Social Security, the cornerstone of retirement income for millions of Americans, has been the subject of intense debate and speculation for decades. As the program continues to face mounting financial challenges, concerns about its long-term viability have become increasingly prevalent. In this comprehensive article, we’ll delve into the pressing question: Will Social Security collapse, leaving future generations without this crucial safety net?

The Looming Trust Fund Depletion

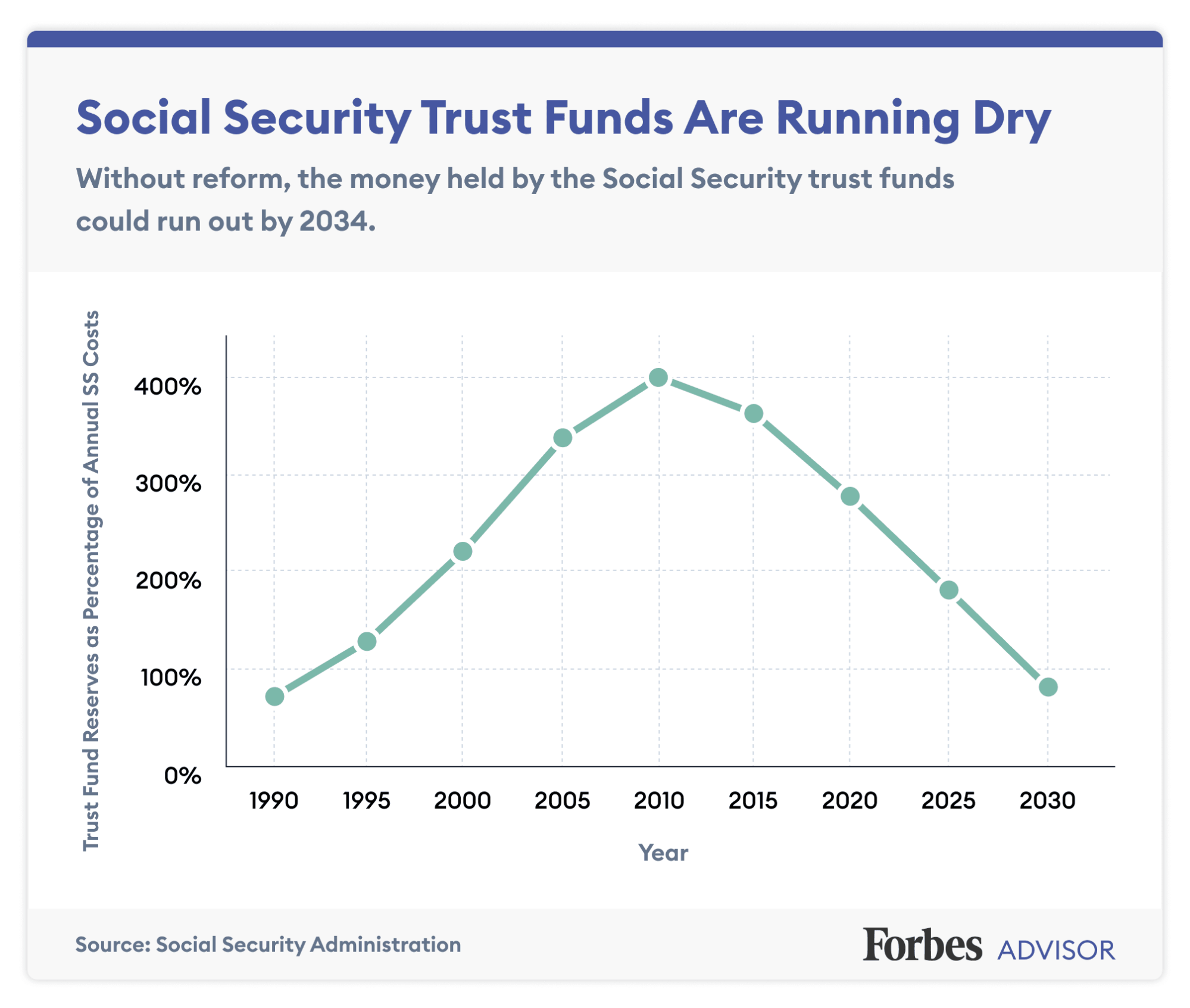

At the heart of the Social Security debate lies the projected depletion of the program’s trust fund reserves. According to the Social Security Board of Trustees’ annual reports, the combined Old-Age and Survivors Insurance (OASI) and Disability Insurance (DI) Trust Funds are expected to run out of money by 2033. This ominous date has fueled fears that Social Security could face an abrupt and catastrophic collapse, leaving millions of retirees and disabled individuals without their hard-earned benefits.

However, it’s important to understand that the depletion of the trust fund does not necessarily spell the end of Social Security. Even after 2033, the program will continue to receive payroll tax revenue from current workers, allowing it to pay a portion of scheduled benefits. The trustees estimate that, without any legislative action, Social Security would still be able to cover approximately 75% of promised benefits after the trust fund’s depletion.

The Role of Lawmakers

While the depletion of the trust fund is a significant concern, it is not an inevitability. Lawmakers have the power to implement changes that could shore up Social Security’s financial health and extend its solvency for decades to come. Throughout the program’s history, Congress has repeatedly stepped in to address funding shortfalls and ensure the continuation of benefits.

According to Steve Goss, Chief Actuary of the Social Security Administration, and Karen Glenn, Deputy Chief Actuary, there are numerous proposals from both Democrats and Republicans that could put the program on a sustainable path for the next 75 years. These proposals range from raising the wage cap on payroll taxes to gradually increasing the retirement age or adjusting the benefit formula.

Potential Solutions on the Table

Among the potential solutions being discussed are:

-

Raising the Payroll Tax Rate: One option is to increase the combined payroll tax rate from the current 12.4% to a higher level, such as 14.4%. This would generate additional revenue to support benefit payments.

