If you’re looking to maximize your wealth-building potential while enjoying tax advantages, a 7702 plan could be the solution you’ve been seeking. This comprehensive guide will demystify the concept of 7702 plans, helping you understand how they work, their benefits, and how they differ from traditional retirement plans.

What is a 7702 Plan?

A 7702 plan is not a specific type of insurance policy but rather a section of the Internal Revenue Code (IRC) that governs the tax treatment of cash value life insurance policies. It outlines the guidelines these policies must follow to retain their tax-advantaged status.

At its core, a 7702 plan refers to a cash value life insurance policy, such as whole life, universal life, variable universal life, or indexed universal life. These policies have two components:

- Death Benefit: The amount paid to your beneficiaries upon your passing.

- Cash Value: A portion of your premiums goes into a separate account that accumulates over time on a tax-deferred basis.

The cash value component is what sets 7702 plans apart from traditional term life insurance policies, which only provide a death benefit.

How Do 7702 Plans Work?

When you purchase a cash value life insurance policy that qualifies as a 7702 plan, a portion of your premium payments is allocated to the death benefit, while the remaining portion goes into the cash value account. This cash value grows tax-deferred, meaning you don’t have to pay taxes on the accumulated growth each year.

The cash value accumulates based on the policy’s crediting rate, which can vary depending on the type of policy you have. For instance:

- Whole Life: The cash value grows at a guaranteed rate set by the insurance company.

- Universal Life: The cash value grows based on current interest rates.

- Variable Universal Life: The cash value is tied to the performance of underlying investment accounts, such as mutual funds.

- Indexed Universal Life: The cash value growth is linked to the performance of a market index, such as the S&P 500.

One of the key benefits of 7702 plans is the ability to access the cash value tax-free through policy loans or withdrawals, subject to certain conditions. This can provide a source of supplemental retirement income or funds for other financial needs.

Benefits of 7702 Plans

Tax-Deferred Growth

The biggest advantage of a 7702 plan is the tax-deferred growth of the cash value component. Unlike traditional investment accounts, where you pay taxes on any gains each year, the cash value in a 7702 plan grows without being subject to annual taxation.

Tax-Free Access to Cash Value

In addition to tax-deferred growth, you can access the cash value in your 7702 plan through policy loans or withdrawals without having to pay taxes, as long as you follow specific rules. This can provide a stream of tax-free income during retirement or help fund other financial goals.

Estate Planning Benefits

The death benefit of a 7702 plan is generally income tax-free for your beneficiaries. Additionally, these policies can be structured in a way that helps minimize estate taxes, making them a valuable estate planning tool.

Lifetime Protection

Unlike term life insurance, which only provides coverage for a specific period, 7702 plans offer lifetime protection as long as you continue paying the premiums.

