Utility services like water, electricity, gas, and trash collection are monthly costs that businesses must plan for. But when you get the bill, should you pay it right away or wait until it’s almost due? If you’re a business owner, knowing the correct accounting and cash flow effects of each option can help you handle utility bills well.

This article will examine the advantages and disadvantages of paying immediately versus postponing payment on business utility bills to optimize cash flow without incurring penalties.

The Dilemma: To Pay Now or Wait?

Upon receiving a utility bill for your business, you have two options:

- Pay it ASAP

- Wait until closer to the due date to pay

Paying immediately may seem ideal to get it off your plate. However, holding onto the cash and delaying payment could be better for managing cash flow.

On the other hand, postponing risks forgetting and paying late resulting in penalties. So what should businesses do when facing this utility payment dilemma each month?

The Accounting Treatment

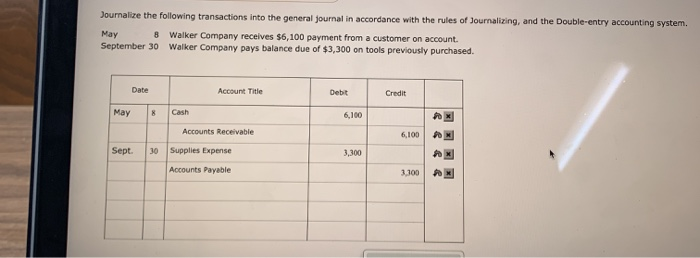

First, understand how to record utility bills properly in your books. When the bill arrives, you should:

- Debit Utilities Expense

- Credit Accounts Payable

This enters the amount you owe as a liability. When you eventually pay the bill, reverse the entries

- Debit Accounts Payable

- Credit Cash

Recording the amount in Accounts Payable when initially received gives you time before outlaying cash

The Benefits of Delayed Payment

Waiting until closer to the due date to pay utility bills can optimize business cash flow in several ways:

- Preserves capital for other uses in the interim

- Earns interest if kept in savings accounts

- Avoids credit card interest charges if paying by card

- Allows time to verify bill accuracy before paying

As long as payment is made by the due date, postponing gives you flexibility without penalty.

Setting Payment Deadlines

To make this approach work, clearly define bill payment deadlines for your accounting team, such as:

- Receive utility bills: 1st of month

- Enter into Accounts Payable: 5th of month

- Pay bills: 20th of month

Having set procedures ensures bills are paid on time while maximizing your cash holding period.

Just be sure to consider utility company policies – some require payment within 10-15 days. Review statements carefully and adjust deadlines accordingly.

The Risks of Delayed Payment

While postponing utility bill payment offers cash flow advantages, some potential downsides also need to be addressed:

- Forgotten payments – Without prompts, you may forget to pay by the deadline

- Late fees – If a bill goes unpaid past the due date, late fees quickly add up

- Utilities cut off – Overdue bills can potentially result in suspended utility services

To prevent these issues, set calendar reminders for payment deadlines. Also review Accounts Payable reports regularly to catch any bills falling through cracks.

Tips for Organizing Utility Bills

Whatever your payment timing strategy, staying organized with utility bills is key:

- Have a single person responsible for utility billing procedures to ensure consistency.

- Set reminders/alerts for payment deadlines each month

- File bills promptly after receipt for easy access

- Log payments in your accounting system right after paying bills

- Review accounts regularly for outstanding liabilities or errors

Streamlining bill management processes minimizes risk of late payments.

Evaluate Payment Timing Strategies

When deciding whether to pay utility bills immediately or wait, consider these factors:

- Your current cash flow needs and savings for earning interest

- Bill accuracy – review charges thoroughly before paying

- Company deadlines – know the exact due dates to avoid late fees

- Your accounting procedures – can your team handle delayed payment properly?

Weigh the benefits and risks to determine the optimal utility payment timing strategy for your business cash flow needs.

Set Clear Policies and Procedures

Ensure your utility billing and payment procedures are defined clearly for staff, such as:

- Who receives, reviews, and enters bills into accounting system

- Deadlines for bill receipt, data entry, and final payment

- Required approvals and processes for releasing payment

- Methods for resolving billing discrepancies

With well-documented policies, your team can consistently manage utility payments in a way that optimizes cash flow.

Leverage Technology for Efficiency

Automating repetitive billing tasks helps streamline utility payment processes:

- Use bill pay features directly through utility company websites

- Set up electronic payments to withdraw on a schedule

- Enable email billing and reminders

- Integrate accounting software with bill pay

- Schedule recurring payments in accounting system

Technology reduces human error risk and saves time on utility billing each month.

Seek Better Rates and Budget Accurately

To control utility costs:

- Negotiate improved rates by committing to longer contracts

- Explore energy efficiency upgrades to lower usage

- Review bills monthly and address sudden spikes immediately

- Monitor expenses annually and budget accurately

Proactive utility cost management reduces financial pressure from these unavoidable business expenses.

In Summary

Utility bills are an obligation, but companies have flexibility in when they pay them. Postponing payment until near the due date can optimize cash flow, as long as you have diligent policies and procedures in place to prevent late payments. Weigh the benefits and risks to develop a tailored utility bill payment strategy that meets your business needs and financial priorities month to month.

elsabramasco4313 is waiting for your help.Add your answer and earn points.verified

- Ambitious

- 6.8K answers

- 3.3M people helped

Never Pay Utility Bills Again

FAQ

When a company has performed a service but has not yet received payment?

What does it mean when accounts payable is debited?

Is an account payable a debt?

Is a suppliers account a debit or credit?