The world of Medicare can be a maze of acronyms, rules, and regulations. One term that often causes confusion for beneficiaries is the Income-Related Monthly Adjustment Amount, or IRMAA. In this article, we’ll demystify IRMAA, explaining what it is, how it’s calculated, and what it means for your Medicare premiums.

What is IRMAA?

The Income-Related Monthly Adjustment Amount (IRMAA) is a surcharge added to your Medicare Part B and Part D premiums if your annual income exceeds a certain threshold. The surcharge is based on a sliding scale, meaning the higher your income, the higher your IRMAA will be.

The IRMAA was introduced as part of the Medicare Modernization Act of 2003 to help cover the rising costs of Medicare. It ensures that individuals with higher incomes contribute more towards their Medicare coverage, while those with lower incomes pay the standard premium.

How is IRMAA Calculated?

The Social Security Administration (SSA) determines your IRMAA based on your Modified Adjusted Gross Income (MAGI) from your most recent tax return. Your MAGI includes your adjusted gross income (AGI) plus any tax-exempt interest income.

The SSA uses your tax filing status (single, married filing jointly, married filing separately, etc.) and your MAGI to determine which IRMAA bracket you fall into. There are currently five IRMAA brackets, each with a different premium surcharge.

Here are the 2024 IRMAA brackets for Medicare Part B premiums:

| Filing Status | MAGI | Part B Premium |

|---|---|---|

| Single | ≤ $103,000 | $174.70 |

| Single | $103,001 – $129,000 | $244.60 |

| Single | $129,001 – $161,000 | $349.40 |

| Single | $161,001 – $193,000 | $454.20 |

| Single | $193,001 – $499,999 | $559.00 |

| Single | ≥ $500,000 | $594.00 |

| Married Filing Jointly | ≤ $206,000 | $174.70 |

| Married Filing Jointly | $206,001 – $258,000 | $244.60 |

| Married Filing Jointly | $258,001 – $322,000 | $349.40 |

| Married Filing Jointly | $322,001 – $386,000 | $454.20 |

| Married Filing Jointly | $386,001 – $749,999 | $559.00 |

| Married Filing Jointly | ≥ $750,000 | $594.00 |

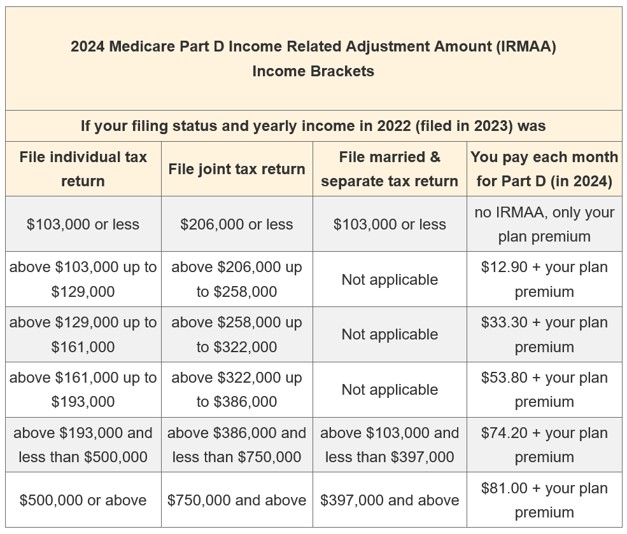

The IRMAA for Medicare Part D prescription drug coverage follows a similar sliding scale based on your MAGI and tax filing status.

How is IRMAA Paid?

If you’re subject to IRMAA, the SSA will notify you of your adjusted premium amount. You have two options for paying the IRMAA surcharge:

-

Deducted from Social Security Benefits: If you receive Social Security benefits, the IRMAA will be automatically deducted from your monthly benefit payment.

-

Billed Directly by Medicare: If you don’t receive Social Security benefits, Medicare will bill you directly for the IRMAA surcharge every three months.

It’s important to note that IRMAA is calculated annually based on your most recent tax return. If your income decreases due to life events like retirement or job loss, you may be eligible for a reduction or elimination of your IRMAA surcharge. You’ll need to submit proof of your income change to the SSA for consideration.

Understanding the Impact of IRMAA

While IRMAA may seem like an additional burden for higher-income beneficiaries, it’s important to remember that it helps to sustain the Medicare program for all participants. By contributing a higher premium based on their income, wealthier individuals help to offset the rising costs of healthcare and ensure the program’s long-term viability.

However, it’s also essential to plan for IRMAA in your retirement budgeting. The surcharge can significantly increase your Medicare expenses, especially if your income falls into the higher IRMAA brackets. Consulting with a financial advisor or Medicare expert can help you understand the potential impact of IRMAA on your overall healthcare costs and develop strategies to manage it effectively.

Conclusion

The Income-Related Monthly Adjustment Amount (IRMAA) is a critical component of the Medicare program, designed to ensure that those with higher incomes contribute more towards their healthcare coverage. While it can add complexity to your Medicare premiums, understanding how IRMAA works and planning for it in advance can help you navigate the system more effectively and ensure you’re adequately prepared for your healthcare expenses in retirement.

IRMAA: Income Related Monthly Adjustment Amount

FAQ

How much is irmaa for 2024?

How is the Irmaa calculated for Medicare?

How long does Irmaa last?

How to reduce Medicare irmaa?