-

Increasing the Retirement Age: Another proposal involves gradually raising the full retirement age beyond the currently scheduled age of 67. This would effectively reduce lifetime benefits for future retirees, easing the program’s financial burden.

-

Modifying the Benefit Formula: Policymakers could adjust the formula used to calculate benefits, potentially creating a more progressive system that provides higher replacement rates for low-income earners.

-

Implementing Means-Testing: Some proposals suggest introducing means-testing for Social Security benefits, reducing or eliminating payments for higher-income retirees.

-

Combining Changes: Many experts believe that a combination of moderate adjustments to payroll taxes, retirement ages, and benefit formulas could be the most viable path to long-term solvency.

The Importance of Timely Action

While the solutions may seem complex, the key to preserving Social Security lies in timely action. Goss and Glenn emphasize that the earlier changes are implemented, the more gradual and less disruptive they can be. Delaying action until the trust fund’s depletion would necessitate more drastic measures, such as sudden benefit cuts or substantial tax increases.

It’s important to note that Social Security’s financial challenges are not a result of mismanagement or overspending, but rather a reflection of demographic shifts and longer life expectancies. As the baby boomer generation retires and the ratio of workers to beneficiaries declines, the program’s costs are expected to rise significantly.

The Path Forward

While the future of Social Security may seem uncertain, history has shown that the program has weathered numerous challenges and emerged stronger through legislative action. As the nation grapples with this issue, it is crucial for policymakers to engage in open and constructive dialogue, weighing the needs of current and future beneficiaries while maintaining the program’s financial sustainability.

Ultimately, the fate of Social Security rests in the hands of lawmakers and their willingness to take decisive action. By implementing thoughtful and responsible reforms, the program can continue to provide a vital safety net for generations to come, ensuring that the promise of a secure retirement remains within reach for all Americans.

3 reasons to abolish Social Security now!

FAQ

Will Social Security exist in 30 years?

What happens if Social Security goes away?

Will Social Security end in the future?

What is the 5 year rule for Social Security?