As we navigate the ever-evolving landscape of healthcare and retirement planning, one question looms large: Will Medicare, the cornerstone of healthcare coverage for millions of Americans, continue to exist in the years to come? This burning query has sparked debates and concerns across the nation, prompting us to delve deeper into the intricacies of this vital program and its prospects for the future.

The Inescapable Reality: An Aging Population

One of the most significant challenges facing Medicare is the rapidly aging population. With the Baby Boomer generation entering their golden years, the number of Americans aged 65 and older is projected to soar, placing an unprecedented strain on the Medicare system. This demographic shift is expected to intensify in the coming decades, as life expectancy continues to rise and the proportion of older adults in the population grows substantially.

The Financial Strain: Can Medicare Keep Up?

The financial sustainability of Medicare has long been a subject of intense scrutiny and debate. According to the 2023 Annual Report of the Boards of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds, the Medicare Trust Fund is projected to be depleted by 2031. This alarming projection has raised concerns about the program’s ability to meet its obligations and provide comprehensive healthcare coverage to beneficiaries.

However, it’s important to note that the depletion of the Trust Fund does not necessarily mean the end of Medicare. Even in the absence of a fully funded Trust Fund, the program can continue to operate by relying on incoming payroll tax revenues and premiums paid by beneficiaries. Nevertheless, without significant reforms or additional funding sources, the quality and scope of coverage could be compromised, potentially leading to higher out-of-pocket costs, reduced benefits, or a combination of both.

The Regulatory Landscape: Adapting to Change

In recent years, the Centers for Medicare & Medicaid Services (CMS) has implemented a series of regulatory changes aimed at enhancing the efficiency and sustainability of the Medicare program. These changes encompass various aspects, including payment rates, risk adjustment methodologies, Star rating systems, and prescription drug coverage.

While these regulatory adjustments are intended to improve the program’s overall performance and align it with evolving healthcare needs, they also present challenges for payers, healthcare providers, and beneficiaries alike. Adapting to these changes requires a nimble and strategic approach, as well as substantial investments in infrastructure, technology, and personnel.

The Rise of Medicare Advantage: A Game-Changer?

One of the most notable developments in the Medicare landscape is the rapid growth of Medicare Advantage (MA) plans. These privately administered plans, which offer an alternative to traditional Medicare, have gained significant traction in recent years, with enrollment projected to continue increasing in the foreseeable future.

MA plans have the potential to introduce innovative care delivery models, enhanced benefits, and more personalized member experiences. However, their long-term viability and impact on the overall Medicare system remain subjects of debate. Concerns have been raised about the potential for higher costs, reduced transparency, and the need for robust oversight to ensure quality of care and consumer protection.

