Are you on the hunt for the best Medicare Supplement insurance plan? If so, understanding the top providers in the market can be a game-changer. Medicare Supplement plans, also known as Medigap, are offered by private insurance companies to bridge the gaps in coverage left by Original Medicare (Parts A and B). Essentially, these plans help cover out-of-pocket costs such as deductibles, copayments, and coinsurance.

In this comprehensive guide, we’ll unveil the largest and most reputable Medicare Supplement provider, as well as shed light on other highly-rated companies worth considering. So, let’s dive right in!

The Largest Medicare Supplement Provider: AARP by UnitedHealthcare

When it comes to Medicare Supplement insurance, one name stands out above the rest: AARP by UnitedHealthcare. This powerhouse partnership combines the advocacy and expertise of AARP (American Association of Retired Persons) with the extensive reach and financial strength of UnitedHealthcare, the nation’s largest health insurance provider.

Here’s why AARP by UnitedHealthcare is the biggest player in the Medicare Supplement arena:

-

Massive Membership Base: AARP boasts an impressive membership of over 38 million individuals aged 50 and above. This vast pool of potential customers gives them a significant advantage in the market.

-

Nationwide Coverage: UnitedHealthcare offers Medigap plans in all 50 states and most U.S. territories, making it one of the most widely available providers.

-

Financial Stability: UnitedHealthcare’s parent company, UnitedHealth Group, is a Fortune 500 company with a strong financial position. This stability ensures reliable claims processing and consistent premium rates.

-

Comprehensive Offerings: AARP by UnitedHealthcare offers a wide range of Medigap plans, including the popular Plan G and Plan N, providing options to suit various needs and budgets.

-

Excellent Customer Service: With a dedicated team of experts and a user-friendly online portal, AARP by UnitedHealthcare is known for its exceptional customer service and support.

Other Highly-Rated Medicare Supplement Providers

While AARP by UnitedHealthcare is the undisputed leader, several other insurance companies have established themselves as reliable and reputable providers of Medicare Supplement plans. Here are some noteworthy mentions:

Mutual of Omaha

- Offers Medigap plans in 49 states

- Provides six different Medigap plan options

- Known for competitive pricing and additional benefits

Cigna

- Offers Medigap plans in 48 states

- Provides five different Medigap plan options

- Offers additional discounts for online enrollment

Aetna

- Offers Medigap plans in all 50 states

- Provides a wide range of plan options

- Highly rated for financial stability by major rating agencies

Humana

- Offers Medigap plans in all 50 states, Washington, D.C., and Puerto Rico

- Provides 10 different Medigap plan options

- Offers additional benefits like SilverSneakers and meal delivery services

Blue Cross Blue Shield

- Coverage available in all 50 states, Washington, D.C., and Puerto Rico

- Offers 12 different types of Medigap plans

- Consistent customer experience across various BCBS companies

These providers have established themselves as reliable options, offering a range of Medigap plans and additional benefits to meet the diverse needs of Medicare beneficiaries.

Choosing the Right Medicare Supplement Plan

While understanding the top providers is crucial, selecting the right Medicare Supplement plan for your specific needs is equally important. Here are some key factors to consider:

- Your Health Condition: Evaluate your current and anticipated health care needs, factoring in your family history and any pre-existing conditions.

- Your Budget: Medigap plans come with varying premium costs, so it’s essential to find a plan that fits your financial situation.

