As the healthcare landscape in the United States continues to evolve, many seniors and individuals with disabilities find themselves grappling with the rising costs of Medicare coverage. In 2022, the standard monthly premium for Medicare Part B saw a staggering 14.55% increase, leaving many beneficiaries wondering what prompted such a significant hike. In this comprehensive article, we delve into the reasons behind this substantial rise and explore the implications for those relying on this essential healthcare program.

The Controversial Alzheimer’s Drug: Aduhelm

At the heart of the 2022 Medicare Part B premium surge lies a controversial Alzheimer’s disease drug called Aduhelm. Developed by the pharmaceutical company Biogen, this medication garnered significant attention when it received accelerated approval from the Food and Drug Administration (FDA) in June 2021, despite concerns from many medical experts regarding its efficacy and potential for high costs.

The Centers for Medicare & Medicaid Services (CMS) acknowledged the uncertainty surrounding the potential coverage and utilization of Aduhelm and similar drugs by Medicare beneficiaries in 2022. To address this uncertainty, CMS implemented contingency reserves, which contributed to the substantial premium increase.

Breaking Down the Numbers

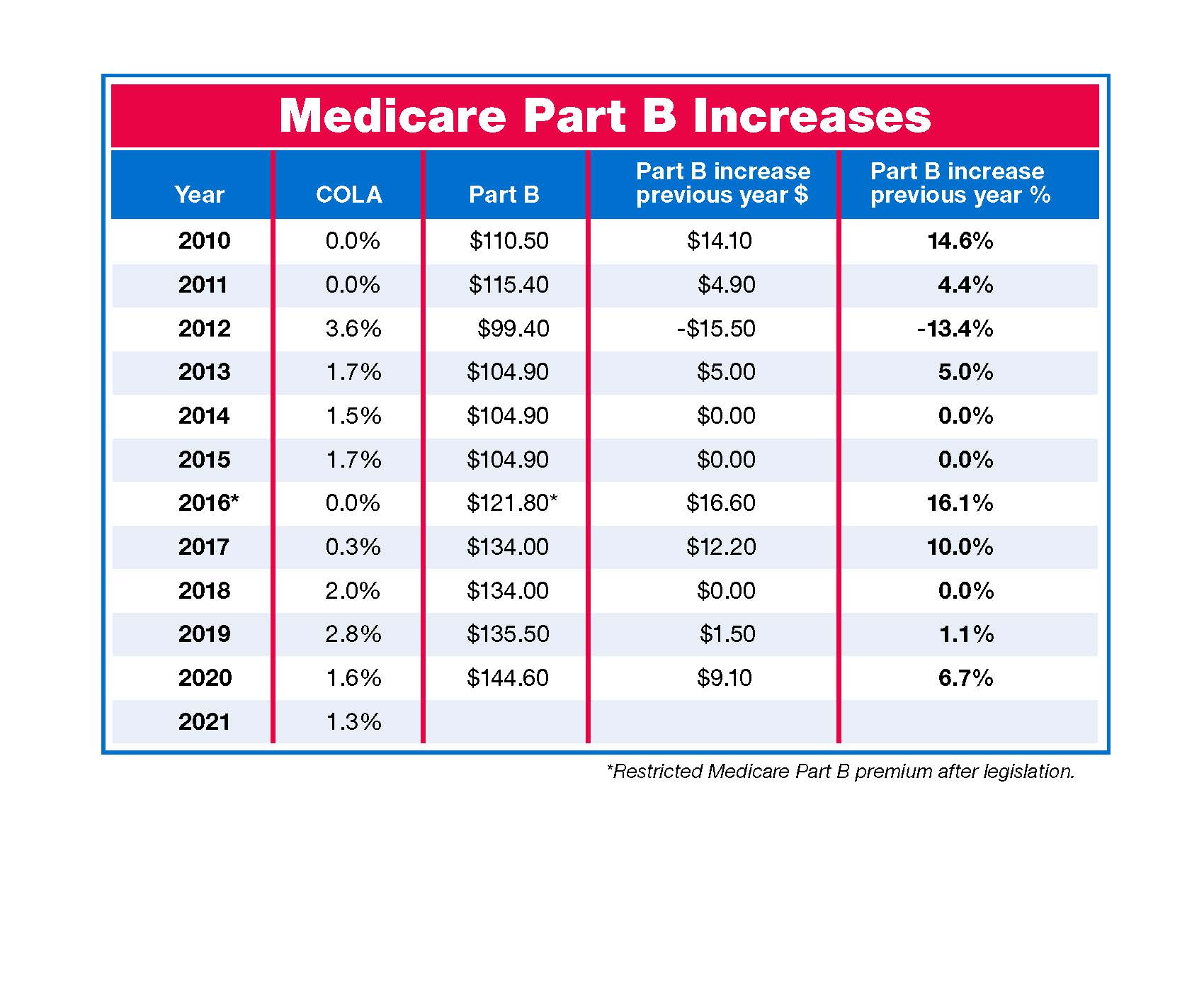

According to the CMS, the standard monthly premium for Medicare Part B enrollees in 2022 was set at $170.10, a significant increase of $21.60 from the 2021 premium of $148.50. Additionally, the annual deductible for Medicare Part B beneficiaries rose to $233, an increase of $30 from the previous year’s deductible of $203.

The premium hike was not the only financial burden faced by Medicare beneficiaries. The Part A inpatient hospital deductible, which covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care, also saw an increase of $72, rising from $1,484 in 2021 to $1,556 in 2022.

Rising Healthcare Costs and Congressional Action

While the uncertainty surrounding Aduhelm played a significant role in the premium increase, other factors also contributed to the higher costs. According to the CMS, rising prices and utilization across the healthcare system, driving higher premiums year-over-year, as well as anticipated increases in the intensity of care provided, were key factors.