How 7702 Plans Differ from Retirement Plans

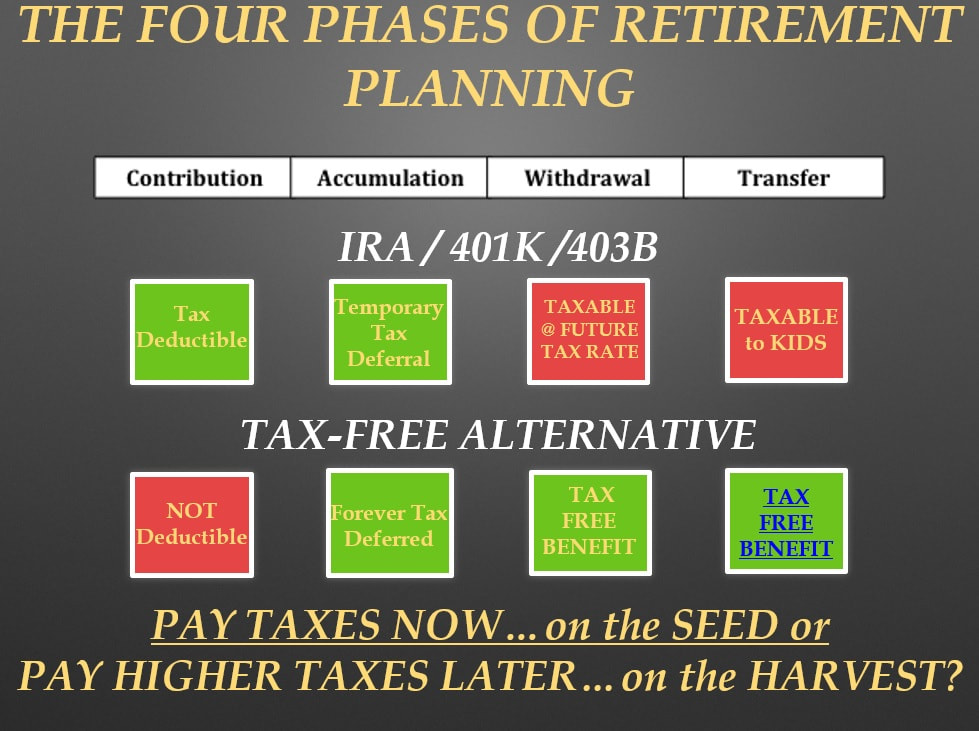

While 7702 plans can be useful for retirement planning, they are fundamentally different from traditional retirement accounts like 401(k)s and IRAs:

| Feature | 7702 Plan | Retirement Plan |

|---|---|---|

| Purpose | Life insurance with cash value component | Retirement savings vehicle |

| Contributions | Premiums paid to the insurance company | Tax-deferred or tax-exempt contributions |

| Tax Treatment | Cash value grows tax-deferred, access is tax-free | Withdrawals in retirement are taxed as ordinary income |

| Investment Options | Limited by the insurance company | Wide range of investment options |

| Fees | Insurance costs, administrative fees, surrender charges | Fund management fees, administrative fees |

It’s important to note that 7702 plans are not intended to be a complete retirement solution. They are designed to complement other retirement savings strategies and provide additional tax-advantaged growth and income streams.

Qualifying for a 7702 Plan

To qualify as a 7702 plan and retain its tax-advantaged status, a cash value life insurance policy must meet specific guidelines outlined in the Internal Revenue Code. These guidelines include:

- Cash Value Accumulation Test (CVAT): The cash surrender value of the policy cannot exceed the premiums paid into the policy at any given time.

- Guideline Premium Test (GPT): The total premiums paid into the policy cannot exceed certain limits based on the policy’s death benefit and the insured’s age.

Insurance companies design their cash value life insurance policies to comply with these guidelines, ensuring they meet the requirements of a 7702 plan.

Is a 7702 Plan Right for You?

Deciding whether a 7702 plan is the right choice for you depends on your financial goals, risk tolerance, and overall financial situation. Here are some factors to consider:

- Long-term Commitment: Cash value life insurance policies require a long-term commitment to premium payments to fully realize their benefits.

- Age and Health: Younger and healthier individuals may qualify for lower premiums, making 7702 plans more cost-effective.

- Risk Tolerance: The cash value growth potential and associated risks vary depending on the type of policy you choose (e.g., variable universal life has higher risk and potential returns).

- Liquidity Needs: While 7702 plans offer tax-free access to cash value, withdrawals or loans could reduce the death benefit or incur surrender charges.

- Estate Planning: If you have a significant estate, a 7702 plan can be a valuable tool for minimizing estate taxes.

It’s essential to consult with a qualified financial advisor or insurance professional to determine if a 7702 plan aligns with your specific needs and circumstances.

Conclusion

7702 plans offer a unique opportunity to combine life insurance protection with tax-advantaged cash value growth. By understanding how these plans work, their benefits, and their limitations, you can make an informed decision about whether they should be part of your overall financial strategy.

Remember, a 7702 plan is not a one-size-fits-all solution; it should be carefully evaluated in the context of your broader financial goals and integrated with other retirement and investment strategies. With proper planning and guidance, a 7702 plan could be the key to unlocking greater financial security and tax-efficient wealth accumulation.

What Are Section 7702 Plans (Are They Even Real Investments)?

FAQ

Are 7702 plans worth it?

What is the change in the IRS rule for 7702?

What is Section 7702 interest rates?