As we navigate the complexities of healthcare in our golden years, understanding Medicare coverage becomes paramount. One of the core components of the Medicare program is Part A, which provides vital inpatient hospital coverage for eligible individuals. In this comprehensive guide, we’ll explore the intricacies of Medicare Part A, shedding light on what it covers, associated costs, and how it can help ensure you receive the necessary medical care during hospital stays.

What is Medicare Part A?

Medicare Part A, also known as Hospital Insurance, is a crucial aspect of the Medicare program. It is designed to cover inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care services. This coverage is particularly important for individuals aged 65 and older, as well as those with certain disabilities or end-stage renal disease.

Inpatient Hospital Coverage Under Medicare Part A

One of the primary benefits of Medicare Part A is its coverage for inpatient hospital stays. This includes:

-

Semi-Private Room: Medicare Part A covers the cost of a semi-private room during your hospital stay, ensuring you have a comfortable and appropriate setting for your recovery.

-

Meals: Your meals during your inpatient stay are covered by Part A, ensuring you receive proper nutrition as you recuperate.

-

General Nursing: The services of general nursing staff, including registered nurses and licensed practical nurses, are covered under Part A.

-

Drugs: Any medications administered to you during your inpatient hospital stay are covered, including methadone for the treatment of opioid use disorder.

-

Other Hospital Services and Supplies: Part A also covers other necessary hospital services and supplies related to your inpatient treatment, such as X-rays, lab tests, and surgical dressings.

It’s important to note that Medicare Part A does not cover private-duty nursing, private rooms (unless medically necessary), television or phone charges in your room, or personal care items like razors or slipper socks.

Costs Associated with Medicare Part A

While Medicare Part A provides comprehensive inpatient hospital coverage, there are certain costs you may need to pay out-of-pocket:

-

Deductible: For each benefit period, you’ll be responsible for paying a deductible of $1,632 (as of 2023).

-

Coinsurance: After meeting the deductible, you’ll have to pay a coinsurance amount for certain days of your inpatient stay:

- Days 1-60: $0 coinsurance

- Days 61-90: $408 coinsurance per day

- After day 90: $816 coinsurance per day while using your 60 lifetime reserve days

Once you’ve exhausted your lifetime reserve days, you’ll be responsible for all costs associated with your inpatient hospital stay.

Additional Coverage Under Medicare Part A

In addition to inpatient hospital coverage, Medicare Part A also provides coverage for:

-

Skilled Nursing Facility Care: If you require skilled nursing care after a hospital stay, Medicare Part A may cover a portion of the costs for a limited period, provided specific criteria are met.

-

Home Health Care: If you’re homebound and require skilled nursing care, physical therapy, speech therapy, or occupational therapy, Medicare Part A may cover these services, as long as specific conditions are met.

-

Hospice Care: For those with a terminal illness, Medicare Part A provides coverage for hospice care, including pain management, nursing care, medical equipment, and other support services.

It’s essential to note that Medicare Part A has certain coverage limits, such as a lifetime limit of 190 days for inpatient psychiatric hospital care in a freestanding psychiatric hospital.

Maximizing Your Medicare Part A Coverage

To ensure you’re making the most of your Medicare Part A coverage, consider the following tips:

-

Know Your Rights: Familiarize yourself with your rights as a Medicare beneficiary, including the right to appeal any coverage decisions you disagree with.

-

Plan Ahead: If you anticipate needing inpatient hospital care, skilled nursing facility care, or hospice care, discuss your options with your healthcare provider and plan ahead to ensure you meet the necessary criteria for coverage.

-

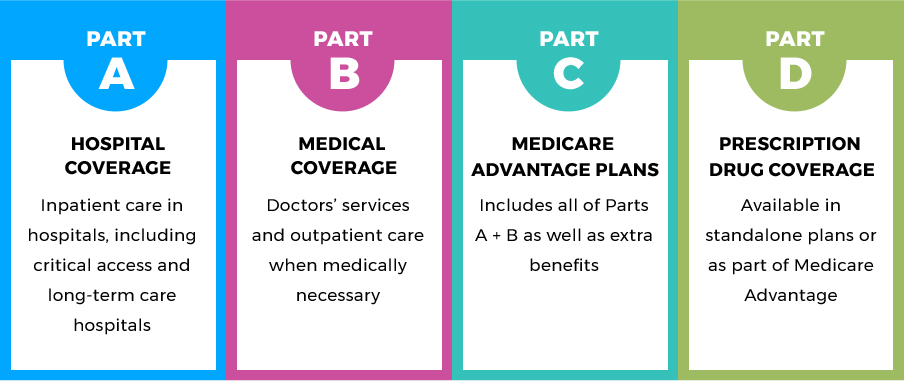

Coordinate with Part B: If you also have Medicare Part B (Medical Insurance), it generally covers 80% of the Medicare-approved amount for doctor’s services you receive while in the hospital.

-

Consider Supplemental Coverage: Many individuals choose to supplement their Medicare coverage with additional plans like Medicare Supplement Insurance (Medigap) or Medicare Advantage plans to help cover out-of-pocket costs and additional services.

By understanding the intricacies of Medicare Part A and taking proactive steps to maximize your coverage, you can ensure you receive the necessary inpatient hospital care without facing overwhelming financial burdens.

Remember, navigating the complexities of Medicare can be challenging, but with the right information and guidance, you can make informed decisions and secure the healthcare coverage you need during your golden years.

Medicare Part A: Hospital Coverage Explained!

FAQ

Does Medicare Part A pay 100% of your hospital stay?

Is Medicare A or B for hospital?

What portion of Medicare is hospital insurance?

What is the difference between Medicare Part A and B and C?