As we navigate the complexities of healthcare costs, one question that often arises for seniors is: “What is the cost of Medicare Part B in 2021?” This article aims to provide a comprehensive understanding of Medicare Part B premiums, deductibles, and coinsurance rates, ensuring you have all the information you need to make informed decisions about your healthcare coverage.

Understanding Medicare Part B

Medicare Part B is the medical insurance component of the Medicare program. It covers a wide range of services, including doctor visits, outpatient care, preventive services, and durable medical equipment. While Medicare Part A primarily covers inpatient hospital care, Part B is essential for accessing routine medical care and services outside of the hospital setting.

Medicare Part B Premiums in 2021

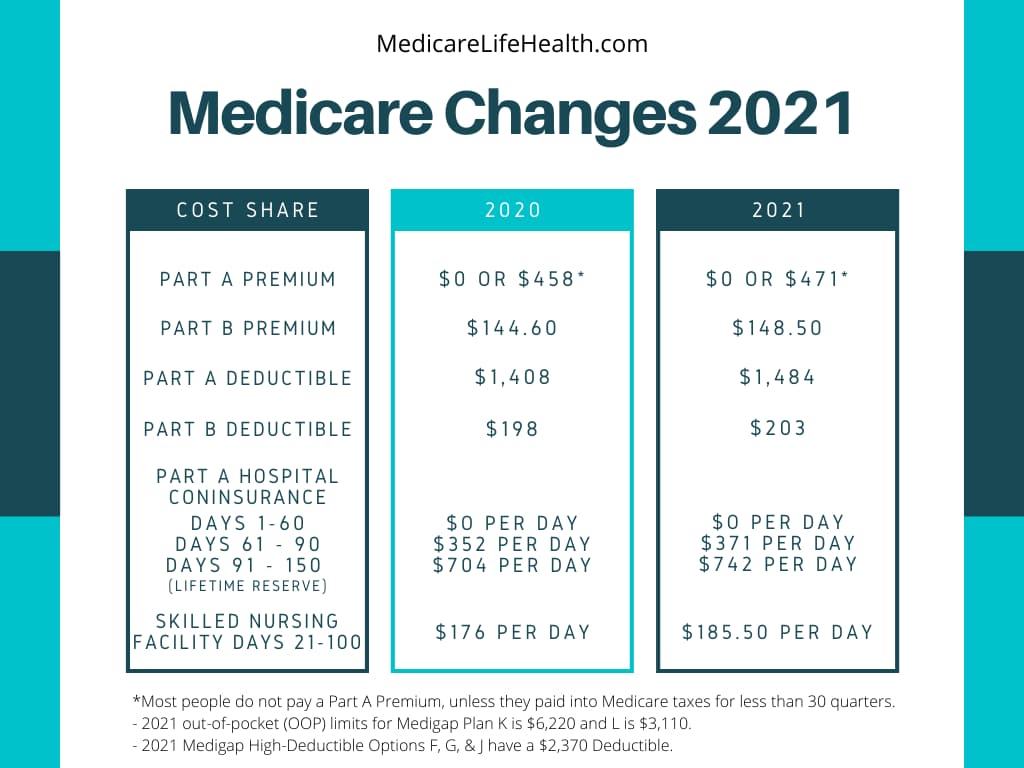

The standard monthly premium for Medicare Part B in 2021 is $148.50. However, it’s important to note that your premium amount may be higher based on your income level. The premiums are income-adjusted, meaning that individuals with higher incomes will pay a higher monthly premium.

Here’s a breakdown of the Medicare Part B premiums for 2021 based on income levels:

| Individual Tax Return Income | Joint Tax Return Income | Monthly Part B Premium |

|---|---|---|

| ≤ $88,000 | ≤ $176,000 | $148.50 |

| $88,001 – $111,000 | $176,001 – $222,000 | $207.90 |

| $111,001 – $138,000 | $222,001 – $276,000 | $297.00 |

| $138,001 – $165,000 | $276,001 – $330,000 | $386.10 |

| $165,001 – $500,000 | $330,001 – $750,000 | $475.20 |

| ≥ $500,000 | ≥ $750,000 | $504.90 |

If you’re married and lived with your spouse at any time during the year, but file separate tax returns, your premium will be based on your individual income.

Medicare Part B Deductible in 2021

The annual deductible for Medicare Part B in 2021 is $203.00. This deductible applies to most services covered by Part B, such as doctor visits, outpatient procedures, and durable medical equipment. Once you’ve met your deductible for the year, you’ll typically pay 20% of the Medicare-approved amount for most covered services.

Medicare Part B Coinsurance in 2021

After meeting your annual deductible, you’ll be responsible for paying a coinsurance amount, which is a percentage of the Medicare-approved cost for covered services. In 2021, the coinsurance rate for Medicare Part B is 20% of the Medicare-approved amount.

For example, if you visit a doctor who accepts Medicare assignment, and the Medicare-approved amount for the service is $100, you would pay $20 (20% of $100) as your coinsurance after meeting your deductible.

Additional Costs and Resources

It’s important to note that the costs mentioned above are specific to Medicare Part B. You may also have additional costs associated with other parts of Medicare, such as Part A (hospital insurance), Part C (Medicare Advantage plans), and Part D (prescription drug coverage).

If you have limited income and resources, you may be eligible for assistance programs like Medicaid or the Medicare Savings Programs, which can help cover some or all of your Medicare premiums and out-of-pocket costs.

For more detailed information and up-to-date costs, you can visit the official Medicare website (www.medicare.gov) or consult with a licensed insurance agent or Medicare counselor in your area.

Remember, understanding the costs associated with Medicare Part B is crucial for budgeting and ensuring you have adequate healthcare coverage in your golden years. By staying informed and exploring all available options, you can make the best decisions for your unique healthcare needs and financial situation.

Medicare Part B Premiums For 2021

FAQ

What is the 2021 and 2022 premium for Medicare Part B?

Does everyone pay $170 for Medicare?

How much will Medicare Part B premiums be in 2024?

How much is deducted from Social Security for Medicare Part B?