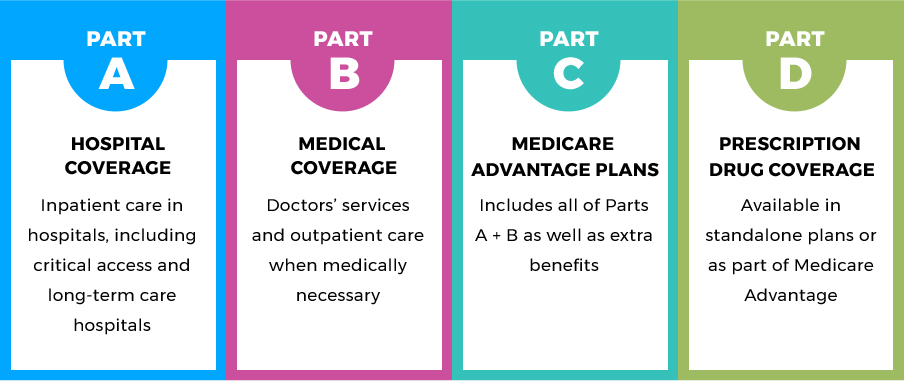

If you’re looking to explore your options beyond Original Medicare, Medicare Advantage Plans (also known as Part C) offer an alternative way to receive your Medicare Part A and Part B coverage. These plans are provided by private companies approved by Medicare and come in various types, each with its own set of rules, costs, and provider networks. In this article, we’ll dive into the four main types of Medicare Advantage Plans, helping you understand their unique features and make an informed decision.

1. Health Maintenance Organization (HMO) Plans

Health Maintenance Organization (HMO) Plans are a type of Medicare Advantage Plan that typically requires you to receive your care from a network of providers. Here are the key features of HMO Plans:

- Provider Network: You generally must get your care and services from doctors, hospitals, and other healthcare providers within the plan’s network, except for emergencies, out-of-area urgent care, or out-of-area dialysis.

- Referrals: In most cases, you’ll need to choose a primary care doctor, and you’ll likely require a referral from them to see specialists.

- Drug Coverage: Most HMO Plans include prescription drug coverage (Part D). If the plan doesn’t offer drug coverage, you cannot enroll in a separate Medicare drug plan.

HMO Plans can be a cost-effective option if you’re willing to follow the plan’s rules and stay within their provider network. However, if you travel frequently or prefer more flexibility in choosing your healthcare providers, an HMO Plan may not be the best fit.

2. Preferred Provider Organization (PPO) Plans

Preferred Provider Organization (PPO) Plans offer more flexibility than HMO Plans when it comes to choosing healthcare providers. Here’s what you should know about PPO Plans:

- Provider Network: PPO Plans have a network of preferred providers, but you can also use out-of-network providers for covered services, typically at a higher cost.

- Referrals: In most cases, you don’t need a referral from your primary care doctor to see a specialist.

- Drug Coverage: Most PPO Plans include prescription drug coverage (Part D). If the plan doesn’t offer drug coverage, you cannot enroll in a separate Medicare drug plan.

PPO Plans generally offer more freedom in choosing healthcare providers, but this flexibility often comes with higher out-of-pocket costs for out-of-network services. If you value the ability to see providers outside the plan’s network without a referral, a PPO Plan might be a suitable option.

3. Private Fee-for-Service (PFFS) Plans

Private Fee-for-Service (PFFS) Plans are a unique type of Medicare Advantage Plan that allows you to receive services from any Medicare-approved provider who agrees to treat you and accept the plan’s terms and conditions. Here are the key features of PFFS Plans:

- Provider Choice: You can visit any Medicare-approved doctor, hospital, or healthcare provider that accepts the plan’s payment terms and agrees to treat you.

- Balance Billing: PFFS Plans may allow providers to charge you up to 15% more than the Medicare-approved amount, which is known as “balance billing.”

- Drug Coverage: Some PFFS Plans include prescription drug coverage (Part D), while others don’t. If your plan doesn’t offer drug coverage, you can enroll in a separate Medicare drug plan.

PFFS Plans offer flexibility in choosing healthcare providers, but the potential for balance billing and the need to confirm provider acceptance of the plan’s terms can be drawbacks. If you value provider choice and don’t mind the additional administrative tasks, a PFFS Plan might be worth considering.

4. Special Needs Plans (SNPs)

Special Needs Plans (SNPs) are Medicare Advantage Plans designed specifically for individuals with certain chronic conditions, institutionalized individuals, or those eligible for both Medicare and Medicaid (dual-eligible). Here are the key aspects of SNPs:

- Eligibility: You must meet specific eligibility criteria based on your health condition, living situation, or dual-eligibility status to enroll in an SNP.

- Tailored Benefits: SNPs tailor their benefits, provider networks, and prescription drug coverage to meet the unique needs of the groups they serve.

- Care Coordination: Many SNPs provide care coordination services to help members manage their health conditions and navigate the healthcare system effectively.

- Provider Networks: SNPs may have provider networks, and your ability to use out-of-network providers depends on whether the plan is an HMO or PPO type.

SNPs can be an excellent choice for individuals with specific health needs or those eligible for both Medicare and Medicaid. By tailoring their services and benefits, SNPs aim to provide more comprehensive and coordinated care for their members.

When exploring your Medicare Advantage Plan options, it’s essential to consider your healthcare needs, budget, and preferences for provider choice and flexibility. Each type of plan has its unique advantages and limitations, so take the time to compare and choose the one that best aligns with your circumstances.

Remember, the availability of these plans may vary depending on where you live, so be sure to check which options are available in your area. Additionally, plan details and costs can change annually, so it’s wise to review your coverage regularly and make adjustments if necessary.

By understanding the four main types of Medicare Advantage Plans, you’ll be better equipped to navigate the world of Medicare and find a plan that provides the right balance of coverage, costs, and convenience for your healthcare needs.

4 Types Of Medicare Advantage Plans ✅ A Brief Overview

FAQ

What is the difference between a Medicare Supplement and a Medicare Advantage plan?