The Role of Technology and Innovation

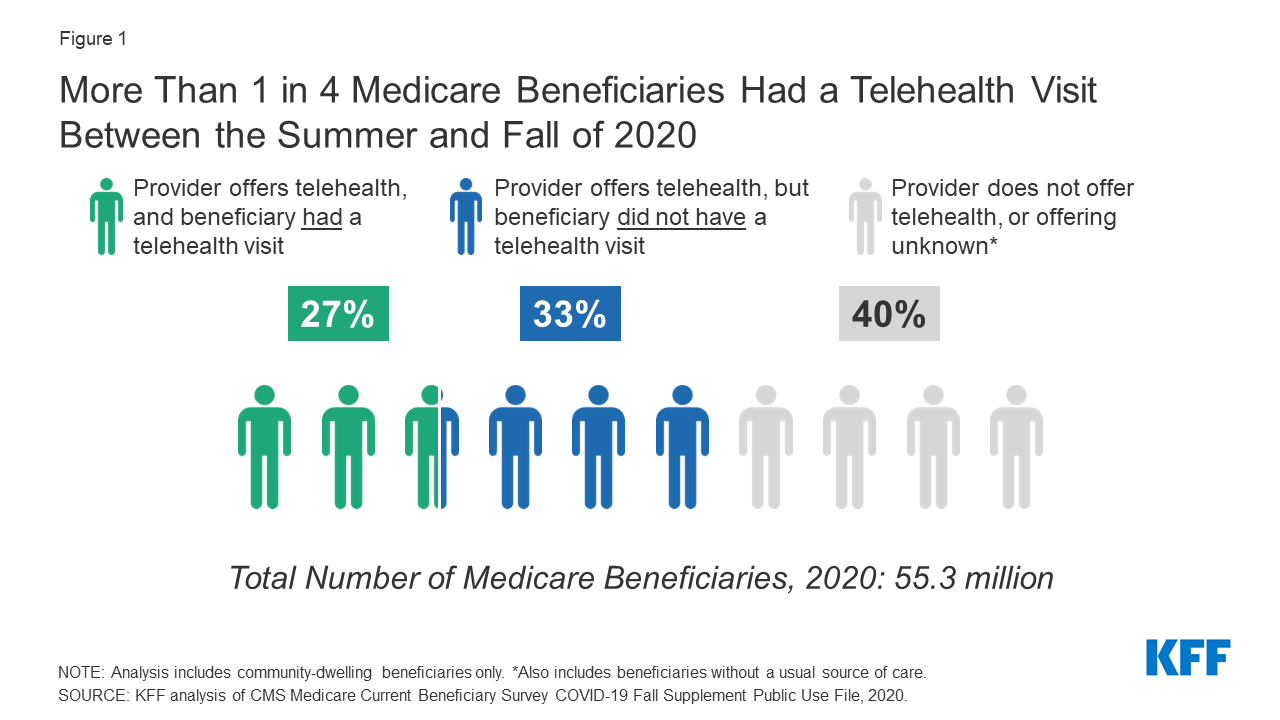

As the healthcare industry continues to evolve, the integration of technology and innovative solutions may play a pivotal role in shaping the future of Medicare. Advancements in areas such as telehealth, remote patient monitoring, and data analytics could revolutionize the way healthcare is delivered and managed, potentially improving efficiency, accessibility, and patient outcomes.

However, the successful adoption of these technologies hinges on several factors, including infrastructure development, data privacy and security measures, and the willingness of healthcare providers and beneficiaries to embrace new modes of care delivery.

The Political Landscape: Navigating Bipartisan Challenges

The future of Medicare is inextricably linked to the political landscape and the priorities of policymakers. While there is widespread recognition of the program’s importance and the need for its long-term sustainability, there are often differing perspectives on the best approaches to achieving this goal.

Navigating the complexities of healthcare reform and securing bipartisan support for substantive changes to Medicare can be a daunting task. It requires a delicate balance between fiscal responsibility, ensuring access to quality care, and addressing the diverse needs of beneficiaries and stakeholders.

Embracing Change and Proactive Planning

As the debate surrounding the future of Medicare continues, one thing remains clear: proactive planning and a willingness to adapt to changing circumstances will be crucial for all stakeholders involved, including payers, healthcare providers, and beneficiaries.

Payers, in particular, must stay ahead of the curve by developing strategic responses to regulatory changes, demographic shifts, and evolving member preferences. This may involve exploring new care delivery models, optimizing administrative costs, enhancing digital engagement, and reimagining product portfolios to better align with the needs of an aging Medicare population.

Beneficiaries, too, must take an active role in understanding their healthcare options, staying informed about potential changes to the program, and making informed decisions about their coverage and care.

Conclusion: A Resilient Program with Room for Improvement

While the future of Medicare is not without its challenges, the program has demonstrated remarkable resilience and adaptability over the decades. Its continued existence and ability to provide comprehensive healthcare coverage to millions of Americans will likely depend on a combination of factors, including:

- Implementing sustainable funding mechanisms and cost-containment strategies

- Embracing technological advancements and innovative care delivery models

- Fostering bipartisan collaboration and a shared commitment to ensuring access to quality healthcare for all Americans

With proactive planning, strategic decision-making, and a willingness to embrace change, Medicare can navigate the challenges ahead and continue to serve as a vital safety net for generations to come.

Will Medicare exist in the future?

FAQ

Will Medicare ever go away?

Will Medicare be around in the future?

Will Medicare survive?

How long will Medicare be around?