When it comes to life insurance policies, most people focus on the coverage amount, premiums, and beneficiaries. However, there’s one often-overlooked aspect that can catch policyholders off guard: the need to fill out a W9 form. This tax document might seem out of place in the context of life insurance, but it plays a crucial role in ensuring compliance with tax regulations. Let’s dive into the reasons behind this requirement and why it’s essential to provide accurate information.

Understanding the W9 Form

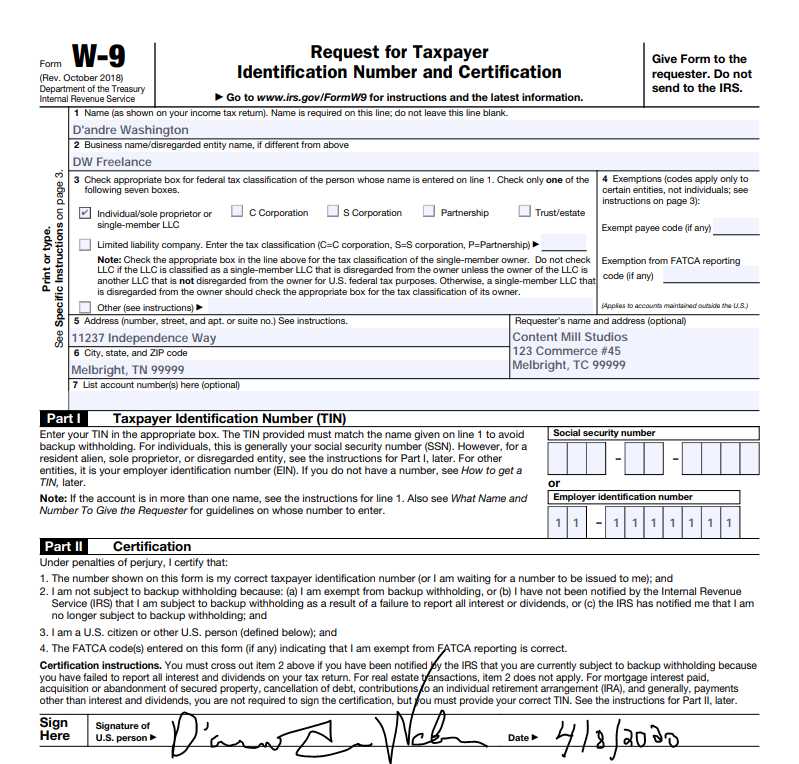

The W9 form, officially known as the “Request for Taxpayer Identification Number and Certification,” is a document issued by the Internal Revenue Service (IRS). Its primary purpose is to gather information about taxpayers, including their name, address, and taxpayer identification number (typically a Social Security number for individuals or an Employer Identification Number for businesses).

This form is commonly used in various financial transactions, such as when receiving interest, dividends, or other forms of income that may be subject to tax reporting. By collecting this information, the IRS can ensure accurate reporting and proper tax compliance.

Why is a W9 Required for Life Insurance?

At first glance, the connection between life insurance and the W9 form might not be immediately apparent. After all, the death benefit paid out by a life insurance policy is generally non-taxable income for the beneficiary. However, there’s a specific circumstance that necessitates the completion of a W9 form.

When a life insurance policy accumulates interest or investment gains over time, that interest may be subject to taxation if it exceeds a certain threshold. According to the IRS, if the interest earned on a life insurance policy exceeds $600 in a given tax year, the insurance company is required to report that interest income to the IRS using a 1099-INT form.

To comply with this reporting requirement, insurance companies need to have accurate taxpayer identification information for the beneficiaries of life insurance policies. This is where the W9 form comes into play. By completing the W9, beneficiaries provide the necessary information to the insurance company, allowing them to properly report any taxable interest earned on the policy.

It’s important to note that even if the interest earned is less than $600, insurance companies may still require beneficiaries to complete a W9 form. This proactive approach helps ensure compliance and avoids potential issues down the line.

Consequences of Not Providing a W9

Failing to provide a W9 form when requested by an insurance company can have consequences. Without the necessary taxpayer identification information, the insurance company may be required to withhold a percentage (typically 24%) of any taxable interest earned on the life insurance policy as a backup withholding.

This backup withholding is a measure implemented by the IRS to ensure that taxes are properly paid on reportable income. By withholding a portion of the interest earned, the IRS aims to collect the taxes owed, even if the taxpayer fails to report the income accurately.

Additionally, not providing a W9 form when requested can result in penalties and interest charges from the IRS if the unreported income is discovered during an audit or other tax review process.

Ensuring Accurate Information

When completing a W9 form for a life insurance policy, it’s crucial to provide accurate and up-to-date information. Any discrepancies or errors in the taxpayer identification number or other personal details can lead to complications and potential penalties.

If you have multiple life insurance policies or beneficiaries, it’s essential to ensure that each beneficiary completes a separate W9 form accurately. This will help streamline the reporting process and avoid any potential issues with the IRS.

Conclusion

While the requirement to fill out a W9 form for life insurance might seem unexpected, it serves an important purpose in ensuring tax compliance and proper reporting of any taxable interest earned on the policy. By understanding the reasons behind this requirement and providing accurate information, policyholders and beneficiaries can avoid potential complications and ensure a smooth claims process.

Remember, life insurance is not just about providing financial protection for your loved ones; it’s also essential to navigate the associated tax implications correctly. By working with a knowledgeable insurance professional and staying informed about tax regulations, you can make the most of your life insurance coverage while minimizing potential headaches down the line.

What Is IRS Form W9? Why Is It Needed for Life Insurance Death Claims?

FAQ

Why is my insurance asking for a W9?

What is a W9 for insurance claims?

Who is required to fill out a W9?

Do you get a 1099 for life insurance proceeds if you?