For veterans who have transitioned into civilian federal employment, understanding the intricacies of healthcare coverage can be daunting. Two prominent options available are TRICARE and the Federal Employees Health Benefits (FEHB) program. In this comprehensive guide, we’ll delve into the key differences between these two health insurance plans, helping you make an informed decision that suits your unique needs.

TRICARE: The Military Health Program

TRICARE is a comprehensive healthcare program designed specifically for active-duty service members, retired military personnel, and their eligible family members. It offers a range of plans tailored to different situations, providing coverage for medical care, prescriptions, and more.

TRICARE Plans:

- TRICARE Prime: A health maintenance organization (HMO) option available in certain U.S. areas, providing access to military treatment facilities and civilian network providers.

- TRICARE Select: A preferred provider organization (PPO) option available across the U.S., offering flexibility in choosing providers, albeit with higher out-of-pocket costs.

- TRICARE Select Overseas: Similar to TRICARE Select, but for those living abroad.

- U.S. Family Health Plan: A TRICARE Prime option available in specific U.S. locations, delivered by private healthcare providers.

- TRICARE For Life: A Medicare-wraparound coverage for TRICARE-eligible beneficiaries who have Medicare Parts A and B.

Key Features of TRICARE:

- Comprehensive coverage for medical care and prescriptions, often with low out-of-pocket costs.

- Eligibility limited to active-duty service members, retired military personnel, and their eligible family members.

- Options for HMO-style plans (TRICARE Prime) or PPO-style plans (TRICARE Select) based on location and personal preferences.

- TRICARE For Life acts as a supplement to Medicare for eligible beneficiaries.

FEHB: The Federal Employees Health Benefits Program

The FEHB program is a comprehensive health insurance program available to federal civilian employees, retirees, and their eligible family members. It offers a wide range of plan options, including fee-for-service (FFS) plans and health maintenance organizations (HMOs).

FEHB Plan Types:

- Fee-for-Service (FFS) Plans: These plans reimburse the enrollee or healthcare provider for covered services, allowing flexibility in choosing providers.

- Health Maintenance Organizations (HMOs): These plans provide comprehensive healthcare services through designated plan physicians, hospitals, and providers within a specific service area.

Key Features of FEHB:

- Wide variety of plan options, including FFS plans and HMOs, allowing for personalized coverage choices.

- Eligibility extended to federal civilian employees, retirees, and their eligible family members.

- Option to continue FEHB coverage into retirement or suspend it for other coverage options, such as Medicare Advantage plans.

- Coordination of benefits with other health insurance plans, including TRICARE and Medicare.

TRICARE vs. FEHB: Key Differences

While both TRICARE and FEHB offer comprehensive healthcare coverage, there are several notable differences to consider:

-

Eligibility: TRICARE is specifically designed for active-duty service members, retired military personnel, and their eligible family members. FEHB, on the other hand, is available to federal civilian employees, retirees, and their eligible family members.

-

Plan Options: TRICARE offers a limited range of plans, primarily focused on HMO-style (TRICARE Prime) and PPO-style (TRICARE Select) options. FEHB provides a wider array of plan choices, including FFS plans and HMOs from various private insurance carriers.

-

Provider Network: TRICARE’s provider network is limited to military treatment facilities and civilian network providers. FEHB plans generally offer broader provider networks, allowing more flexibility in choosing healthcare providers.

-

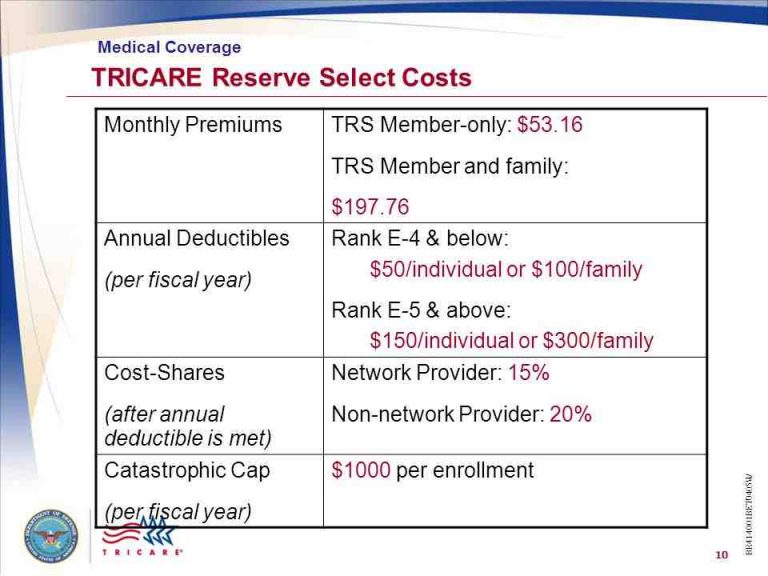

Cost: While both TRICARE and FEHB require premium payments, TRICARE plans typically have lower out-of-pocket costs compared to FEHB plans, making them a more affordable option for eligible beneficiaries.

-

Coordination of Benefits: If you are covered by both TRICARE and FEHB, the FEHB plan will be the primary payer, while TRICARE will act as the secondary payer. If you are also enrolled in Medicare, the order of payment may vary based on your specific situation.

Making the Right Choice

Choosing between TRICARE and FEHB can be a complex decision, as it depends on various factors such as your eligibility, healthcare needs, budget, and personal preferences. Here are some considerations to keep in mind:

- If you are eligible for TRICARE and prioritize affordability, TRICARE may be the more cost-effective option, especially when combined with Medicare (TRICARE For Life).

- If you value a wider range of plan choices and provider networks, FEHB may be the better fit, offering more flexibility in selecting coverage that aligns with your healthcare requirements.

- If you are eligible for both TRICARE and FEHB, carefully evaluate the coordination of benefits and determine which plan should be primary based on your specific circumstances.

It’s essential to thoroughly review the plan details, coverage options, and costs associated with both TRICARE and FEHB to make an informed decision that best suits your healthcare needs and financial situation.

Remember, as a veteran transitioning into civilian federal employment, you have access to valuable healthcare resources. Take the time to understand your options, consult with healthcare professionals or benefits advisors if needed, and make the choice that provides the most comprehensive and cost-effective coverage for you and your family.

How Does Medicare Work With FEHB, TRICARE, and VA Benefits?

FAQ

Should I use TRICARE or FEHB?

Is TRICARE part of the Federal Employees Health Benefits Program?

Is TRICARE the best health insurance?

Why is FEHB so expensive?