When it’s time to pay your monthly natural gas or electricity bill from Xcel Energy, you likely want a quick and convenient payment option. Accepting credit card payments seems like an obvious choice for a major utility provider. But does Xcel actually allow customers to pay by credit card?

As an Xcel Energy customer, I’ve researched the ins and outs of their payment methods. While Xcel does not directly accept credit cards, they do offer alternative online payment options and third party services.

In this article, I’ll outline the payment types accepted by Xcel, workarounds for paying by credit card, and tips for managing your account.

Overview of Xcel Energy Bill Payment Options

Xcel Energy provides customers with a few different ways to pay their gas and electric bills each month. Here are some of the most common Xcel payment methods:

- Auto Pay – Set up recurring payments from your bank account

- One-Time EFT Payment – Make immediate payments via electronic funds transfer

- Online Bank Pay – Link your bank account to make one-time payments

- By Mail – Send a check or money order with your payment stub

- In Person – Pay at an authorized walk-in payment location

- By Phone – Call Xcel’s automated payment system

Xcel also offers an online Account Center where customers can review billing history, compare energy usage set up alerts and manage payment settings.

However, Xcel Energy does not directly accept credit card payments for residential customer bills at this time. Any credit card logos you see refer to third party services only.

Why Doesn’t Xcel Take Credit Cards Directly?

Given the ubiquity of credit cards for online transactions, it’s reasonable to wonder why a major energy provider like Xcel doesn’t accept them directly. There are a few factors driving this policy:

-

High Processing Fees – Credit card companies charge a transaction fee that would drive up operating costs.

-

Risk of Fraud/Reversals – Utilities have to protect against fraudulent charges and payment reversals

-

Federal Regulations – Laws prohibit utilities from charging credit card customers more to cover the added fees.

-

Administrative Burden – Managing credit card payments adds reporting requirements and administrative processes.

By only accepting bank transfers, checks, cash, and select third party services, Xcel reduces costs and payment risks that would otherwise impact all customers.

Paying Xcel Bills with a Credit Card via Third Party Services

While you can’t pay Xcel directly with a credit card, authorized third party payment services provide a workaround. They accept credit cards, charge a processing fee, and then send a payment to Xcel on your behalf These include:

-

Paymentus – Xcel’s preferred credit card processor. Charges $3.95 convenience fee per transaction.

-

Plastiq – Pay any bill with your credit card for a 2.5% fee. Sends your payment info to Xcel.

-

Doxo – Links to your Xcel account and charges $1.99 per transaction.

-

Budget Bill Pay – $4.95 to pay Xcel online by credit card.

These services allow the credit card processing costs to be separated and paid directly by the customer rather than impacting Xcel’s operating budget. This structure satisfies legal requirements and avoids driving up rates.

Tips for Managing Xcel Energy Bills

As an Xcel customer paying my electric and gas bills through their online Account Center, I have some tips:

- Go paperless by opting for eBills to get notifications when your bill is ready.

- Set up AutoPay from your bank account for on-time payments without the hassle.

- Review your usage metrics regularly to identify spikes and get saving tips.

- Update your payment method right away if your card number or account changes.

- Pay a few days early in case processing takes extra time.

- Contact support immediately if you see an incorrect or duplicate charge.

- Take advantage of budget billing to spread costs evenly throughout the year.

Don’t Get Charged Late Fees – Know Your Payment Options

I never want to have to deal with late fees or service disruptions just because I missed an Xcel Energy bill payment. That’s why I make sure to pay my balance online each month through Xcel’s automated system linked to my bank account.

While Xcel doesn’t directly accept credit cards, I can still use my rewards card to pay through an authorized third party processor like Paymentus or Plastiq for a small fee. This allows me to rack up points or cash back while ensuring my natural gas and electricity stay on.

The bottom line is that Xcel restricts payment types to control costs and reduce risks that would impact all customers. But thankfully, verified third party services bridge the gap for credit card users. Just prepare for their processing fees.

As long as you pay your Xcel Energy utility bill in full and on time every month using one of their accepted payment methods, you can avoid late fees and service interruptions. Set up reminders, automate payments, monitor your usage, and leverage Xcel’s online account tools to take control of your billing and never miss a payment due date. Your home depends on reliable energy!

How to Pay Online

Pay online using your checking account with My Account.

Bank Pay from MyCheckFree is a convenient way to view and pay your bill online at your bank site.

Use My Account or Kubra EZPay with your credit/debit card. Wisconsin residential customers will incur no fee, but non-residential customers will incur a 2.2% fee. Customers using their mobile device can pay with Apple Pay or Google Pay.

Learn more about credit/debit card payments.

Find a Pay Station

See pay station map

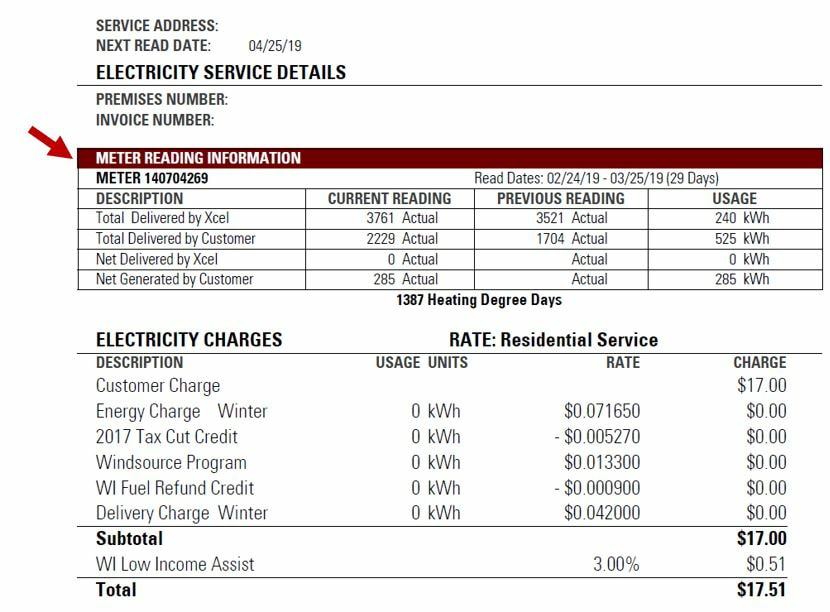

Xcel Energy – Understanding Your Bill

Can I pay my Xcel Energy Bill via credit or debit card?

All credit/debit card types allow a maximum of 25 credit/debit card payments in a 28-rolling-day period per Xcel Energy account, per credit/debit card. All Xcel Energy residential and business customers are eligible for payment via credit or debit cards. To pay your bill via credit or debit card, you can choose from the following options:

Does Xcel Energy pay a fee?

Xcel Energy does not benefit from this fee. Residential type customers are those on residential rates. Payments have transaction limits of $1,000/transaction. Non-residential type customers are those customers not on a residential rate. Payments have transaction limits of $250,000/transaction.

What are Xcel Energy payment limits?

Payments have transaction limits of $1,000/transaction. Non-residential type customers are those customers not on a residential rate. Payments have transaction limits of $250,000/transaction. All credit/debit card types allow a maximum of 25 credit/debit card payments in a 28-rolling-day period per Xcel Energy account, per credit/debit card.

How can I pay EZpay in Wisconsin, Xcel Energy?

Wisconsin residential customers can pay Xcel Energy’s EZpay using My Account or Kubra EZPay with their credit/debit card, incurring no fee. Non-residential customers will incur a 2.2% fee. Customers using their mobile device can pay with Apple Pay or Google Pay.