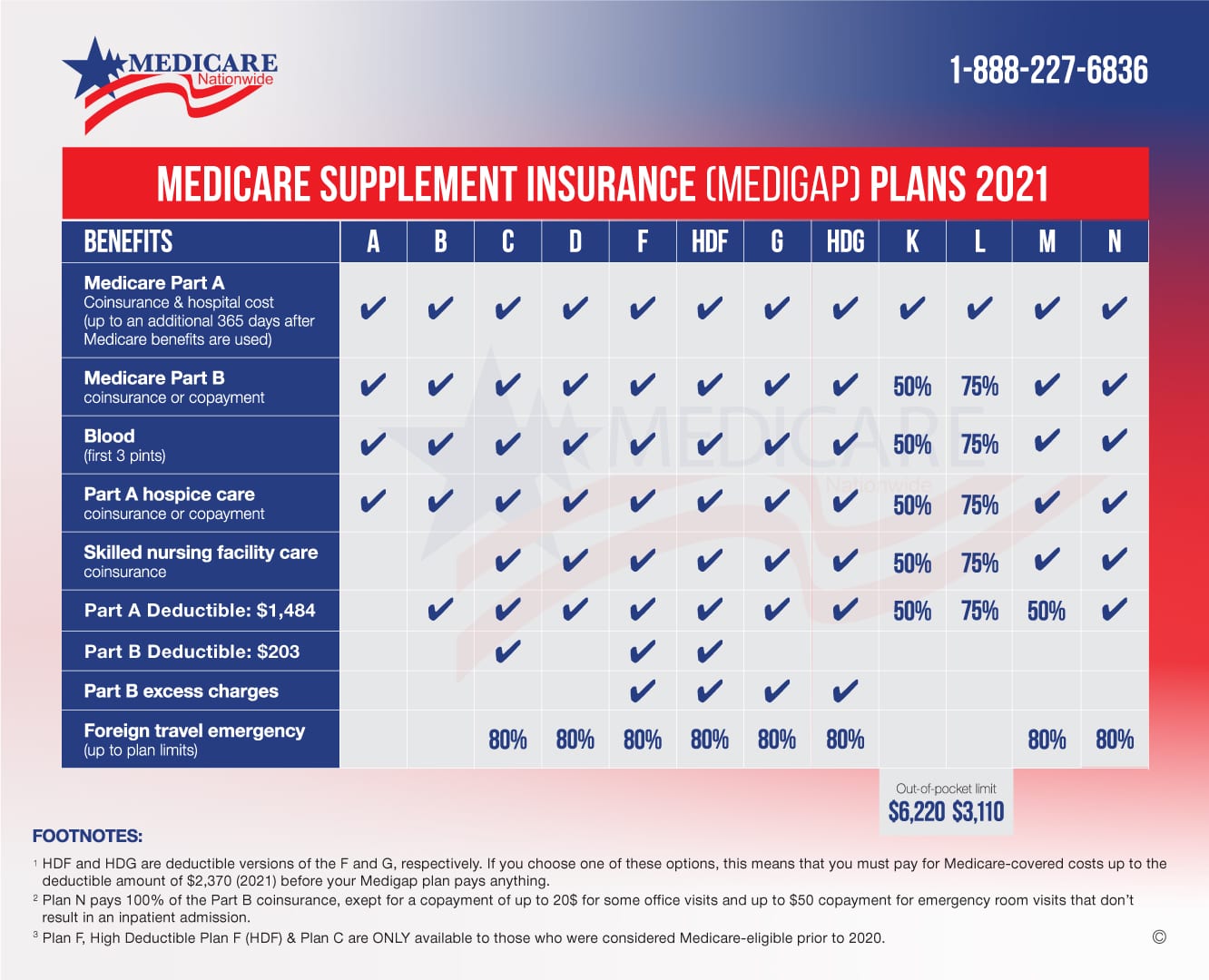

- Plan Coverage: Different Medigap plans offer varying levels of coverage, so carefully review the benefits and exclusions of each plan.

- Additional Benefits: Some providers offer extra perks like fitness memberships, discounts, or even dental and vision coverage.

- Provider Network: If a plan has network restrictions, ensure that your preferred healthcare providers are included.

Working with a Licensed Insurance Agent

Navigating the complexities of Medicare Supplement plans can be overwhelming, especially with the numerous options available. Consider working with a licensed insurance agent who can guide you through the process and help you find the best plan that aligns with your specific requirements.

These professionals have in-depth knowledge of the various providers, plan offerings, and pricing structures. They can provide personalized recommendations based on your health needs, budget, and preferences, ensuring that you make an informed decision.

Conclusion

In the realm of Medicare Supplement insurance, AARP by UnitedHealthcare stands tall as the largest provider, offering unparalleled coverage and customer support. However, other reputable companies like Mutual of Omaha, Cigna, Aetna, Humana, and Blue Cross Blue Shield are also worthy contenders, each with their own strengths and unique offerings.

Ultimately, the key to finding the best Medicare Supplement plan lies in understanding your individual needs, evaluating the available options, and seeking guidance from licensed professionals. By taking the time to research and compare providers, you can ensure that you have the right coverage in place to support your health and financial well-being during your golden years.

Why are so many people are on AARP Medicare Supplement Plans?

FAQ

What is the highest rated Medicare Supplement company?

Who is the largest carrier of Medicare supplements?

Which Medicare Supplement plan has the highest level of coverage?

What is the most expensive Medicare Supplement plan?

|

Medigap Plan Type

|

Medigap Cost Range (monthly)

|

|

Medicare Supplement Plan D

|

$290 – $339

|

|

Medicare Supplement Plan F

|

$254 – $461

|

|

Medicare Supplement High-Deductible Plan F

|

$64 – $156

|

|

Medicare Supplement Plan G

|

$237 – $409

|