Additionally, Congressional action to significantly lower the increase in the 2021 Medicare Part B premium resulted in the $3.00 per beneficiary per month increase being continued through 2025, further impacting the 2022 premium.

Impact on Beneficiaries

The substantial increase in Medicare Part B premiums and deductibles created a financial burden for many beneficiaries, especially those living on fixed incomes. While the Social Security cost-of-living allowance (COLA) for 2022 provided some relief, with an average increase of $92 per month for retired workers, the Medicare premium hike effectively reduced the net benefit of the COLA for many seniors.

For example, a retired worker receiving $1,565 per month from Social Security in 2021 would have seen a net increase of only $70.40 per month after the higher Medicare Part B premium was deducted from their COLA.

Looking Ahead: Potential Policy Changes

The controversy surrounding Aduhelm and the subsequent premium increase reignited discussions about the need for policy changes to address the rising costs of healthcare and prescription drugs in the United States. Proposals such as empowering Medicare to negotiate prices for high-cost prescription drugs, as suggested by President Biden’s Build Back Better Act, gained renewed attention.

While the fate of such proposals remains uncertain, the staggering increase in Medicare Part B premiums highlighted the importance of finding sustainable solutions to ensure affordable and accessible healthcare for millions of Americans.

Conclusion

The 2022 Medicare Part B premium hike served as a stark reminder of the complex challenges facing the healthcare system in the United States. As the nation grapples with rising costs, innovative treatments, and an aging population, it is crucial for policymakers, healthcare providers, and stakeholders to work together to find equitable and sustainable solutions.

By addressing the underlying factors contributing to premium increases, such as the high costs of prescription drugs and the uncertainties surrounding new treatments, we can strive to preserve the integrity and affordability of essential healthcare programs like Medicare, ensuring that all Americans have access to the care they need, regardless of their financial means.

PRICE REDUCTION for Medicare Part B in 2022?! Find out why here. – Senior Solutions Group

FAQ

Why did my Medicare Part B premium go up?

What is the projected 2024 Medicare Part B premium?

Why would Social Security stop paying Medicare Part B?