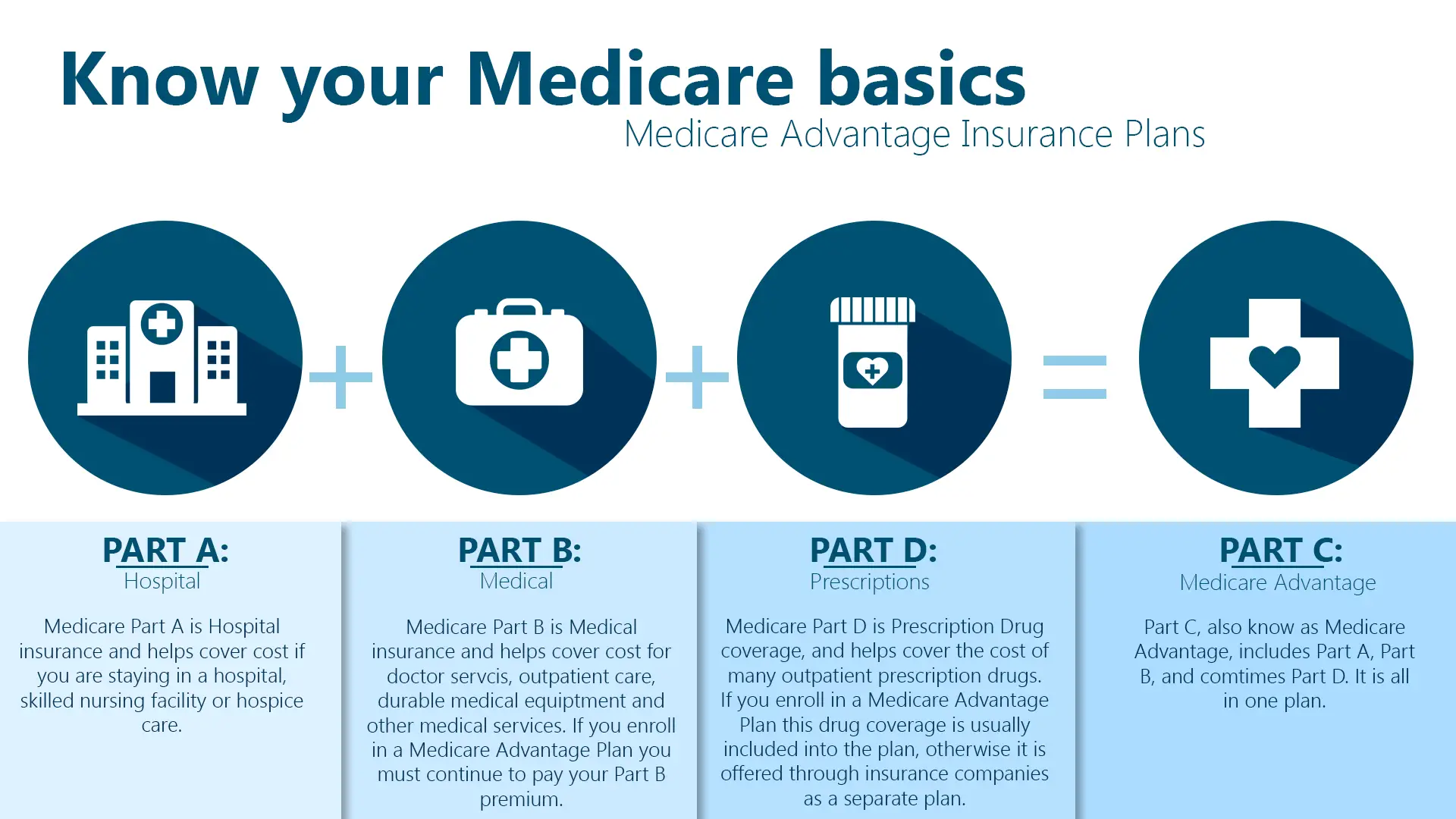

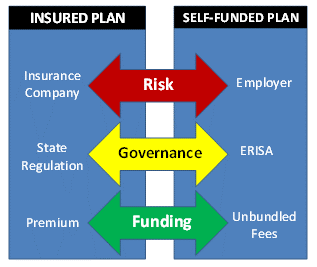

Are you on the hunt for the best Medicare Supplement insurance plan? If so, understanding the top providers in the market can be a game-changer. Medicare Supplement plans, also known as Medigap, are offered by private insurance companies to bridge the gaps in coverage left by Original Medicare (Parts A and B). Essentially, these plans … Read more